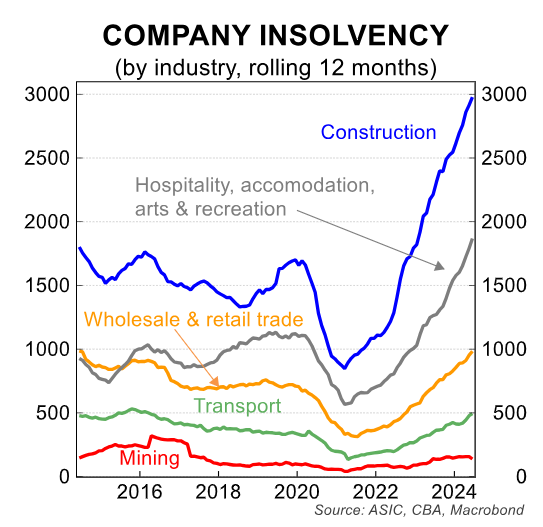

Australian home builders are in a world of pain, as evidenced by nearly 3,000 construction firms collapsing over the past year:

This week, leading Victorian builder Grandeur Homes collapsed only weeks after claiming that “we are thriving”.

On 21 August, news.com.au was told: “Grandeur Homes is solvent and is not in financial difficulty. The suggestion that it is in financial difficulty is false and, if published, would cause substantial and unjustified damage to its trading reputation”.

Only nine days later, Grandeur Homes was placed into external administration on 30 August.

As a result, construction work has been halted on more than 100 projects, leaving homeowners “devastated”.

“We understand there are 108 homeowners affected by our appointment and have been made aware some homeowners have had difficulties obtaining updates from the company on the progress of their construction recently”, a spokesperson for administrator Cor Cordis said.

One customer Karishma Seechurn highlighted the pitfalls in trying to build a home in Australia.

The 32-year-old told News.com.au that she originally tried to build with Snowdon Developments in 2020 before the company collapsed. She then signed with Grandeur Homes in 2023, only for them to also collapse.

Now she has been left with a half-built home that is exposed to the elements, and no timeline of when it will be completed.

“I’m super stressed and upset”, she told news.com.au in tears. “The stress of having two builders going under is just unimaginable”.

“I’m really worried about the situation of the house as I just have scaffolding all around and the top is frames. They don’t look good anymore, they have been weathered badly”.

“The company said the roof tiles were going to be on site but it never came, so now it will be over a year that the frames have been exposed”, she said.

Meanwhile, the homeowner is stuck paying a mortgage on a home that she cannot occupy. It is a financial disaster in the making.

“Even though they have gone under I still have to pay my mortgage”, she added.

Another “devastated” customer, Abhishek Marpally, told news.com.au that they had paid almost $340,000 to Grandeur Homes after construction commenced in June 2023.

The above highlights why trying to build a home in Australia has devolved into a risky game of Russian Roulette.

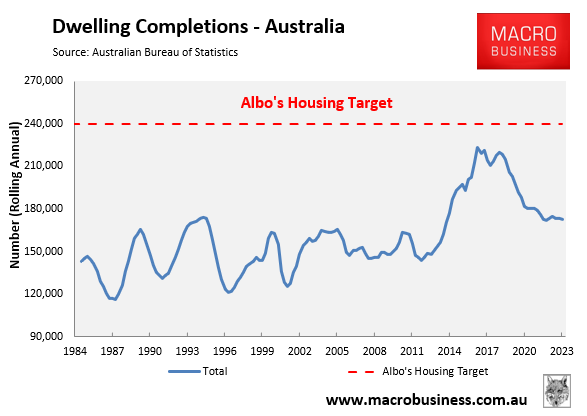

It also highlights why the Albanese government’s target of building 1.2 million homes over five years is delusional.

Interest rates and building costs are structurally higher, state government ‘big build’ infrastructure projects are sucking up the available labour, and building companies are trading on thin margins and struggling to survive.

As a result, buyer demand and confidence are shot.