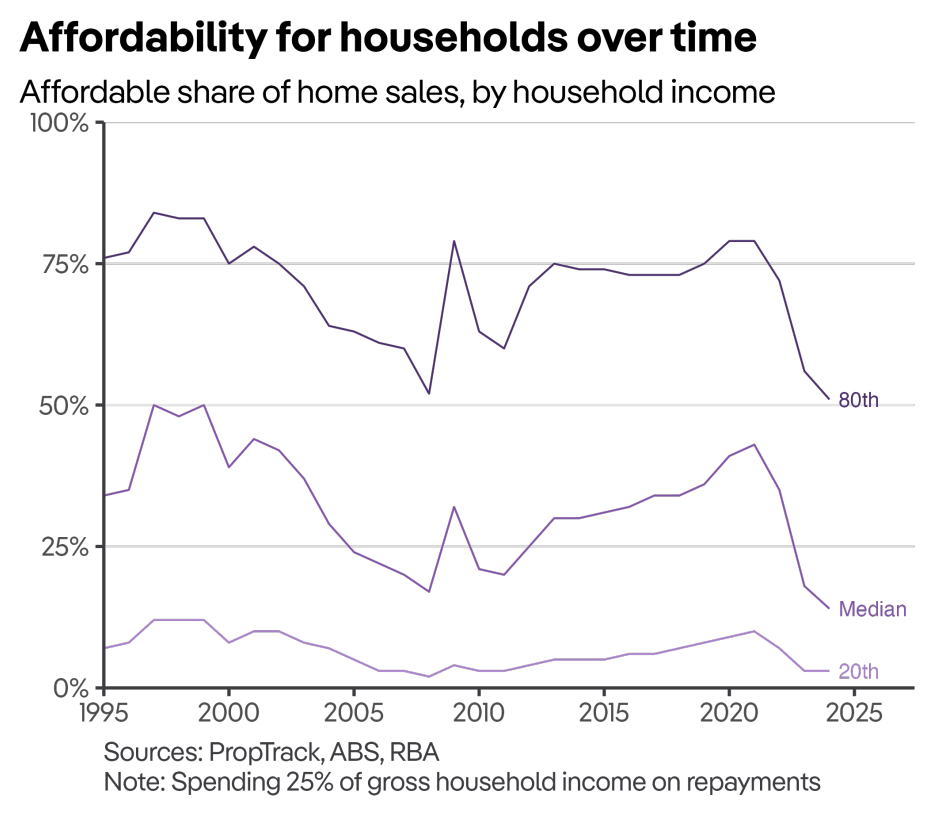

PropTrack’s latest housing affordability report revealed that housing has never been more unaffordable in Australia, with median-income households earning just over $112,000 a year only able to afford 4% of homes sold across the nation over the past year:

Australians now need to be high-income households earning $213,000 a year (i.e., in the top 20% of income earners) to be able to afford to purchase half of the homes sold in Australia over the past year.

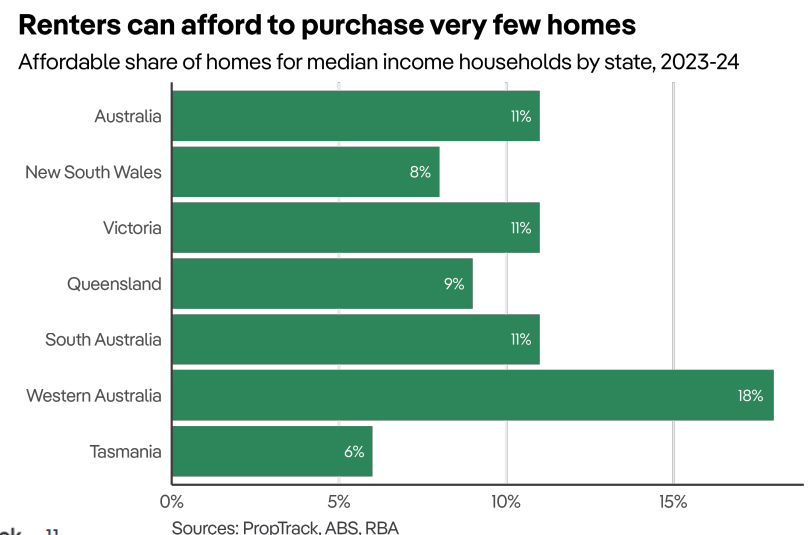

First-home buyers (i.e., renters looking to purchase) are finding it especially hard to purchase a home.

