Westpac with some nice data.

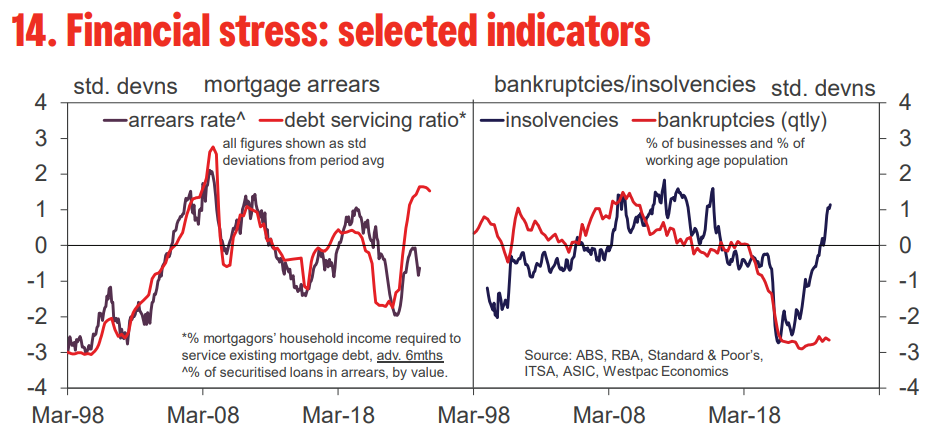

So firstly, the credit cycle. The situation here remains relatively benign. The end of COVID-era special treatments and the sharp rise in mortgage rates – the ‘fixed rate cliff’ included

This saw mortgage arrears climb in 2022 and 2023. However, arrears have retraced a little lower over the first half of 2024 and, overall, remain much lower than might be expected given current high debt servicing costs.

This almost certainly reflects the absence of a material weakening in labour markets. Mortgage distress tends to arise from some combination of high debt servicing costs and some other factor – typically job loss, relationship breakdown, serious health issues or some combination of the three.

When labour markets are weakening – as they often are around or just after the top of an interest rate tightening cycle, the incidence of job loss is higher.

It also makes it harder for those losing jobs to find new employment. Notably, the ‘cure’ rate amongst Westpac customers entering hardship is currently about 70% – i.e. seven out of ten borrowers that go into hardship get back on track after their hardship period ends.

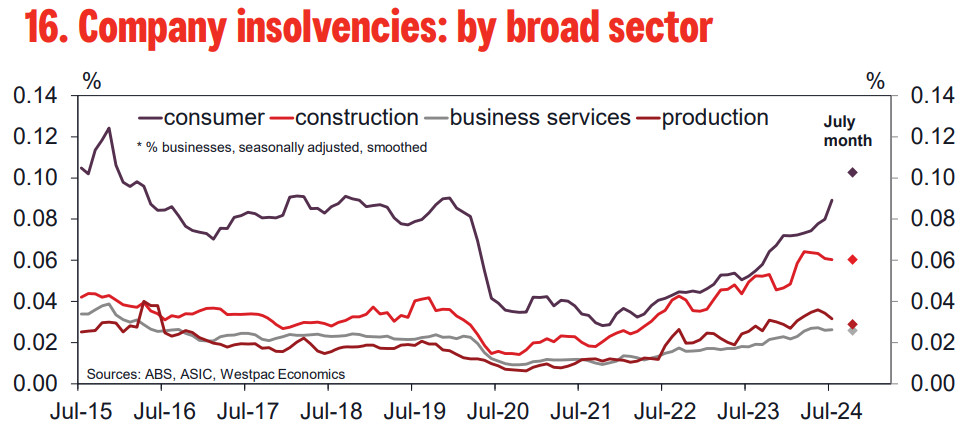

These positives are somewhat offset by a deterioration in business insolvencies which are now near the previous peaks seen a decade ago.

Failures remain high across the construction sector and have risen sharply in consumer sectors – insolvencies in accommodation & food services hitting an all-time high in July.

It should be noted that while insolvencies affect a very small proportion of businesses (<0.1%) there is likely a wider number of businesses moving through more orderly exits.

Latest ABS figures show over one in six businesses in the consumer sector exited in 2023-24, about 15% above the average over the last decade.

It appears households are putting every penny into mortgages so consumption sector businesses are suffering.

Construction busts can thank Albo’s building materials price shock via the gas cartel he refuses to touch.