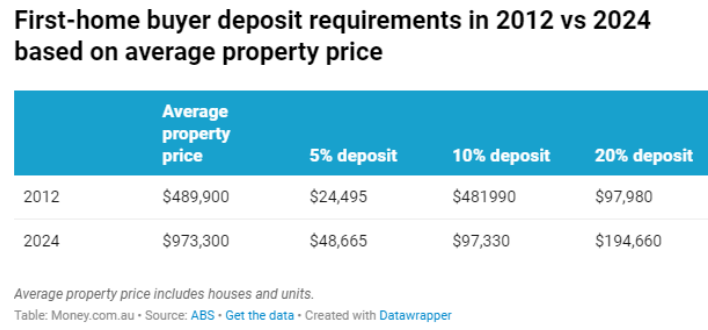

Analysis by Money.com.au shows that first home buyers need to save nearly double the deposit to purchase an average Australia compared to 12 years ago:

“Since the ABS began measuring dwelling values in Australia, the average property price has surged by 99% — from $489,900 in 2012 to $973,300 in 2024”, notes Money.com.au.

“Back in 2012, a first-home buyer would have needed $48,990 for a 10% deposit, while today that figure has nearly doubled to $97,330 — a 99% bigger deposit”.

“For homebuyers wanting to avoid lender’s mortgage insurance (LMI), a 20% deposit in 2012 would have been $97,980, whereas today it’s $194,660”, the analysis says.

While average deposit requires have risen by 99%, the average full-time worker is earning only 42% more.

“The affordability gap for first-home buyers has widened dramatically, making saving for a deposit a near-impossible task”, says money.com.au’s Home Loans Expert, Mansour Soltani.

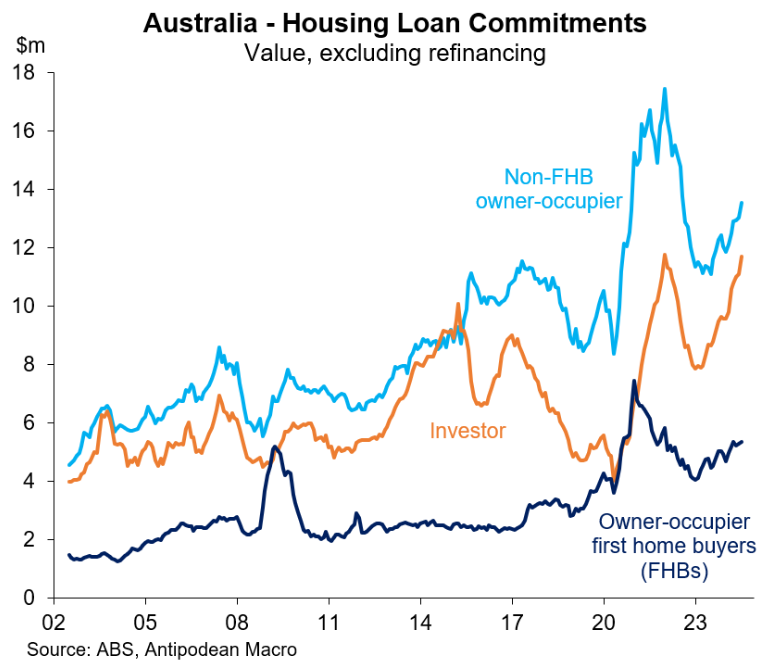

Mortgage data from the Australian Bureau of Statistics (ABS) suggests that investors and upgraders are crowding out first home buyers:

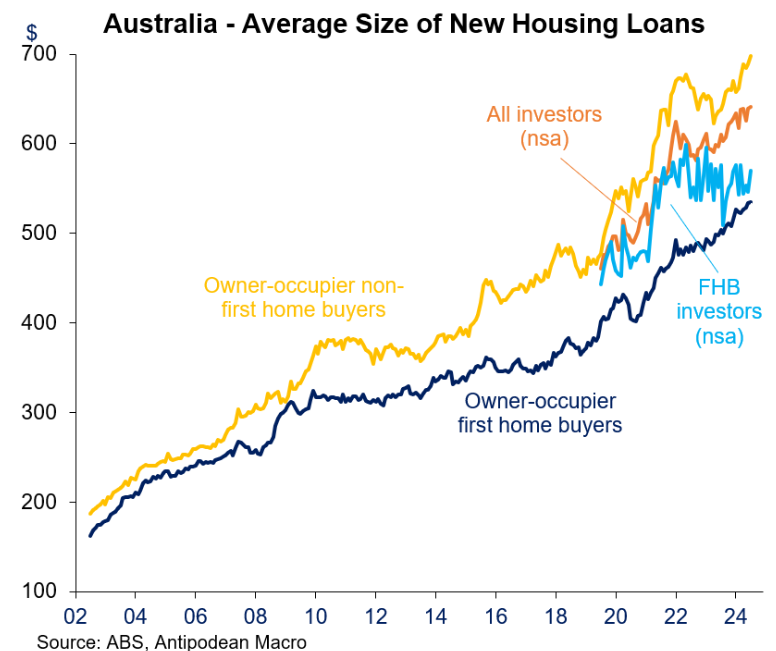

The relative weakness of first home buyer demand is due to strained affordability, as evidenced by the average loan amount for first home buyers being significantly lower than that for upgraders and investors:

The declining affordability and rising deposit gap has forced first home buyers to seek alternative financing methods.

