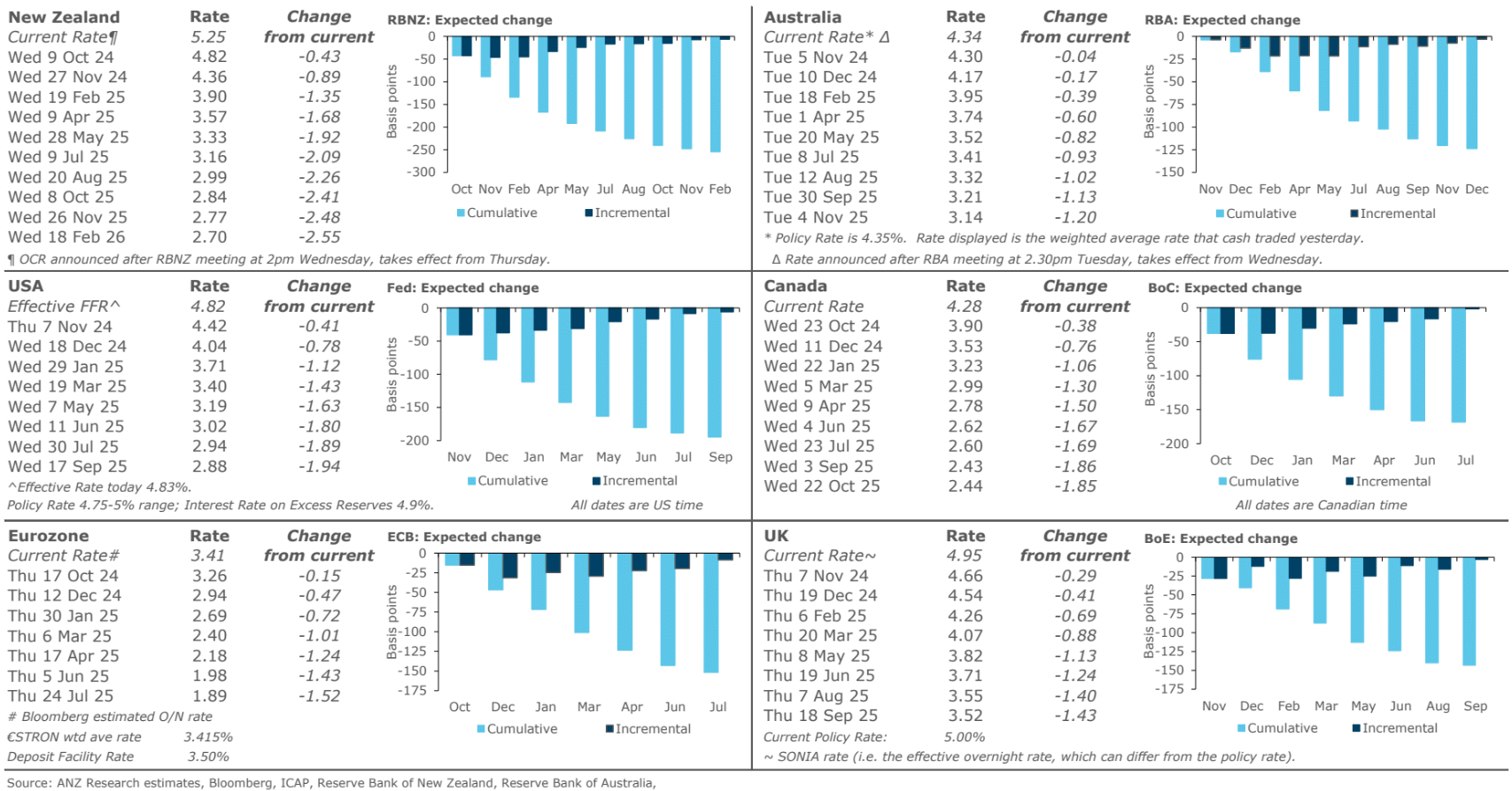

RBA cash rate futures are slowly but surely getting the message that the Australian outlook for inflation is not so different to other developed markets.

This week futures added a fifth rate cut before the end of 2025:

While still a more shallow cycle than comparable economies, the process of deepening cuts will likely continue.

Once energy rebates are rolled over before the election and the Chinese commodity crash resumes through next year, the RBA will have to round down its estimates for trimmed mean inflation.

