By Gareth Aird, head of Australian economics at CBA:

Key Points:

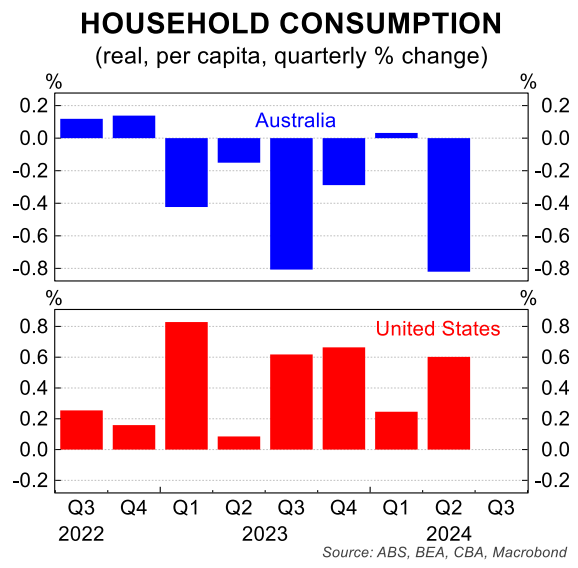

- Real consumer spending contracted in Q2 24 to be just 0.5% higher through the year (comfortably below the RBA’s forecast of 1.1%/yr).

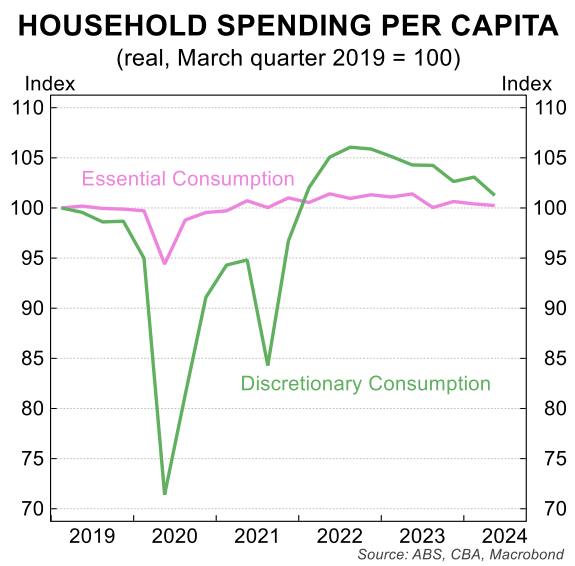

- Real consumer spending per capita has fallen over the past eighteen months, primarily driven by a decline in discretionary spending.

- Private surveys suggest the inflationary pulse has stepped down so far in Q3 24 as weak consumer demand and the ongoing gradual loosening in the labour market assists the disinflationary process.

- We are more constructive on the inflation outlook than the RBA and continue to see consumer inflation declining a little more swiftly than the RBA expects.

- A lower Q3 24 trimmed mean outcome than the RBA has forecast coupled with a more pronounced loosening in the labour market are necessary conditions for the RBA to commence an easing cycle in Q4 24, as per our base case.

- The key near-term domestic economic release for Australian financial market participants is the September labour force survey (19/9).

RBA hawkish rhetoric continues despite consumer weakness:

Arguably the biggest news in last week’s national accounts was the weakness in consumer spending over the June quarter.

According to the ABS, real consumer spending fell by 0.2%/qtr over Q2 24 and annual growth slumped to 0.5%. That outcome compares with the RBA’s forecast for household consumption to be a more buoyant 1.1%/yr in Q2 24.

Despite the miss on consumer spending relative to the RBA’s expectations, Governor Bullock maintained her relatively hawkish tone following the national accounts at last week’s address to the Anika Foundation.

Specifically, the Governor stated in her speech that, “with underlying inflation having fallen very little over the past year in quarterly terms, the Board is vigilant to upside risks”.

And the Governor reiterated her message following the August Board meeting that, “if the economy evolves broadly as anticipated, the Board does not expect that it will be in a position to cut rates in the near term.”

Based on the August Statement on Monetary Policy (SoMP), we have backsolved the RBA’s inflation profile to estimate the RBA has forecast Q3 24 trimmed mean inflation to be 0.8%/qtr, which would see the annual rate print at ~3.5% (down from 3.9%).

Favourable base effects will be at work in the September quarter when the solid 1.2%/qtr increase in the Q3 23 trimmed mean CPI drops out of the annual calculation.

On the RBA’s forecasts the six-month annualised rate of core inflation would dip to 3.4% in Q3 24. We believe such an outcome would constitute decent progress on reducing inflation over the past six months.

But the Board is likely to need to see a softer trimmed mean outcome than the RBA expects to be willing to commence an easing cycle this calendar year. We anticipate that outcome.

