Reports that the Albanese government is considering modest changes to negative gearing have resulted in the usual scaremongering from property interests.

The most extreme example came from the below great Australian, Bharat Patel, who has amassed a portfolio of 32 homes and claims that changes to negative gearing would devastate the nation:

“You rely on these tax incentives and without them the whole economic system will fall apart”, said Patel.

“Negative gearing is the only vehicle for that sort of tax relief, and there will be no incentive to buy these properties without it”.

These bold proclamations are hilarious when you consider the modest scope of the reforms being considered by the Albanese government, which reportedly centres around capping the number of properties a taxpayer could negatively gear.

Any reform would also be grandfathered so that existing investors were not impacted.

Therefore, the proposed reforms would not impact current investors and would merely discourage future property investors from owning multiple properties.

In other words, they are insignificant and would merely moderate future investor demand.

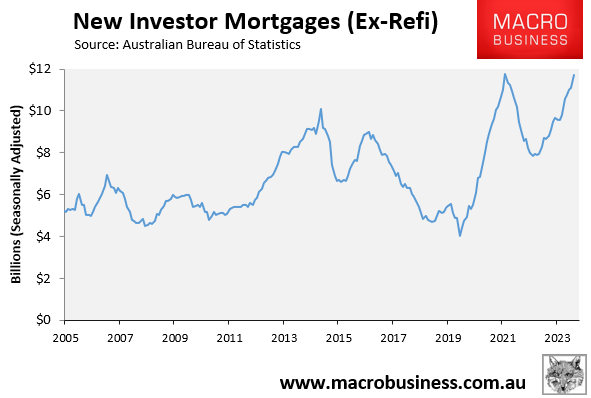

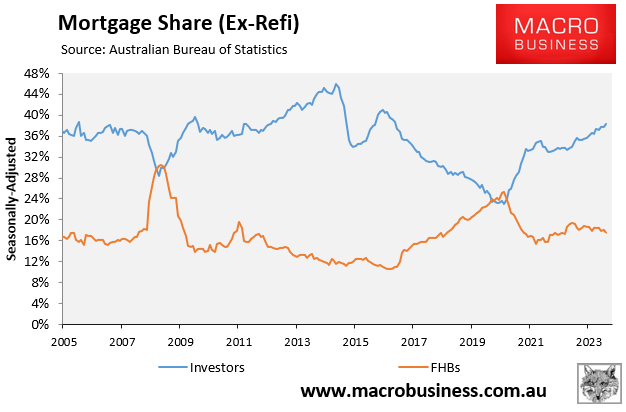

The proposed modest negative gearing changes come in the context of surging demand from investors, which is crowding out first-home buyers:

Moderating investor demand would, therefore, increase the share of purchases from first-home buyers, increasing Australia’s homeownership rate. Surely that would be a positive development?

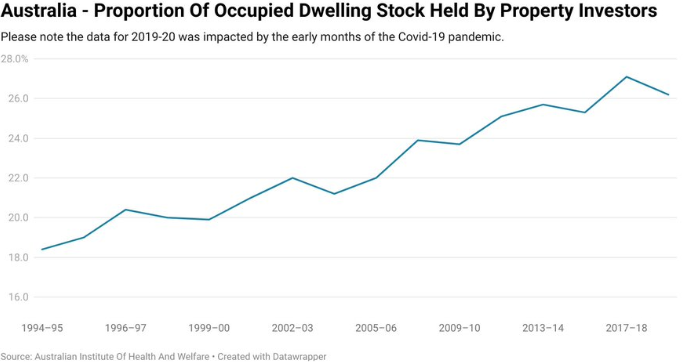

The following chart from independent economist Tarric Brooker shows that the share of Australia’s housing stock owned by investors has grown inexorably over the past 30 years:

“One could conclude the purpose of negative gearing & the CGT discount is to drive up the property investor held share of housing stock”, noted Brooker on Twitter (X).

“Then the question becomes, is that something we want the government to support?”.

Brooker asks a salient question. Is the primary purpose of the housing market to house Australians? Or is it a vehicle for the likes of Bharat Patel to accumulate wealth via preferentially taxed speculation?

I would have thought that policy should aim to increase the homeownership rate, not lower it.

Because that is the effect of Australia’s current property tax regime.