Shifting into 2026, I expect Australia to enjoy a significant catch-down to other DMs on rates as the Pilbara killer arrives and takes the income shock associated with the Chinese slowing to all new depths.

Goldman is pivoting dovish.

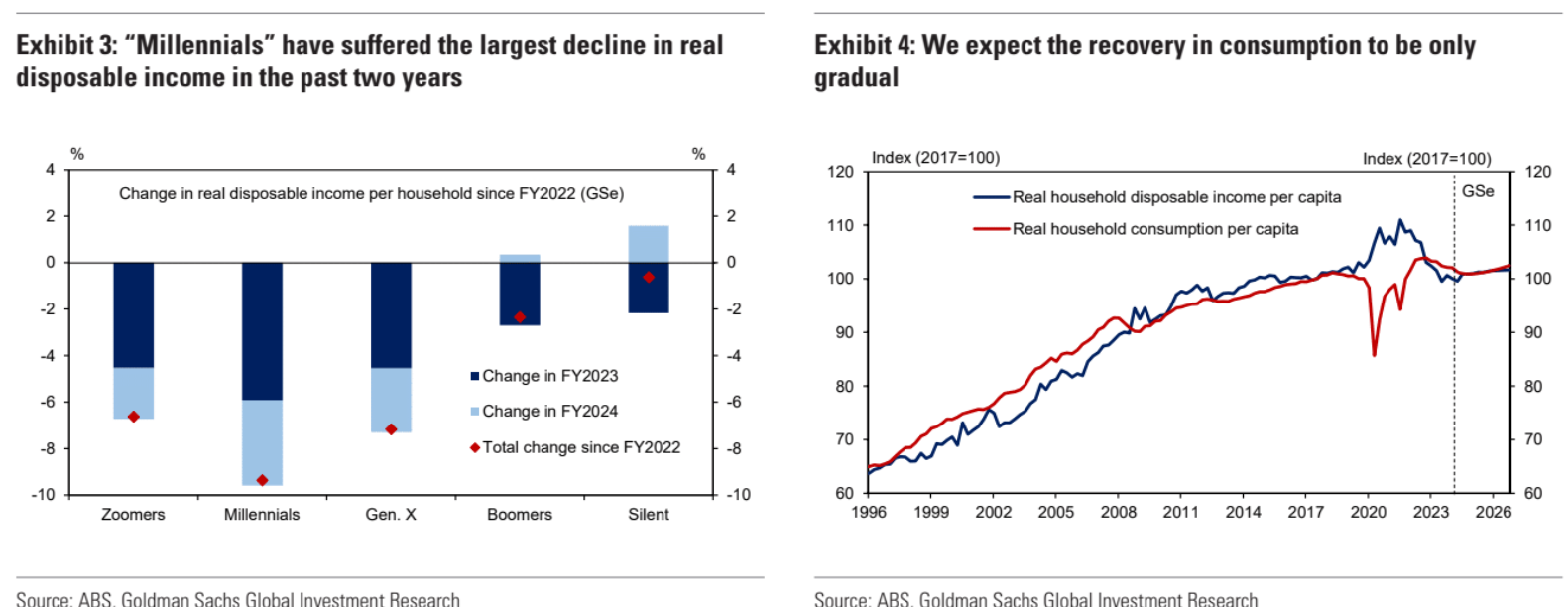

On the household side, we attribute softening activity to the emergence of a “Millennial Recession”, as younger households cut back discretionary spending alongside an estimated 7-10% decline in real disposable income over the past two years (Exhibit 3).

