A history lesson is on order:

In October 2000, Daniel Scotto, the most renowned utility analyst on Wall Street, suspended his ratings on all energy companies conducting business in California because of the possibility that the companies would not receive full and adequate compensation for the deferred energy accounts used as the basis for the California Deregulation Plan enacted during the late 1990s. Five months later, Pacific Gas & Electric (PG&E) was forced into bankruptcy. Republican Senator Phil Gramm, husband of Enron Board member Wendy Gramm and also the second-largest recipient of campaign contributions from Enron, succeeded in legislating California’s energy commodity trading deregulation. Despite warnings from prominent consumer groups which stated that this law would give energy traders too much influence over energy commodity prices, the legislation was passed in December 2000.

As the periodical Public Citizen reported:

Because of Enron’s new, unregulated power auction, the company’s “Wholesale Services” revenues quadrupled – from $12 billion in the first quarter of 2000 to $48.4 billion in the first quarter of 2001.

After the passage of the deregulation law, California had a total of 38 Stage 3 rolling blackouts declared, until federal regulators intervened in June 2001. These blackouts occurred as a result of a poorly designed market system that was manipulated by traders and marketers, as well as from poor state management and regulatory oversight. Subsequently, Enron traders were revealed as intentionally encouraging the removal of power from the market during California’s energy crisis by encouraging suppliers to shut down plants to perform unnecessary maintenance, as documented in recordings made at the time. These acts contributed to the need for rolling blackouts, which adversely affected many businesses dependent upon a reliable supply of electricity, and inconvenienced a large number of retail customers. This scattered supply increased the price, and Enron traders were thus able to sell power at premium prices, sometimes up to a factor of 20 × its normal peak value.

