Treasurer Jim “chicken” Chalmers needs a pat on the back. He’s finally delivered interest rate relief.

The problem is it is in Europe, not Australia.

The reason? Treasurer Jim “chicken” Chalmers’s energy cowardice.

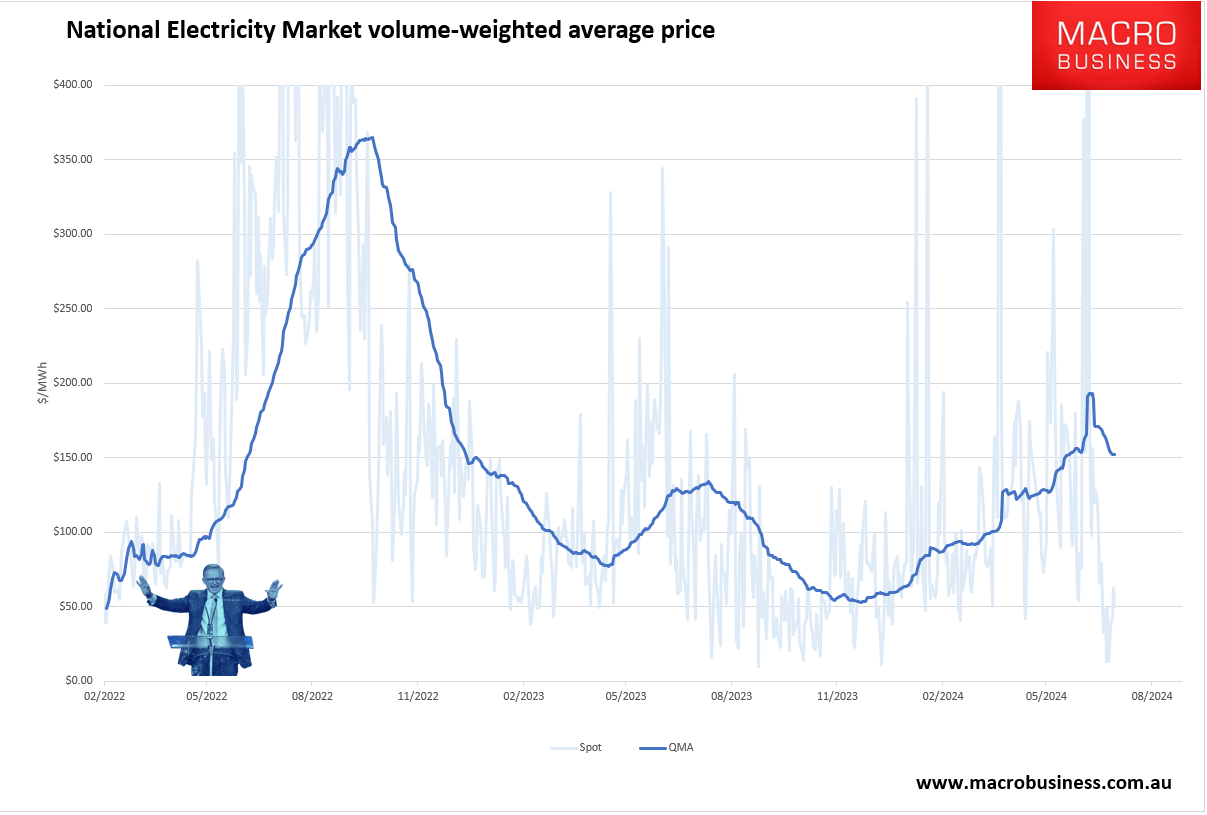

Back in 2022, when first elected, the new Labor government sat on its hands as the Ukraine War began and the global gas prices exploded.

A terrified Chalmers hid under his desk rather than act in the national interest by using domestic reservation or export levies to prevent the local gas cartel from war profiteering.

The rest is history. European gas prices landed Downunder and blew up the Australian electricity market.

This injected a massive inflation shock that is still playing out today in every energy bill east of WA.

It is directly responsible for why the RBA is focused on core, not headline inflation, and won’t cut:

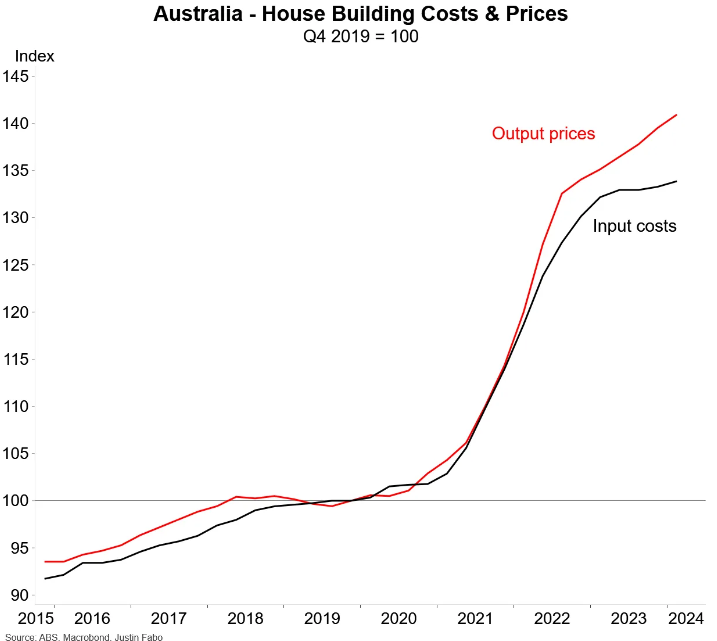

It is also central to the housing construction crisis because building materials are so energy-intensive.