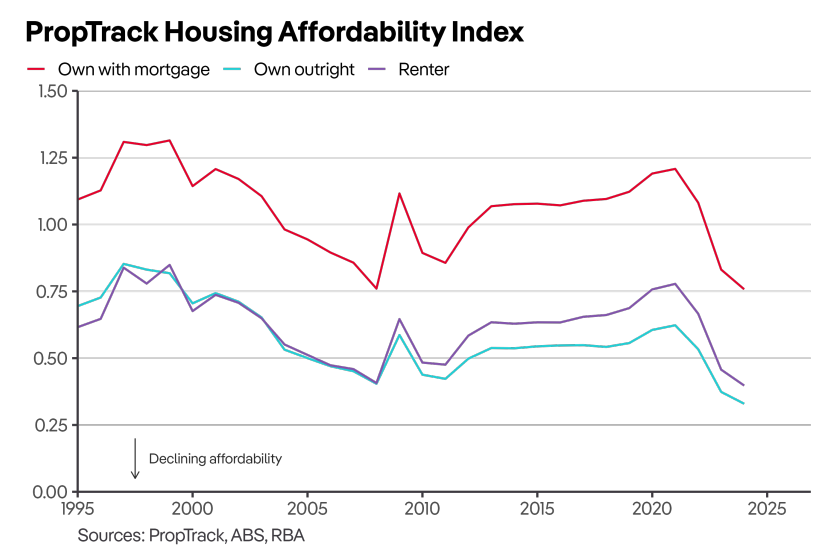

A median-income renting household could afford just 11% of homes sold over the past year (and just 9% of houses). In comparison, the median household with a mortgage could afford 34% of homes sold over the past year:

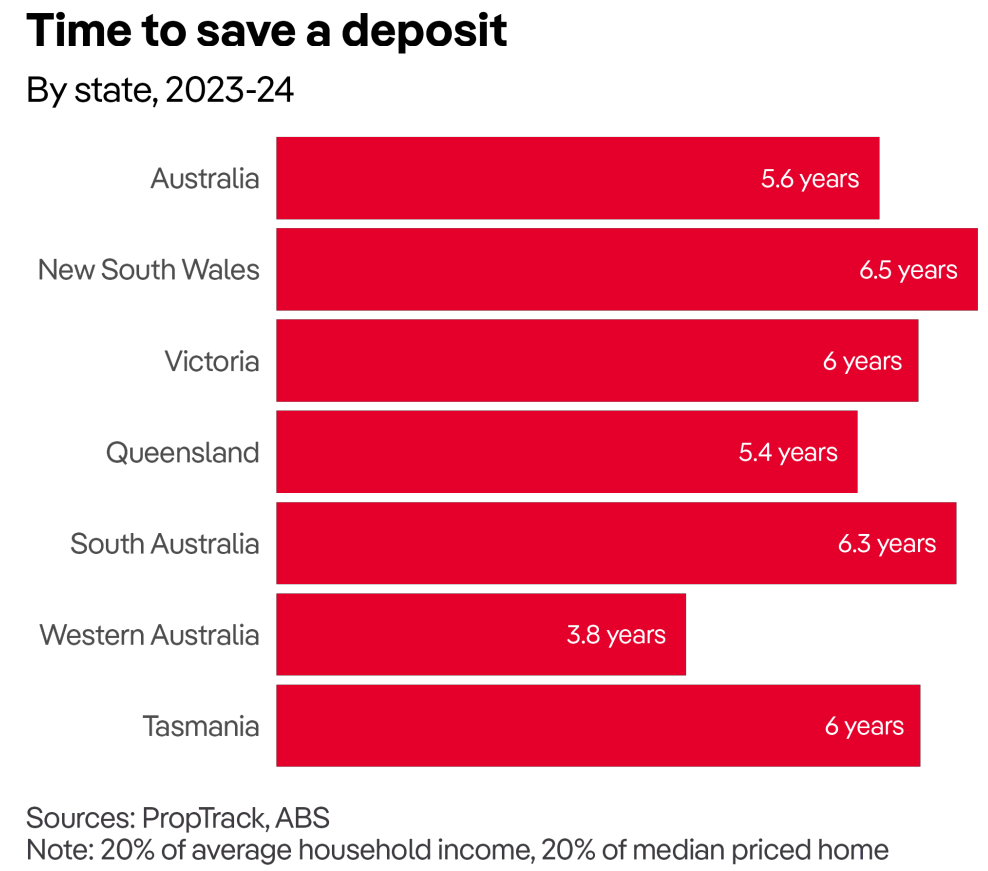

Many first-home buyers struggle to save a deposit while paying rent, even if they can afford mortgage payments.

An average-income household would have to save 20% of their salary for more than five and a half years to save a 20% deposit on a median-priced Australian home:

Despite the above facts, Sydney real estate agent Amir Jahan blamed “emotional” first home buyers for rising prices.

Jahan claimed that it isn’t uncommon for him to sell a home to a young couple willing to pay more than market value for the home they want.

“They are emotional buyers. Young people who have help from rich parents will say, ‘I love this property,’ and their parents will help them get it”, Jahan told news.com.au

He said that when prices sell for high prices, it always comes down to “buyers emotionally falling in love with the property”.

