By now, we all know how the gas cartel has trashed Australian economic management (even though you won’t read about it anywhere else):

…Inflation fell to a three-year low last month as millions of households received $75 electricity bill rebates from the federal government, but prices for other goods and services continued to increase quickly, making interest rate cuts a distant prospect.

…Treasurer Jim Chalmers will argue the figures show that Labor is helping to get cost-of-living pressures under control as the government tries to counter voter anger over its handling of inflation.

But RBA governor Michele Bullock on Tuesday warned the decline in inflation in August would only be temporary and ruled out a near-term interest rate cut, despite bond markets pricing a three-in-four chance of a cash rate reduction by Christmas.

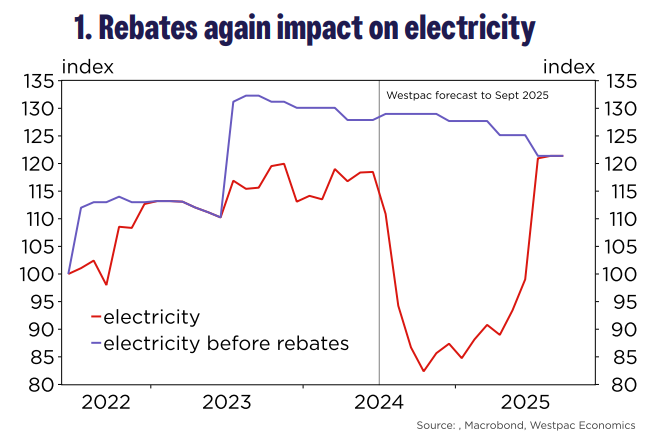

The RBA expects inflation to jump back to 3.7 per cent late next year when the federal government’s electricity bill rebate and similar state government energy subsidies expire.

Here it is in chart form. The rebates roll off mid-2025:

In short, the RBA is ignoring crashed headline inflation because it assumes Labor will drop energy rebates amid a cost-of-living election.

Why would it when another smallish investment renders the RBA outlook preposterous? Here’s its rationale:

Rolling the energy rebates in MYEFO means core and headline inflation come into line a year earlier than the RBA outlook and it will be forced to cut:

…the year-ended rate of headline inflation in 2025 is forecast to be almost 1 percentage point higher than trimmed mean inflation, reflecting both the legislated unwinding of the 2024 electricity rebate and an increase in the federal tobacco excise.6

While these policy changes will affect the rate of headline inflation (and at the margin might affect inflation expectations), it is assessed that they will not materially affect underlying inflationary pressures.

But they will affect underlying inflation because energy spillovers will be much smaller and administrative prices like tobacco, grog, pensions etc. are linked to headline, not core inflation.

The RBA is going to look like it’s smoking some very hawkish grass and, more to the point, it will be forced to cut hand over fist because it is behind the curve.