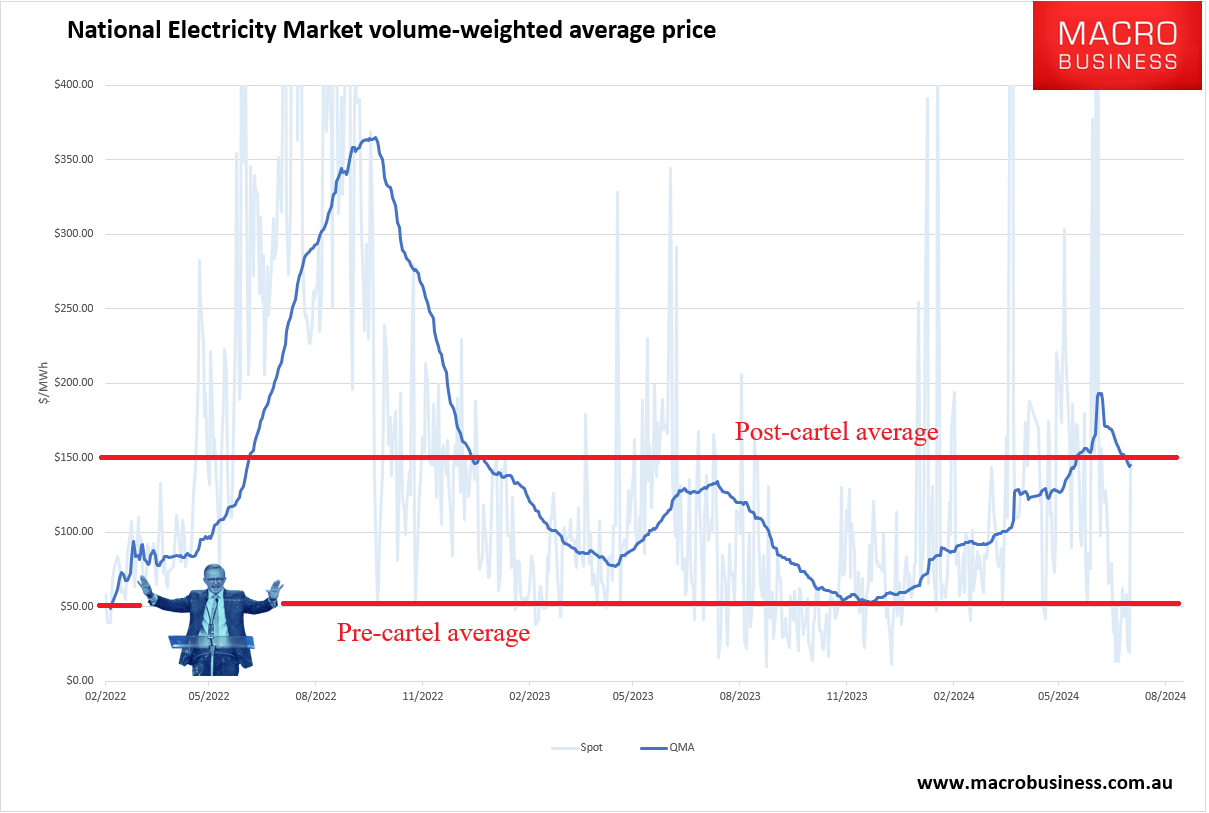

This is Australia’s failed energy market today. Enron is the gas cartel. It rations supply to ensure sky-high prices 400% above the historical average:

Which tips into the failed electricity market (NEM) where cartel/gentailers like Origin Energy profiteer:

The major difference with the Enron case is that US regulators eventually caught up with accounting malfeasance and ENRON was prosecuted out of business.

On the other hand, in Australia, the gas cartel has occupied the entire political economy where it sponsors think tanks like the Grattan Institute to publish pro-cartel reports and it controls the ALP, LNP, as well as the bureaucrats with cash and fear.

Which brings us to Peter Dutton and his gas plan:

According to the government’s Future Gas Strategy, Australia currently has a projected gas supply shortfall between 2027 and 2035 of 3,302 petajoules (PJ). For context, annual production for both domestic use and offshore shipments is expected to be about 1,977 PJs this year.

Under the Coalition’s plan, Labor said, Australia’s cumulative gas supply gap would widen to 9,383 PJs.

Between now and 2035 — during which time the Australian Energy Market Operator (AEMO) forecasts a 50 per cent increase in energy demand and a series of coal closures — the Coalition’s freeze on utility-level renewables and halts on transmission infrastructure will create an east coast energy supply shortfall of 860 terrawatt hours (TWh).

…Energy Minister Chris Bowen said gas has a significant role to play in the future energy grid, but at nowhere near the scale the Coalition is proposing.

“Under our plan, [gas-fired power plants] will be there in reserve and be turned on increasingly less frequently,” he told the ABC.

“Under their plan, with much less renewables in the system, they would have to rely on that gas a lot, lot more.

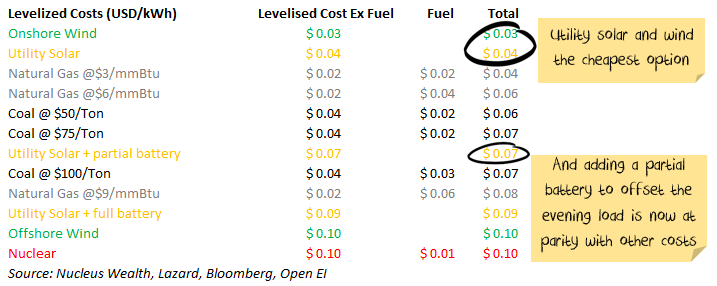

These figures all make sense to me. Using gas as baseload, as opposed to peaking, will deliver triple renewable prices:

The following makes no sense at all:

Shadow resources minister Susan McDonald confirmed last week there would be a significant expansion in gas usage under a future Coalition government, which would seek to incentivise more exploration and production.

In exchange for the green light, the opposition says it will insist gas giants put aside enough gas for expanded domestic use.

Whether exploration will work hangs on state governments, not federal.

Also, recall that it was the LNP government of Malcolm Turnbull that was forced to create the Australian Domestic Gas Security Mechanism (ADGSM) because the cartel had driven local gas prices higher than those in Japan.

The cartel is not partisan. It will rort anybody and everybody equally in its path. The LNP is mad to trust it.

If new production comes onstream, the cartel will juggle its portfolio of acreage to ensure the cheapest gas goes offshore and the most expensive stays in Australia.

There will be some price relief from imported gas as a global glut arrives over the next few years, but all signs suggest that the East Coast gas cartel will also dominate these volumes.

The gas cartel’s stranglehold over reserves means no amount of new supply will lower prices.

Thus, lifting NEM reliance upon gas without reform that restores the market first is completely mad—equivalent to the US gifting ENRON mobsters management of the national grid.