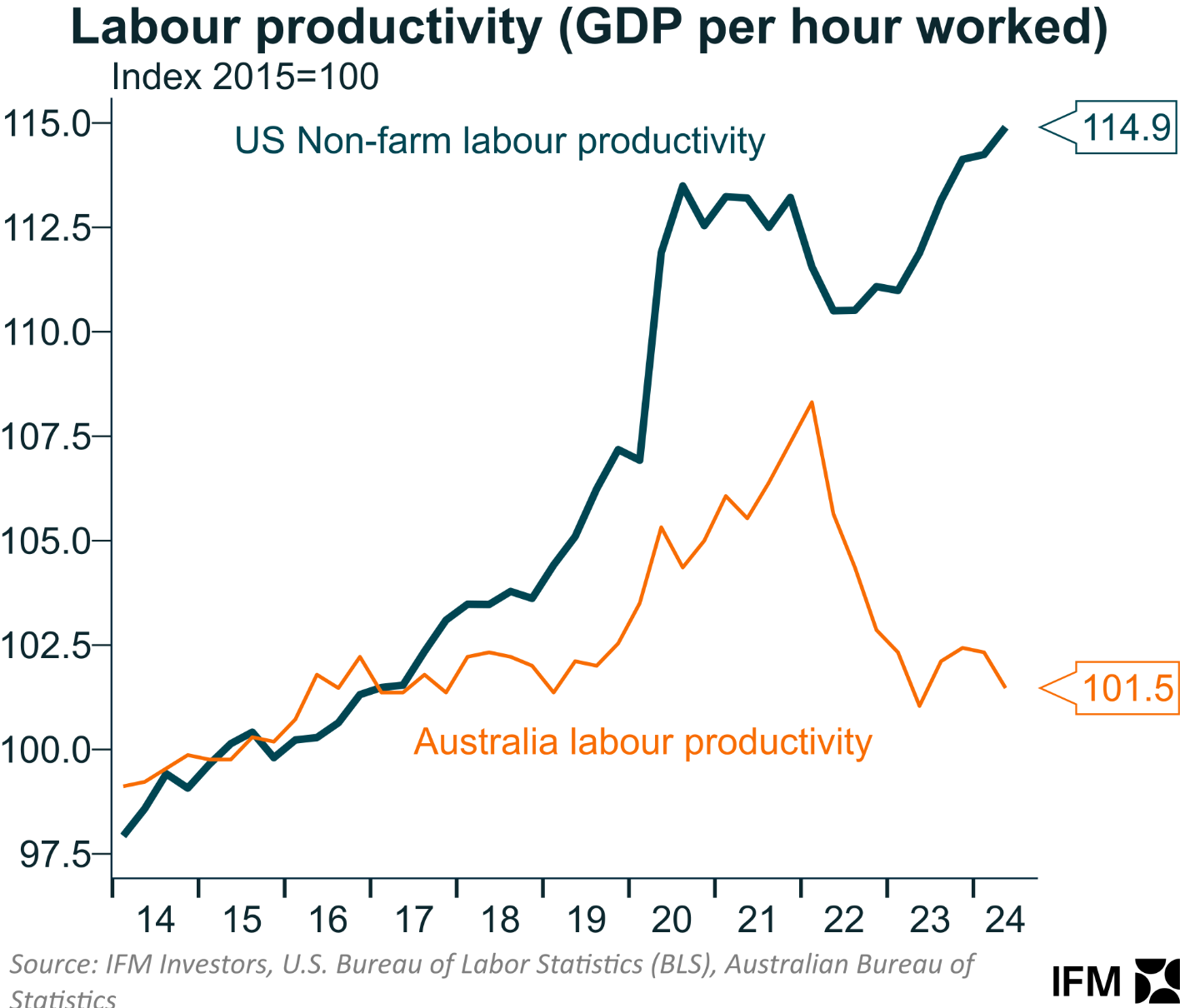

Chief economist at IFM Investors, Alex Joiner, posted the following chart on Twitter (X) comparing Australia’s woeful labour productivity against the United States:

According to Wednesday’s Q2 national accounts from the Australian Bureau of Statistics (ABS), Australia’s labour productivity is tracking at the same level as September 2016. That is, labour productivity has experienced no growth in nearly eight years.