Our preliminary forecast is for Q3 24 trimmed mean CPI of 0.7%/qtr. We have held that forecast since May.

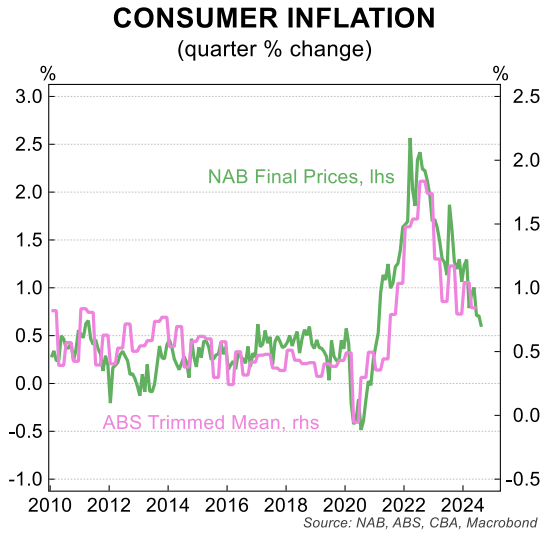

The July monthly CPI indicator was broadly in line with our quarterly forecast. And more recently we have been encouraged by the softening prices gauges in key private surveys for our inflation call.

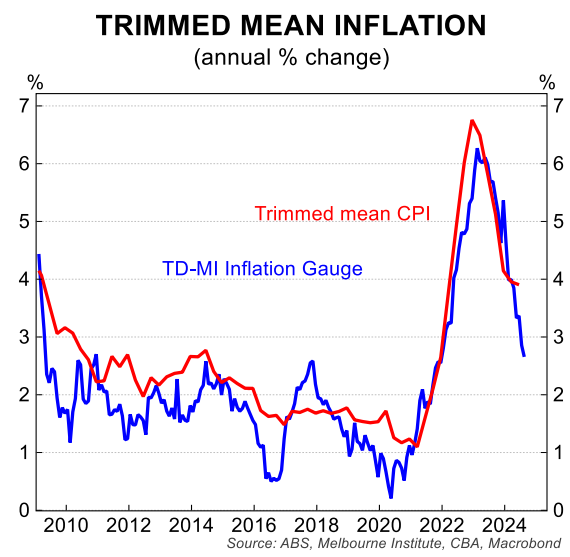

Melbourne Institute Inflation Gauge has dropped sharply.

The Melbourne Institute (MI) monthly inflation gauge is based on ABS methodology. It is designed to replicate the quarterly CPI based on estimates of monthly price movements of goods and services.

Prior to the introduction of the ABS monthly CPI indicator it was considered the main monthly inflation gauge in Australia.

Whilst the importance of the MI inflation gauge has diminished a little because of the ABS monthly CPI indicator, it is still a timely update on the inflationary pulse.

The August MI trimmed mean inflation gauge, which was released last week, was flat over the month. This was the softest monthly outcome in 10 months. The annual rate ticked down to 2.7%, its lowest level since January 2022.

At times the MI trimmed mean inflation gauge deviates from the ABS trimmed mean, so the correlation is certainly not perfect. But the gauge has historically provided a good directional steer on changes in the rate of core inflation. And we were particularly encouraged by the August outcome.

NAB final prices measure eased in August

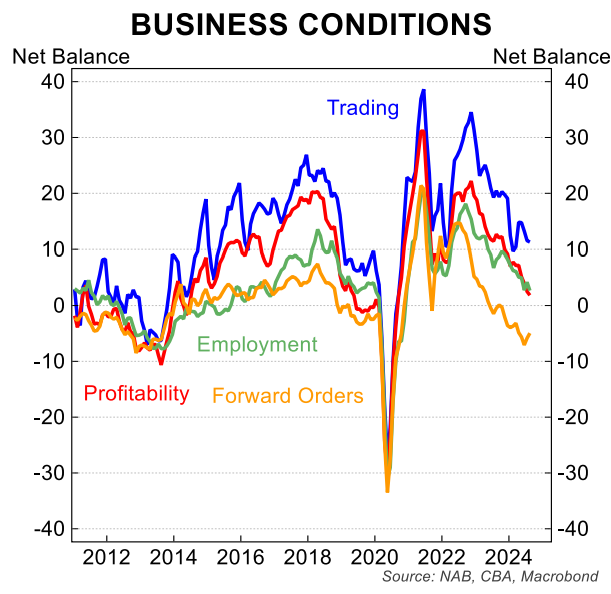

The August NAB monthly business survey was weak. Confidence fell into negative territory. And the more important business conditions measure dipped back to below its long run average.

