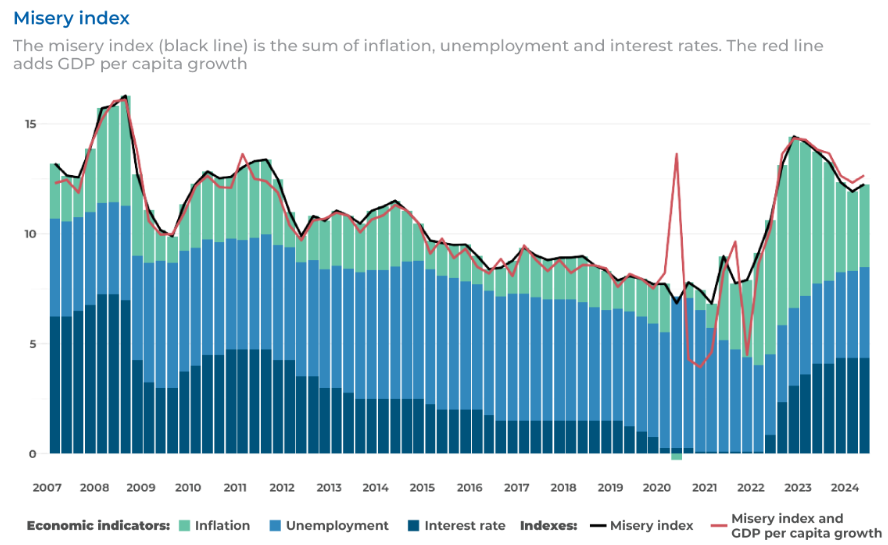

According to new analysis from the Committee for Economic Development of Australia (CEDA), Australians are living through the most protracted period of economic misery since 2011:

Rising inflation has driven around half the rise in the misery index, followed by rising interest rates.

“Inflation remains stubbornly high, despite having moderated since its peaks. It continues to hurt households by forcing them to spend more of their income on the essentials of daily life”, noted CEDA.

By contrast, “the resilient jobs market has helped households maintain their incomes in the face of stubborn inflation and a faltering economy”.

CEDA stresses that the Misery Index is an aggregate measure. Therefore, the various segments of the Australian economy are impacted differently.

“Those fortunate enough to own their homes outright or have large savings in the bank will benefit from higher interest rates”.

“But high inflation disproportionately hurts those on lower and fixed incomes with less financial wiggle room to cope with rising prices”.

Ben Phillips from the Australian National University played down the result, arguing that most households are comfortable.

“It’s a little bit over-egged, or a little overblown. I don’t really think at the moment Australia’s in a period of serious economic misery”, he said.

“It’s true that things are a little tougher for some at the moment, particularly those with a mortgage”.

“But so long as unemployment remains as low as it is, it’s still about 4.2%, it’s a bit of a bold claim to say that we’ve got a sort of a prolonged period of economic misery”, Phillips said.

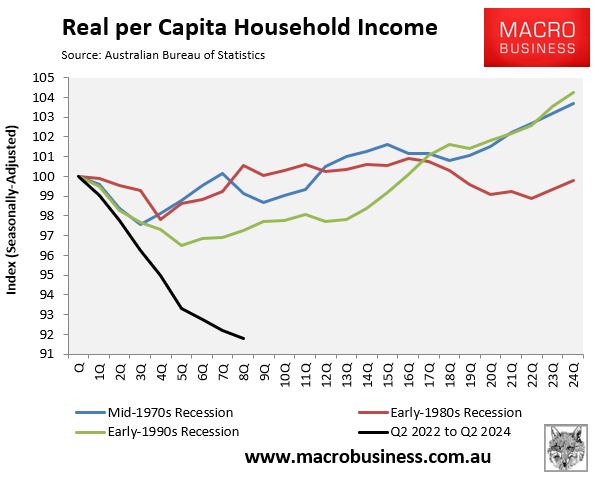

Phillips’ Panglossian view ignores the record decline in Australian household disposable income, which dwarfs the early-1990s recession:

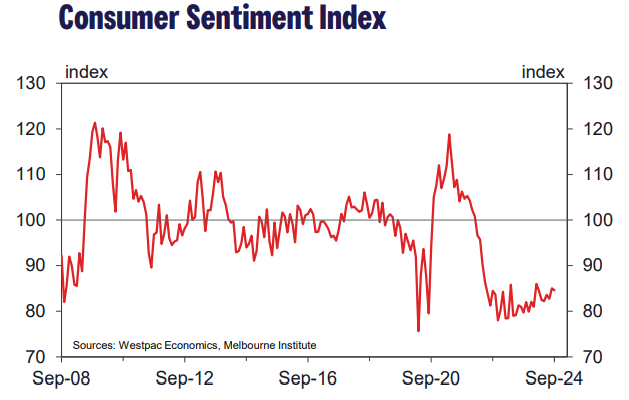

Consumer sentiment has also been stuck firmly at recessionary levels for two years:

The mood of consumers is certainly miserable, and rightly so. Their living standards have declined for two straight years with no real signs of lifting.