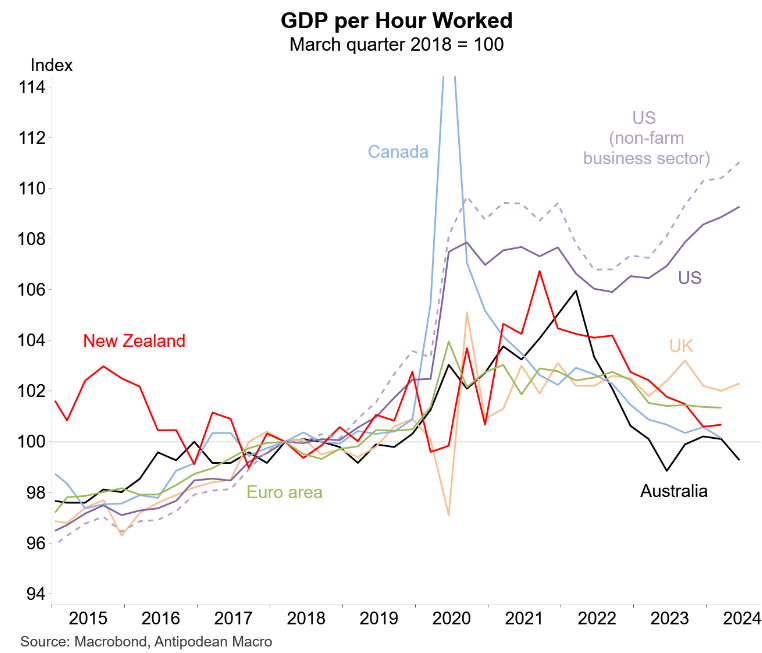

Justin Fabo at Antipodean Macro also posted the following chart showing that Australia has experienced the weakest labour productivity growth out of the Anglo nations since 2018:

There are arguably two key reasons why Australia’s labour productivity is so poor.

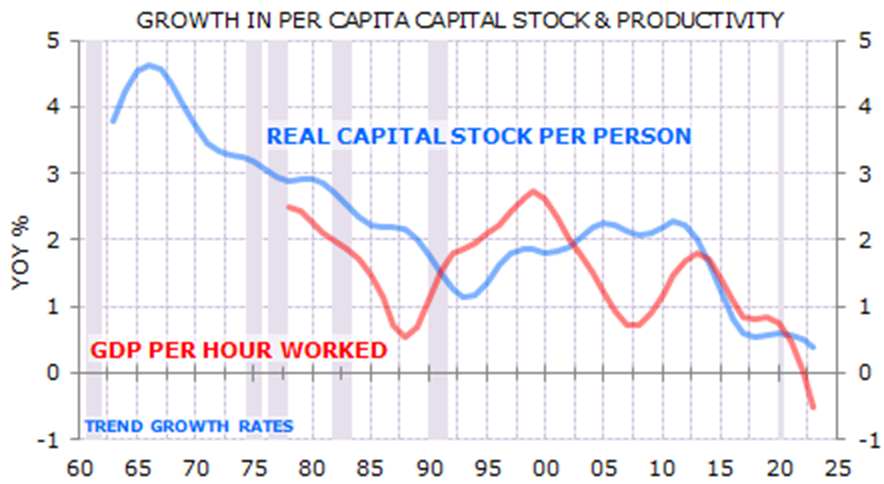

The first relates to “capital shallowing”. For decades, Australia’s population has grown more quickly than business and infrastructure investment. This has left Australia with less capital per worker and increased congestion costs, thereby lowering the nation’s productivity growth.

Source: Gerard Minack

Leading independent economist Gerard Minack explained this capital shallowing as follows:

Australia’s economic performance in the decade before the pandemic was, on many measures, the worst in 60 years. Per capita GDP growth was low, productivity growth tepid, real wages were stagnant, and housing increasingly unaffordable…

There were many reasons for the mess, but the most important was a giant capital-to-labour switch: Australia relied on increasing labour supply, rather than increasing investment, to drive growth…

The capital-to-labour switch has been massively detrimental to living standards. To maintain living standards a country’s capital stock – assets such as schools, roads, hospitals, factories, offices, and housing – needs to match its population growth. Without that investment living standards fall…

The high population growth of the past 15 years has meant that almost all Australia’s investment spending has been the equivalent of replacing smashed windows…

Capital deepening drives productivity. The switch to a population-led growth model has starved Australia of capital deepening investment. The result is declining productivity…

