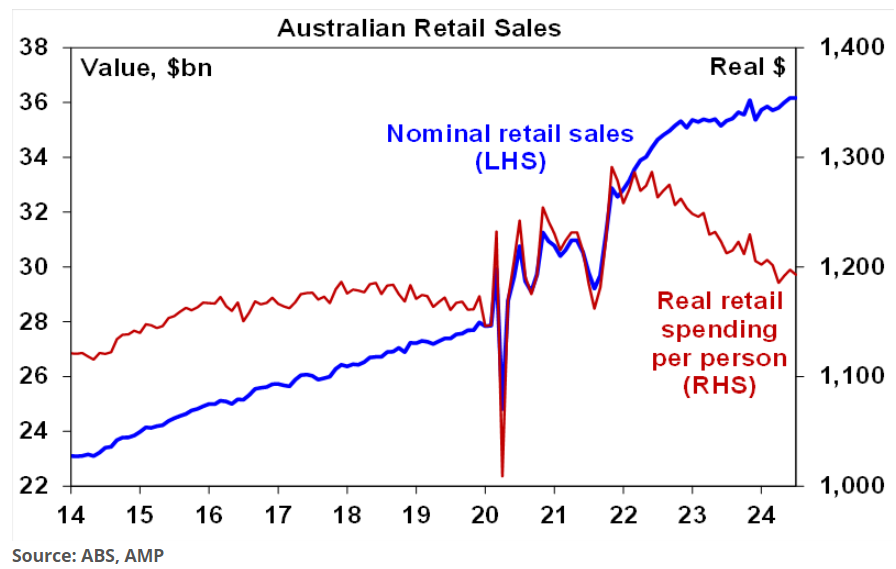

Friday’s retail trade data from the Australian Bureau of Statistics (ABS) recorded no bounce from the Stage 3 tax cuts, with the value of sales remaining flat (0%) over the month and falling in real per capita terms.

