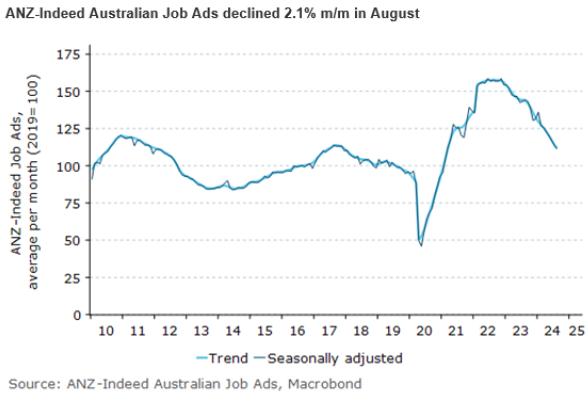

On Monday, the ANZ-Indeed job ads survey was released, which showed that job ads fell by 2.1% in August:

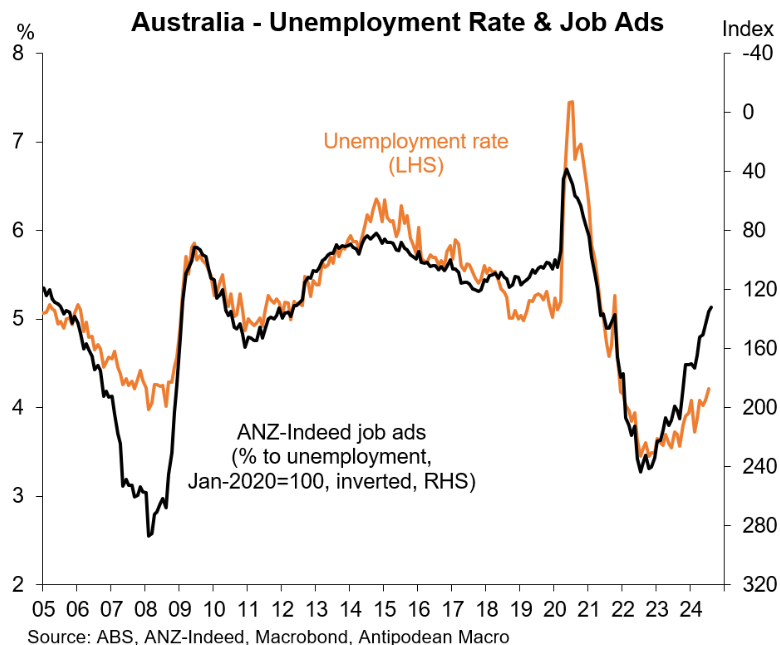

The following chart from Justin Fabo at Antipodean Macro plots the change in ANZ-Indeed job ads against the unemployment rate:

Based on historical correlations, Australia’s unemployment rate should shoot higher.

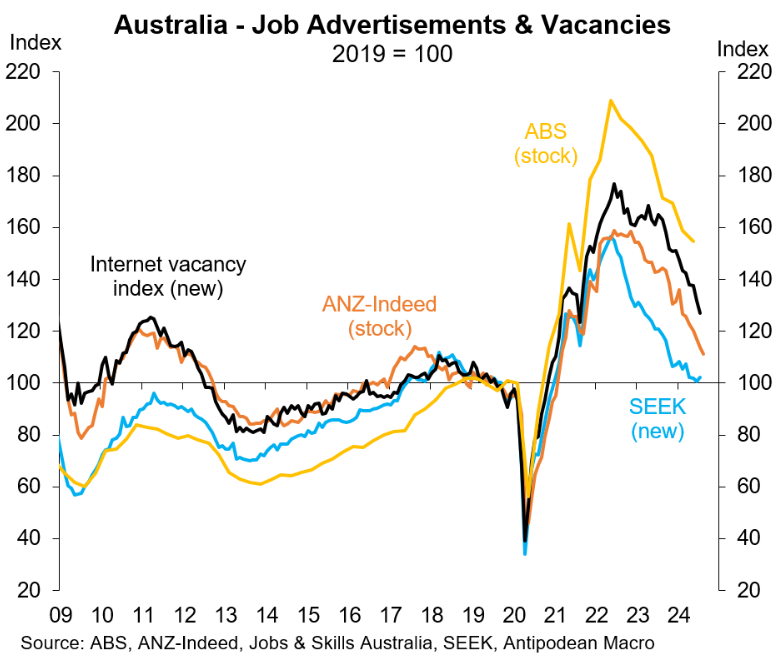

Fabo has also compiled the below chart tracking the various measures of job ads and vacancies:

As you can see, all measures have fallen sharply, with variations likely related to methodological differences and changes in market share.