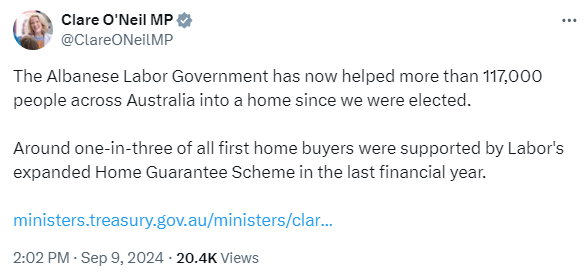

Housing minister Clare O’Neil recently boasted that Labor’s expanded Home Guarantee Scheme had assisted one in three first home buyers last financial year:

Separate data on the ‘Bank of Mum & Dad” showed that up to 60% of first home buyers had received some form of financial assistance from parents to buy, a significant increase from 2010 when it was around 12%.

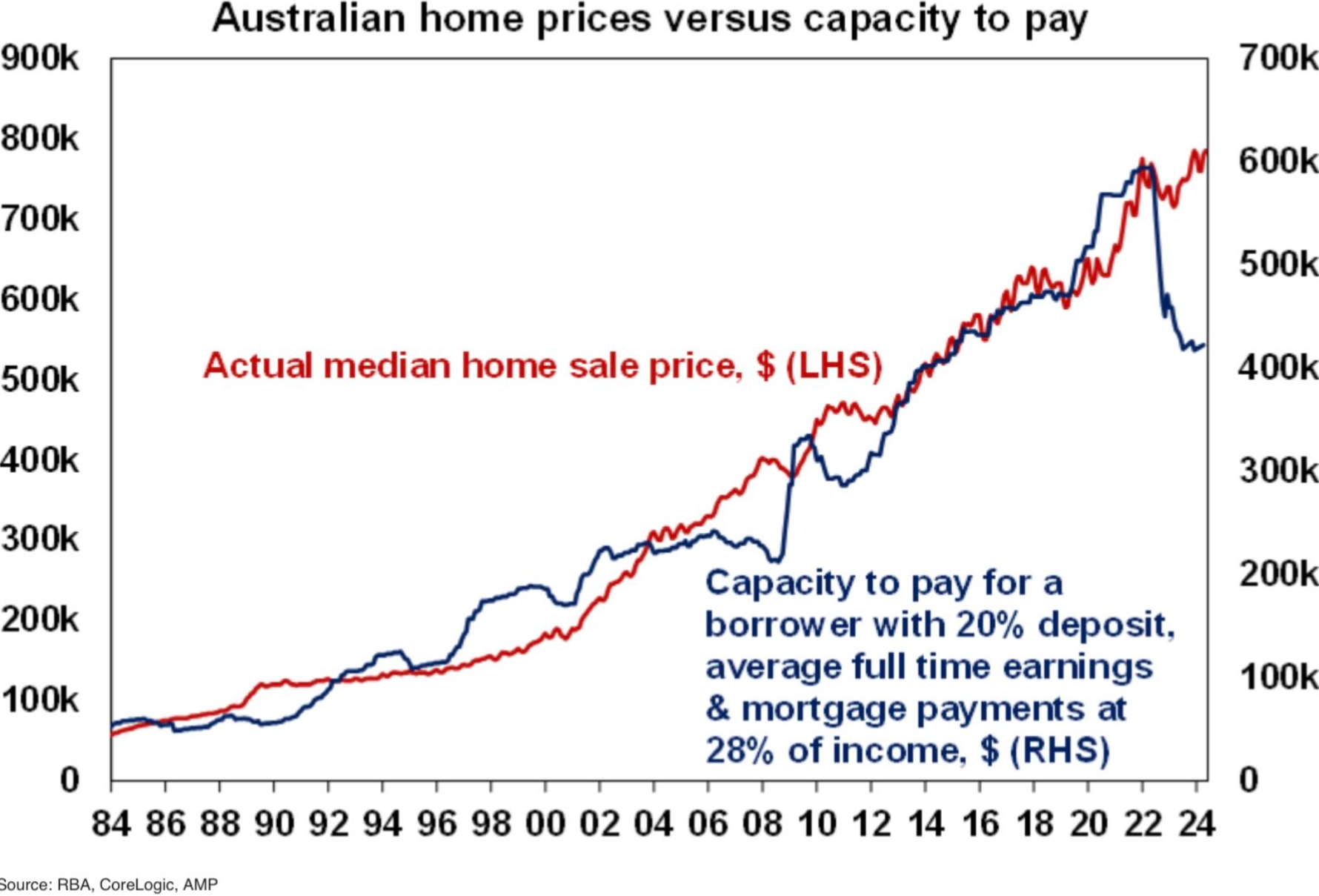

The following AMP chart, which illustrates the enormous discrepancy between borrowing capacity and median home values, summarises the underlying issue confronting first home buyers:

Australian home values are simply too high and must fall if the average first home buyer has any chance of purchasing a home without the assistance of taxpayers or the Bank of Mum & Dad.