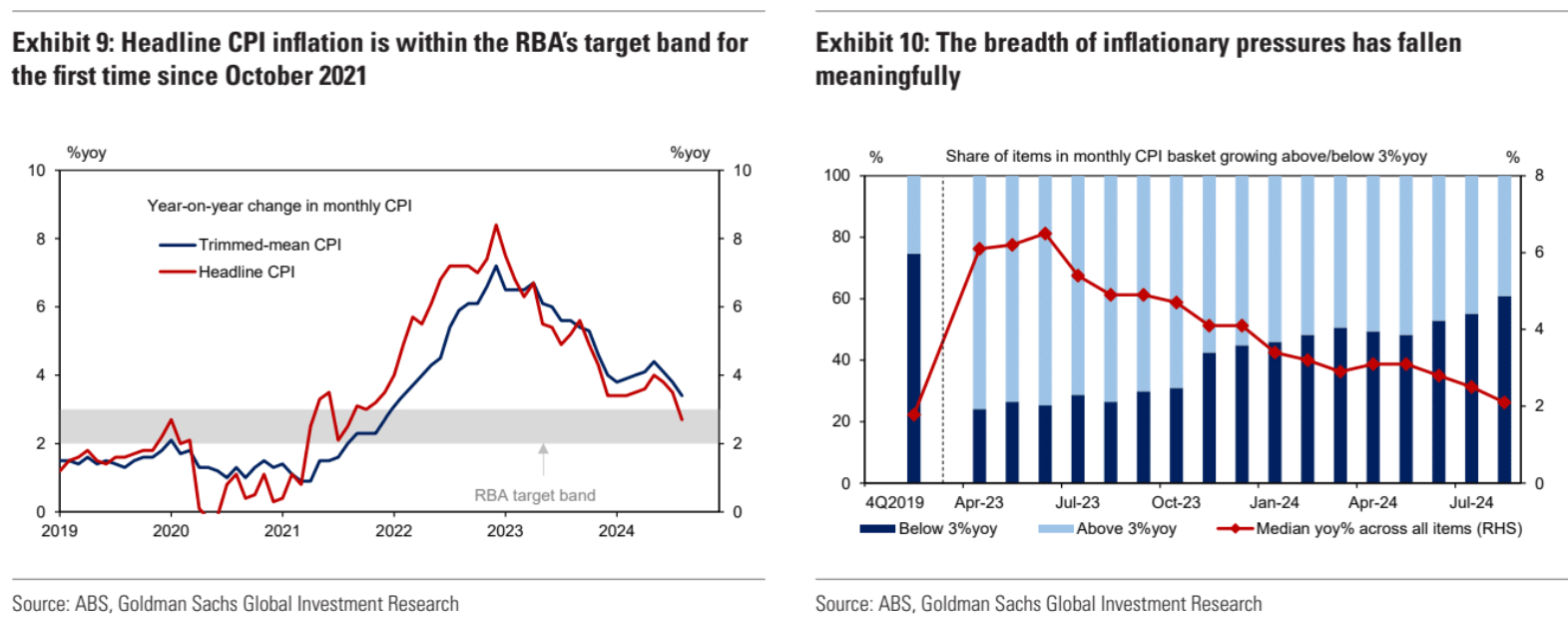

…Inflation also appears on course to surprise RBA forecasts, albeit to the downside.

In August, the RBA’s favoured trimmed mean CPI measure decelerated 40bp to +3.4%yoy (Exhibit 9) – already 10bp below the RBA’s end-2024 forecast (+3.5%yoy) with four months of the year remaining.

The breadth of disinflationary pressures is also encouraging, with fewer than 40% of the items now inflating above the 3.0% upper-bound of the RBA’s target band (Exhibit 10).

The (unweighted) median inflation rate across all items also eased to just +2.1%yoy, down from +4.9%yoy in August (Exhibit10).

At the headline level, inflation also decelerated 80bp to +2.65%yoy, to be well within the RBA’s 2-3% target band for the first time since October 2021.

RBA Governor Bullock’s September press conference marked as oft dovish pivot in our view, mostly because the Governor confirmed that “the Board did not explicitly consider a rate hike” at September’s Board meeting.

This was a clear change, given a hike had been explicitly considered at each RBA meeting since March 2024 and was “seriously considered” by the RBA only last month.

The omission from the Governor’s prepared remarks of August’s hawkish forward guidance on rates cuts (“a near-term reduction in the cash rate doesn’t align with the Board’s current thinking”) was also notable, although this guidance was eventually restated deep into the subsequent Q&A session when the Governor was explicitly asked about it.

To be fair, other aspects of the Governor’s comments did also retain a hawkish flavour, but financial markets reflected our net dovish interpretation of the day – with yields on the 3 year bond rallying 8bp from pre-meeting levels.