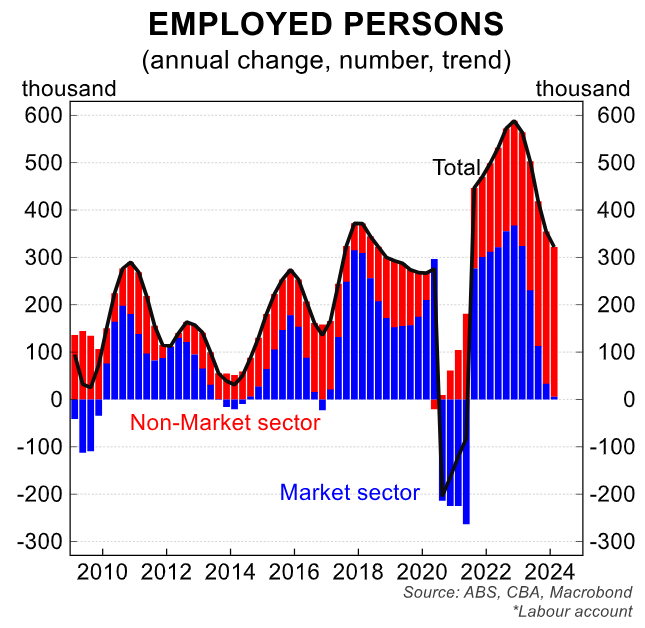

The second likely cause of Australia’s declining productivity has been the growing reliance on government-aligned sectors for growth and employment:

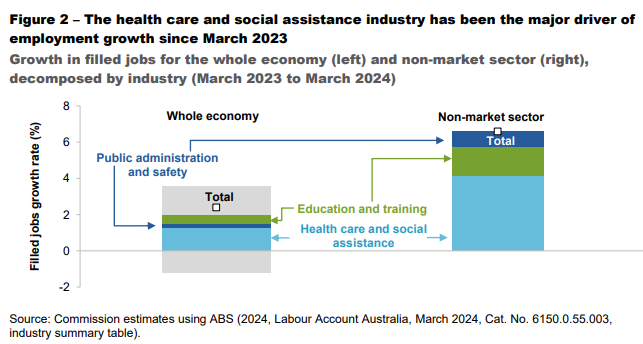

According to the most recent quarterly labour market account from the Australian Bureau of Statistics (ABS), nearly all of the jobs generated in Australia the previous year were in the non-market (government-aligned) sector:

In contrast, the market sector added minimal (6,000) jobs over the year, while the total number of hours worked declined by 27 million across the market sector.

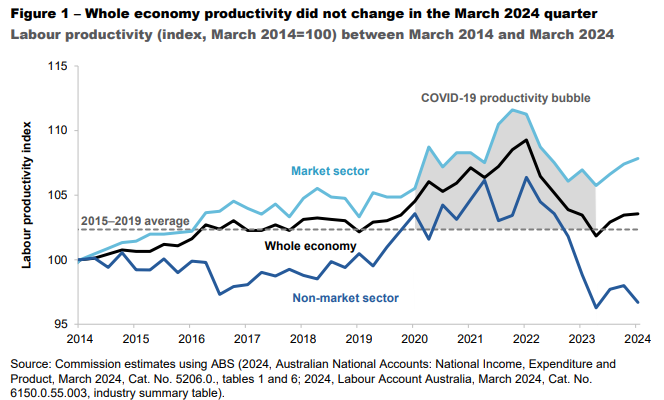

The data below from the Productivity Commission (PC) illustrates why the rise in non-market jobs is a problem for Australian productivity growth:

As shown above, the non-market sector has historically experienced substantially slower productivity growth than the market sector.

Indeed, labour productivity in the non-market sector is roughly 3% lower than it was in 2015, whereas productivity in the market sector is nearly 9% greater.

The healthcare and social assistance industry has been the primary driver of job growth in Australia, owing to the expansion of the NDIS, aged care, and the country’s ageing population:

This presents a challenge for Australia’s future productivity, as the healthcare and social assistance industries are also likely to fuel job growth in the future.

Indeed, the Parliamentary Budget Office projects that the NDIS will cost more than $100 billion over the next ten years, up from just over $40 billion now:

The big question is: where will Australia’s productivity growth come from if the non-market sector dominates employment growth and the population via immigration continues to grow faster than business and infrastructure investment?

If the status quo is maintained, Australia faces a low productivity future with falling living standards.