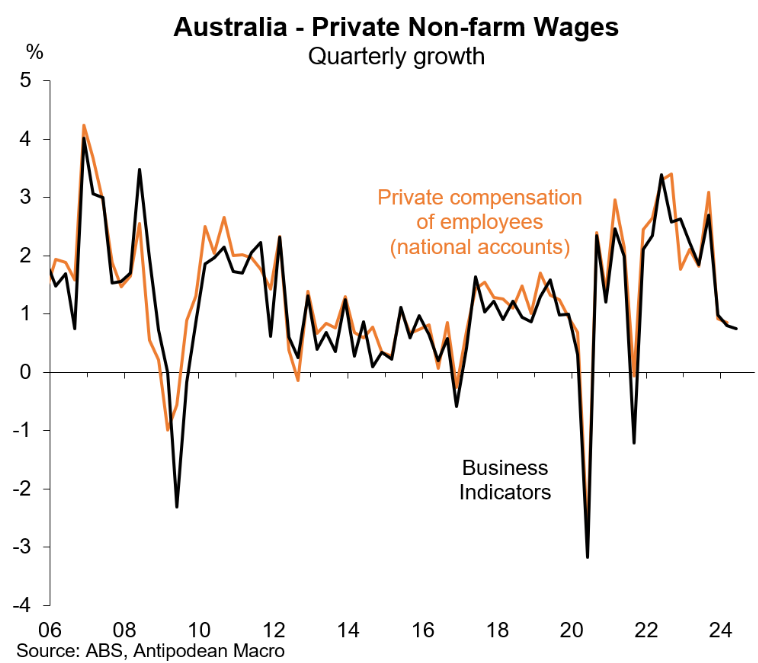

Finally, Justin Fabo has compiled the following chart on private non-farm wages from Monday’s Business Indicators survey from the ABS:

Fabo noted that “Australia’s private-sector wages bill rose just +0.7% q/q in Q2 following an upwardly revised +0.8% q/q rise in Q1”.

“Combined, the 1.5% rise in the private wages bill over H1 this year was the weakest since 2017 (excluding the pandemic period)”.

“This reflects both weak private-sector employment growth and slower growth in wage rates”, explained Fabo.

The below deterioration of the labour market is a key reason why economists at CBA and Westpac believe that services inflation will fall over H2 2024, lowering underlying inflation.

Indeed, for the RBA to commence an easing cycle, it will need to see one of two things:

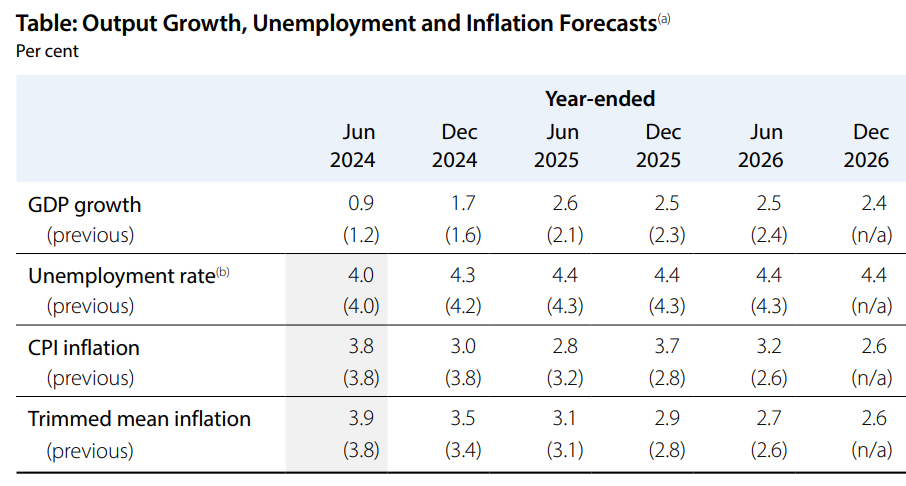

- A sharper deceleration of underlying inflation (the RBA forecasts 3.5% trimmed mean inflation by December 2024); or

- A sharper than expected rise in unemployment (the RBA forecasts 4.3% unemployment by December 2024).

Source: RBA Statement of Monetary Policy (August 2024)