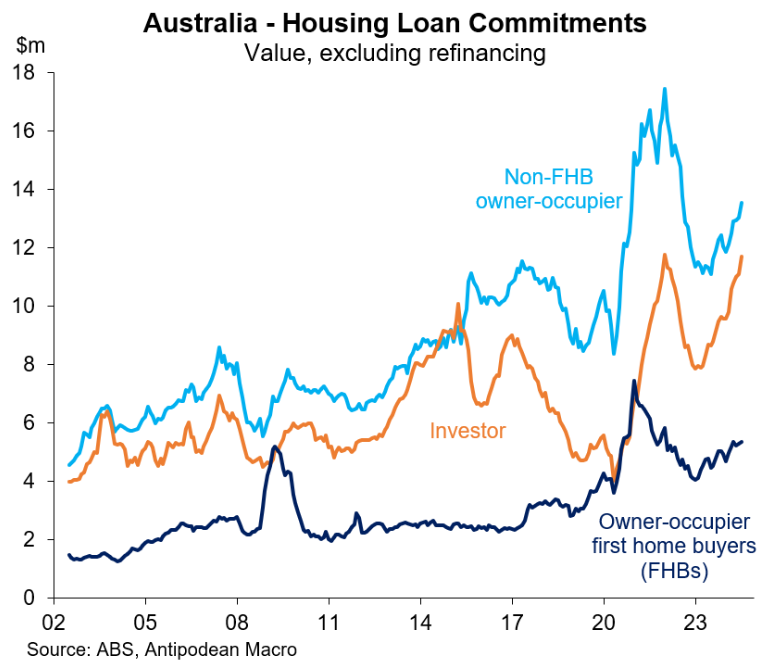

This is classic victim blaming by Amir Jahan. Housing finance data from the Australian Bureau of Statistics (ABS) clearly shows that investor mortgage demand is tracking at record levels and dwarfs first home buyer demand:

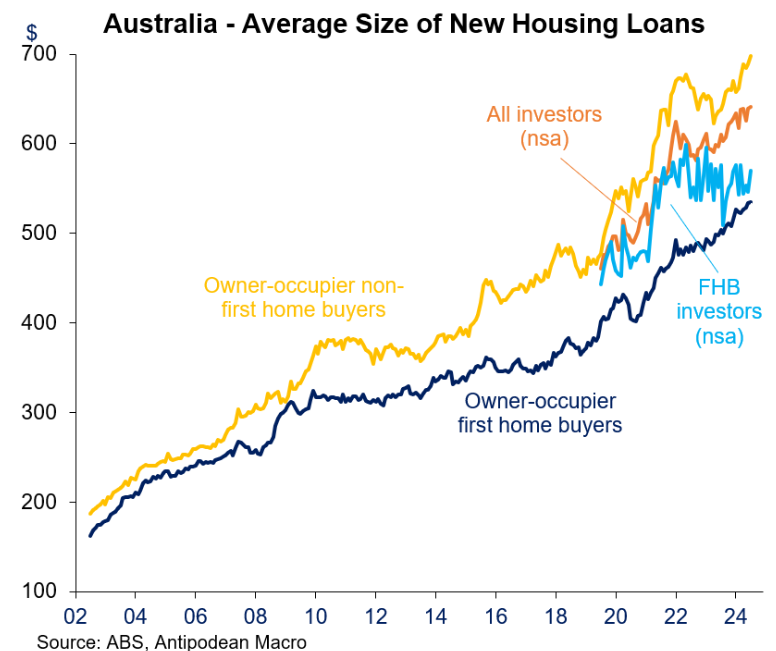

The average loan size for first home buyers is also way below upgraders and investors:

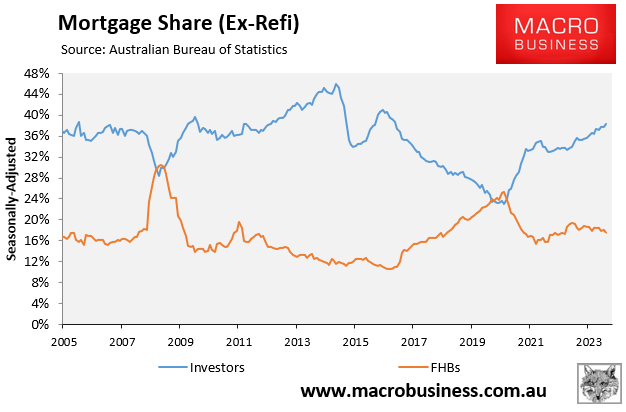

Finally, the following chart clearly shows that first home buyers are being crowded-out by investors:

It is clearly shown above that investor mortgage commitments are inversely correlated with FHB mortgage commitments.

On average, investors have larger budgets and capacity to pay than first home buyers. Therefore, when investor demand increases, they typically outbid first home buyers.

The fact is that Australian housing is too expensive and prices need to fall if the average first home buyer is to have any realistic hope of buying without parental assistance or help from taxpayers.

Moreover, one of the best ways to increase home ownership is to make property investment less attractive via reforming property tax concessions (e.g., negative gearing and the CGT discount).

A moderation of investor demand would likely result in a commensurate uplift in first home buyers entering the market.