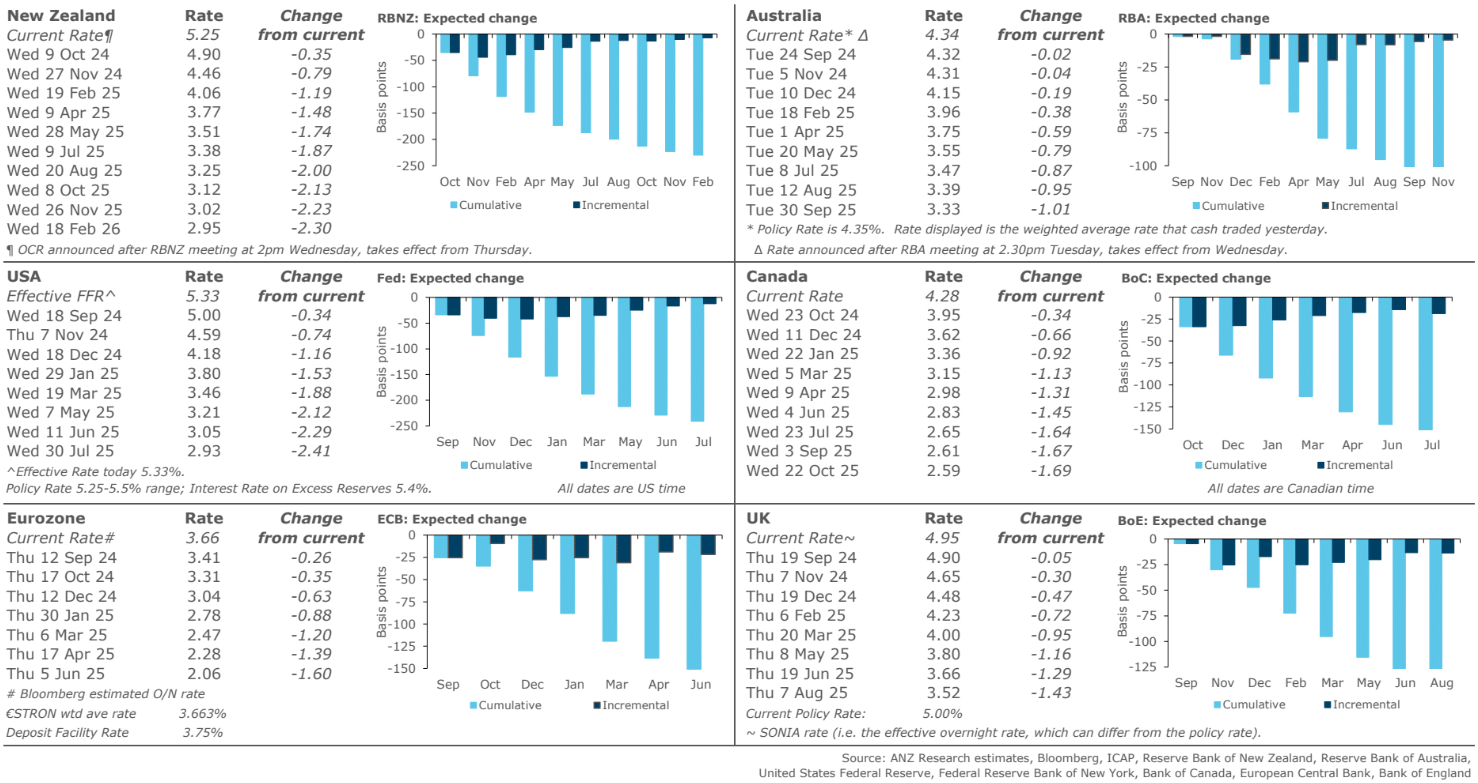

Australian gas was sent to Europe to help alleviate its inflation shock and overnight they enjoyed the benefits via a dovish ECB:

The Governing Council today decided to lower the deposit facility rate – the rate through which it steers the monetary policy stance – by 25 basis points. Based on the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission, it is now appropriate to take another step in moderating the degree of monetary policy restriction.

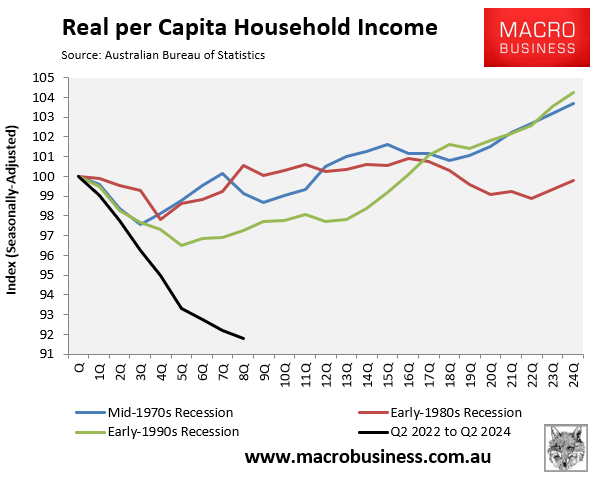

In Australia, we instead have the Chalmers stagflation crushing households:

Adding insult to injury, rate forward markets are pricing two more cuts for Europe than Australia over the next year:

What a generous man is Jim “chicken” Chalmers.