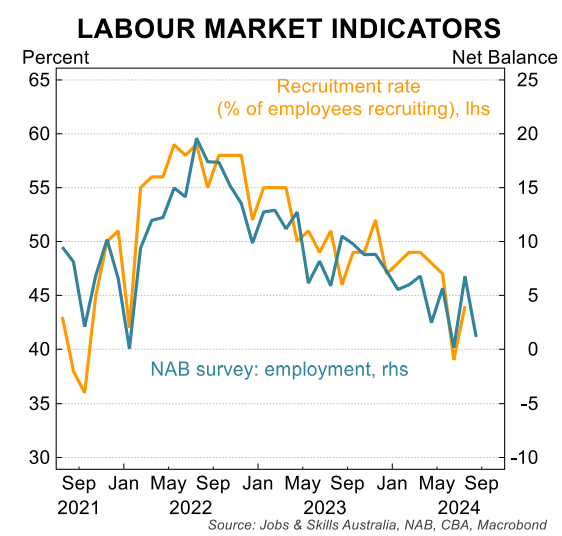

The decline was led by a fall in the employment subcomponent, implying the labour market will continue loosening.

The news was not all bad. The weakening in business conditions has led to encouraging news on the prices side.

The NAB final prices gauge, which is most positively correlated with consumer prices, grew by 0.6%/qtr in August, a touch lower than the previous two monthly reads of 0.7%/qtr in June and July.

For context the final prices gauge averaged a much firmer 1.1%/qtr over H1 24.

The prices data in the NAB survey is generally choppy month to month. But the two monthly reads so far in the September quarterly bode well for the allimportant official Q3 24 CPI (due 30/10).

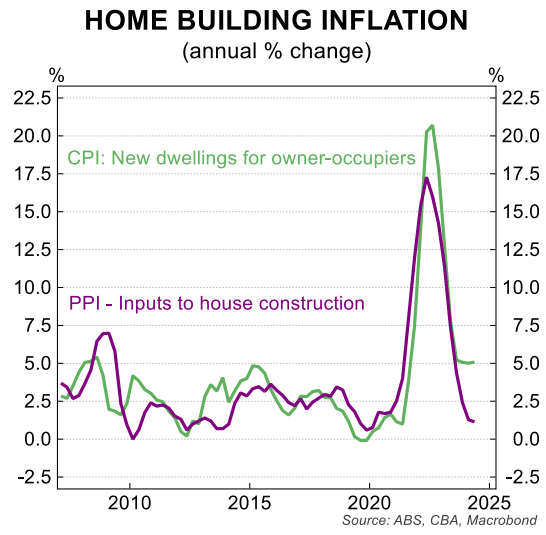

Housing inflation to moderate

The housing component of the CPI basket (worth ~22% of the overall basket) has been a key driver of inflation over the past two years.

Strong growth in the cost of building a home and rents in particular have been behind the strength in overall prices growth. But the outlook for housing inflation is slowly improving.

The signal from upstream producer prices, as measured by inputs to home construction, is constructive for the cost of building a home.

Inputs into home construction from the PPI have historically had a close positive correlation with price changes in the cost of building a home. And growth in the PPI measure points to some disinflation in the home building space.

On rents, elevated prices growth is expected to persist in the near term as we are simply not building enough homes. But the lead signal from advertised rents suggests growth in the overall stock of rents will moderate.

Changes to household formation are assisting as my colleague Stephen Wu noted.

Utility prices are also part of the housing component of the CPI basket. It has been well documented that electricity prices will drop sharply over the September quarter due to government energy rebates.

The RBA is on record as saying it will look through the energy subsidies. And utilities prices will be ‘trimmed out’ in Q3 24.

Notwithstanding, the fall in household energy prices will drop headline inflation materially, which will keep inflation expectations anchored as well as slow growth in administered prices linked to actual CPI outcomes.

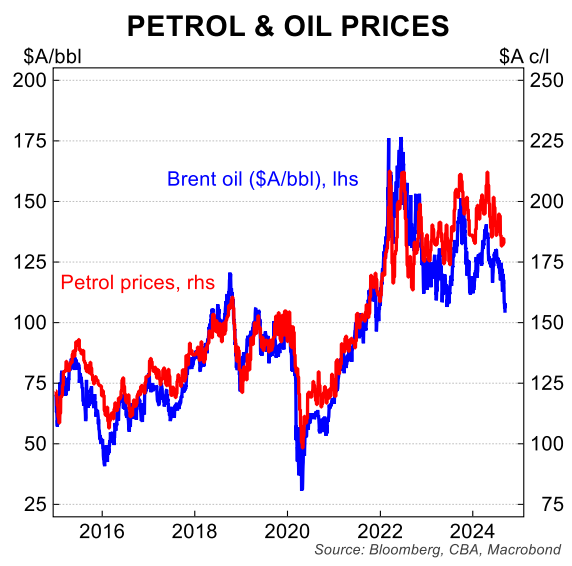

Oil prices have retraced materially

Global oil benchmark Brent crude futures have just settled at their lowest level since December 2021. The move lower has been driven by the downward revision from OPEC+ for demand growth for the rest of this year and 2025.