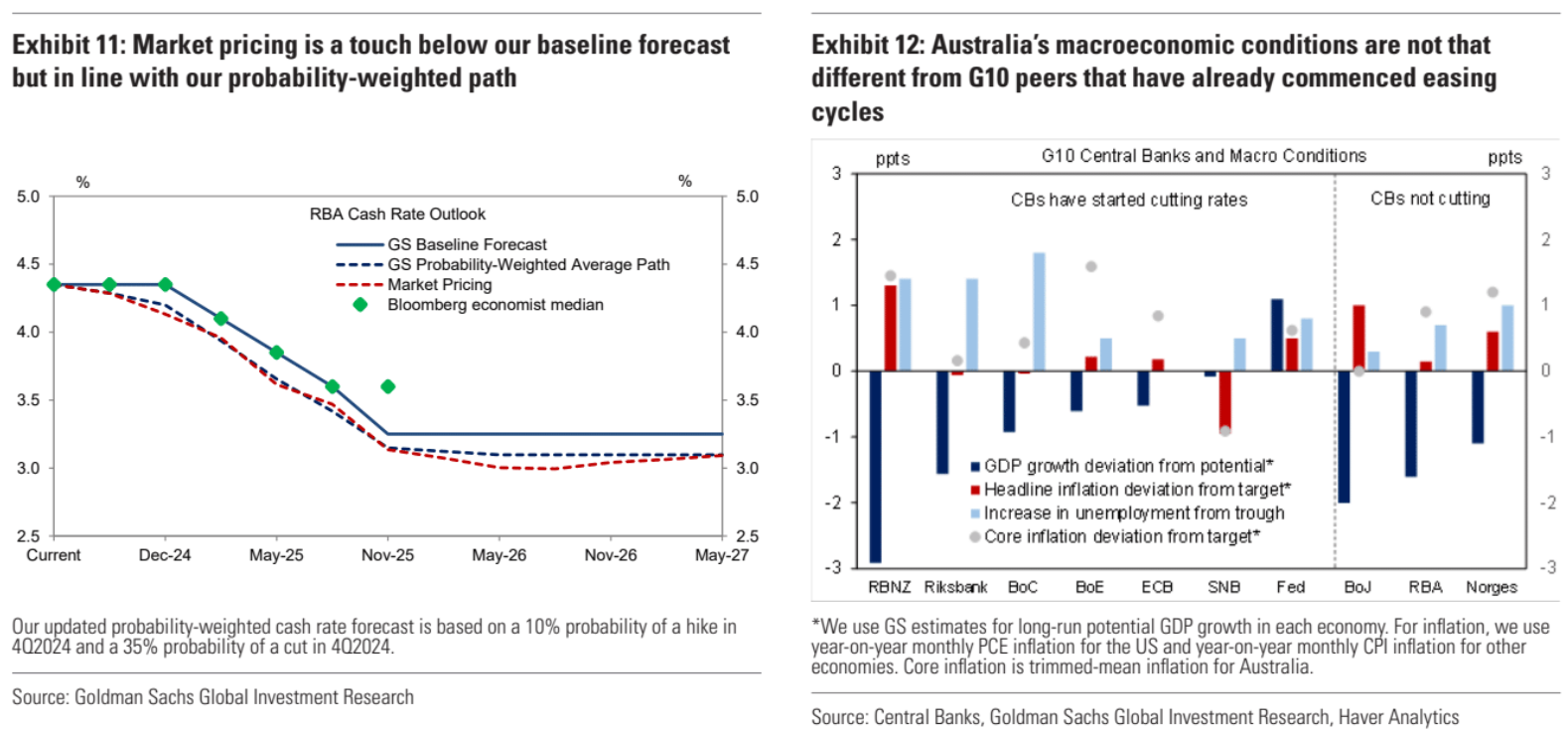

Given our forecast that Norges Bank will cut rates in December, the RBA looks on course to be the last hawk standing across G10 (ex-Japan) this cycle.

Our baseline forecast remains for the RBA to start cutting in February 2025, with 25bp cuts each quarter to a terminal rate of 3.25% in late 2025 (Exhibit 11).

However, we see risks skewed to cuts starting in late 2024 and occurring at a quicker pace through 2025, given that Australia does not look that different to peers across key measures of macroconditions (Exhibit 12) and that we are forecasting weaker outcomes than the RBA for GDP growth, inflation and the labour market.

I agree with futures. Once the energy rebates are extended, there’s an RBA Christmas surprise coming for households.