As noted by out commodities analyst Vivek Dhar, worries around US oil demand have joined forces with concerns around China’s oil consumption.

Lower oil prices will push down petrol prices at the local bowser. But more generally, a lower oil price will aid the global disinflationary pulse.

This helps to curb growth in input costs for many Australian businesses, thereby dampening cost-push inflation.

Labour market data is critical to the monetary policy outlook

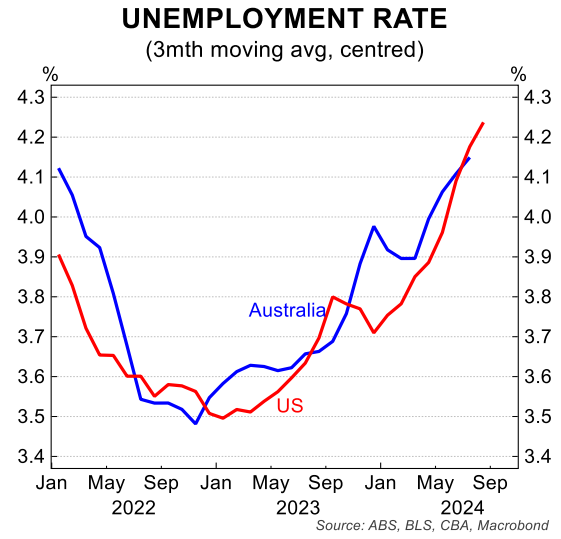

A firmer disinflationary pulse than the RBA expects in Q3 24 is a necessary ingredient to see the RBA commence an easing cycle this calendar year. But the evolution of the unemployment rate will also play a big role in when the central bank joins its global peers in cutting rates.

The August labour force survey prints next week on 19 September. The unemployment rate increased by 0.1ppts in July to 4.2%. Indeed the unemployment rate has risen by 0.7ppts from its cyclical low of 3.5%.

The monthly labour force data has been choppier than usual more recently. But the trends are clear. The supply of labour is rising faster than the demand for workers so unemployment is moving higher. This in turn is seeing wages pressures ease.

Another lift in the unemployment rate to 4.3% in August will leave us more comfortable with our non-consensus call for the RBA to commence an easing cycle in Q4 24.

And if we see such an outcome next week, we expect the RBA will soften its hawkish rhetoric at the September Board meeting on 24/09.

The August Board Minutes stated that, “it was appropriate to continue placing somewhat greater-than-usual weight on the flow of data, relative to the forecasts, when there were uncertainties about the persistence of supply shocks (our emphasis on bold)”.

This suggests that the RBA is more data dependent than usual. As a result, we believe the Board will be more reactive to near term data than is generally the case.

Importantly, it means the probability of an RBA ‘pivot’ is higher than usual in the policy setting process.

In addition, we think the implicit admission by the Board that it will be more reactional to the economic data flow waters down the recent forward guidance that the Board does not expect that it will be in a position to cut rates in the near term.

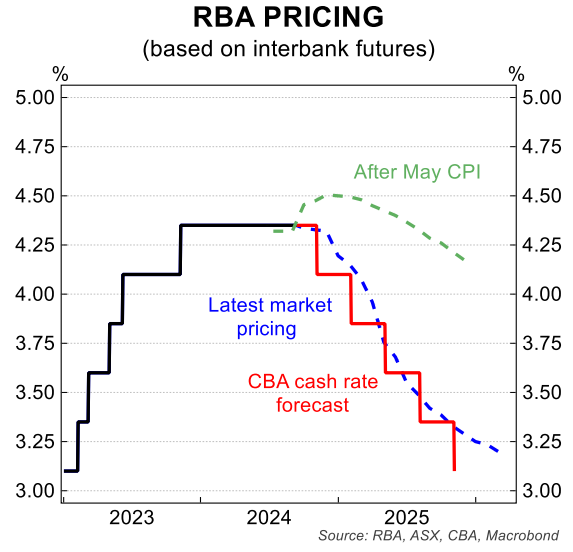

Our central scenario for the RBA is currently in broad agreement with money market pricing. We expect ~125bp of policy easing by the end of 2025 that would take the cash rate to 3.10%.

Fiscal policy remains a key source of uncertainty, particularly as we head into an election year. Note the 2025 Commonwealth Budget is currently scheduled to be handed down in March 2025, earlier than the usual month of May, to make room for an expected election.