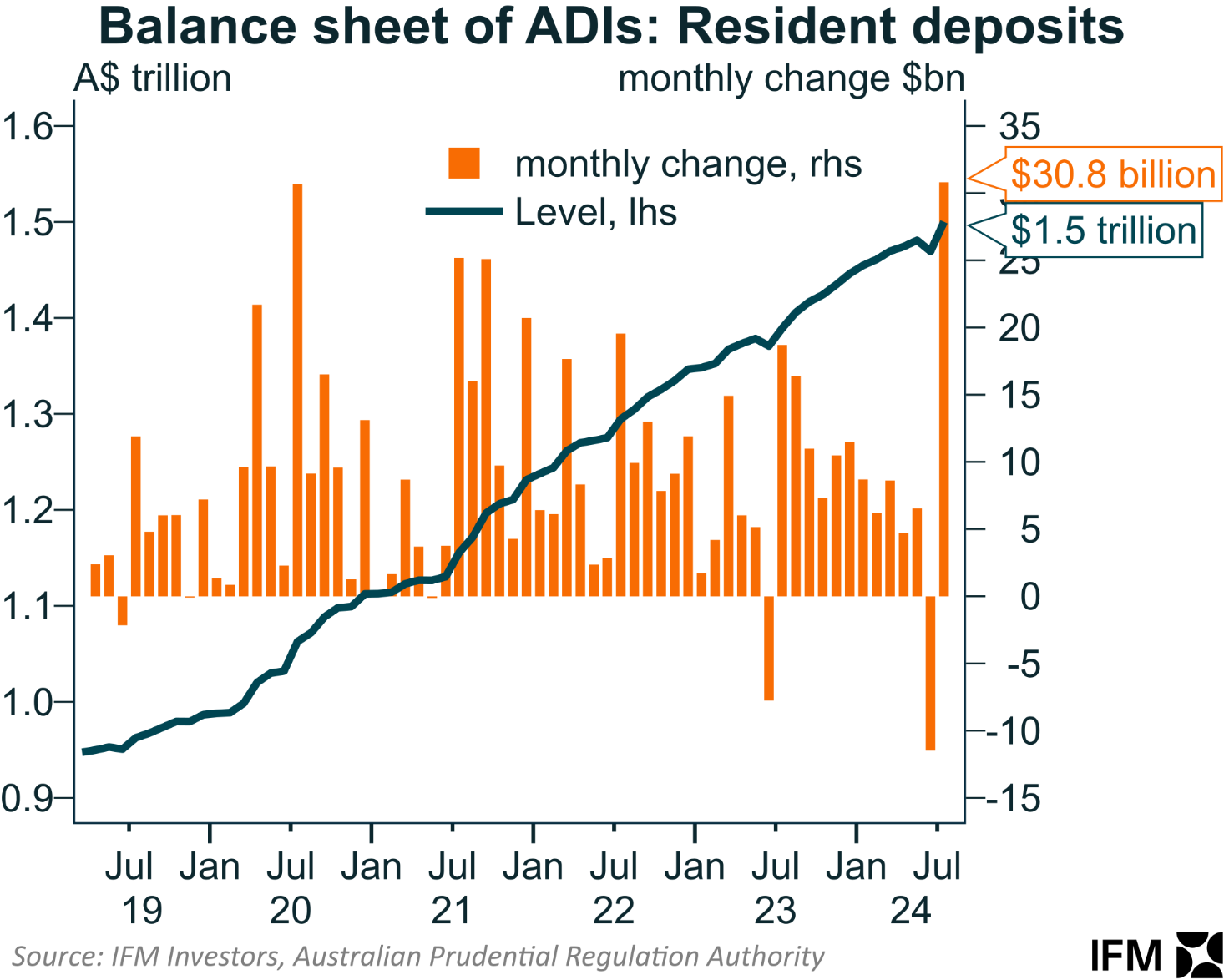

Chief economist at IFM Investors, Alex Joiner, posted the following chart on Twitter (X) showing that the value of resident deposits bounced by $30.8 billion in July in non-seasonally adjusted terms:

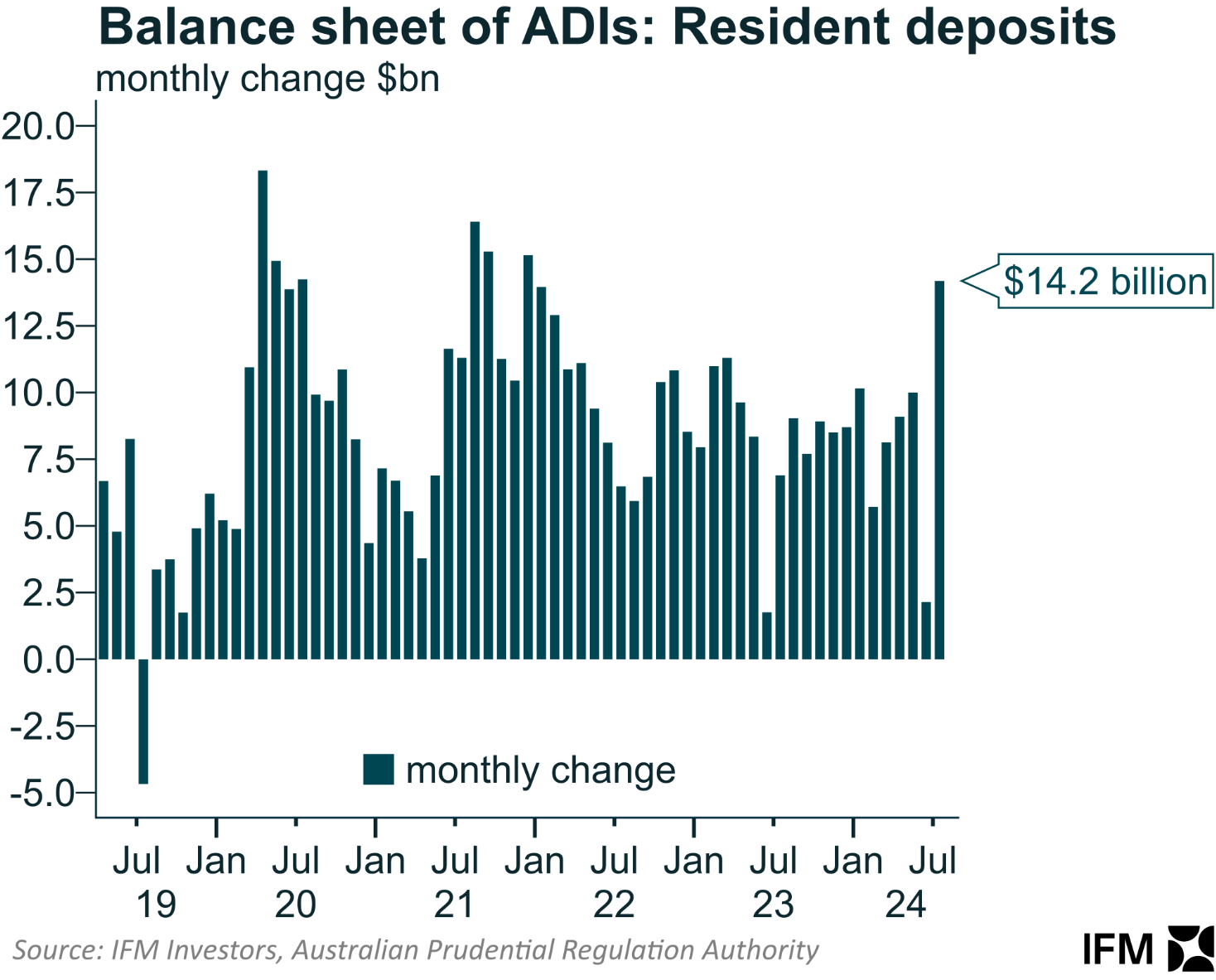

Once seasonal adjustments are applied, resident deposits still rose by an abnormally large $14.2 billion in July:

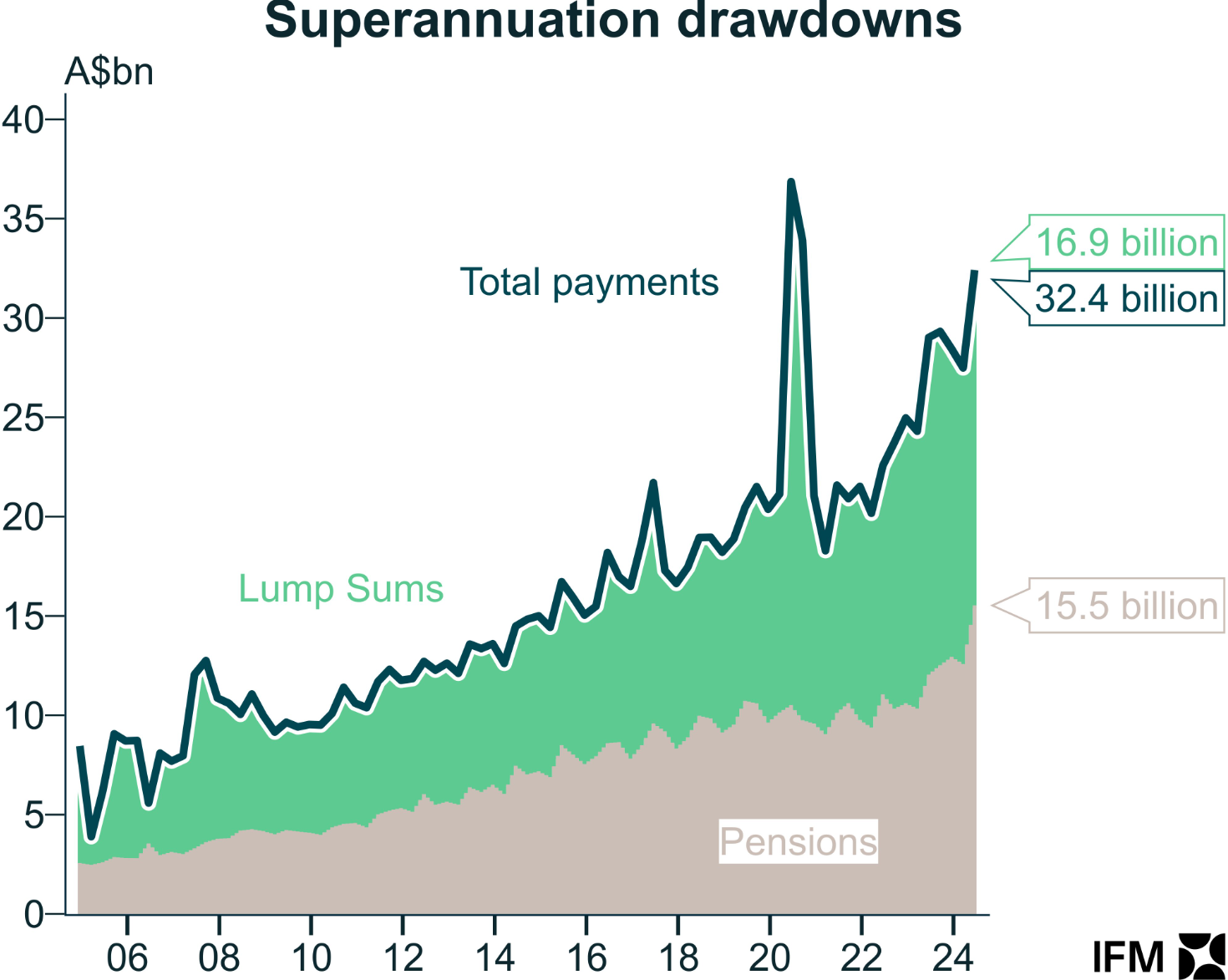

Joiner also noted that there was a sharp rise in superannuation drawdowns in Q2:

Based on the above, it appears that most Australians have chosen to save their Stage 3 tax cuts over spending them.

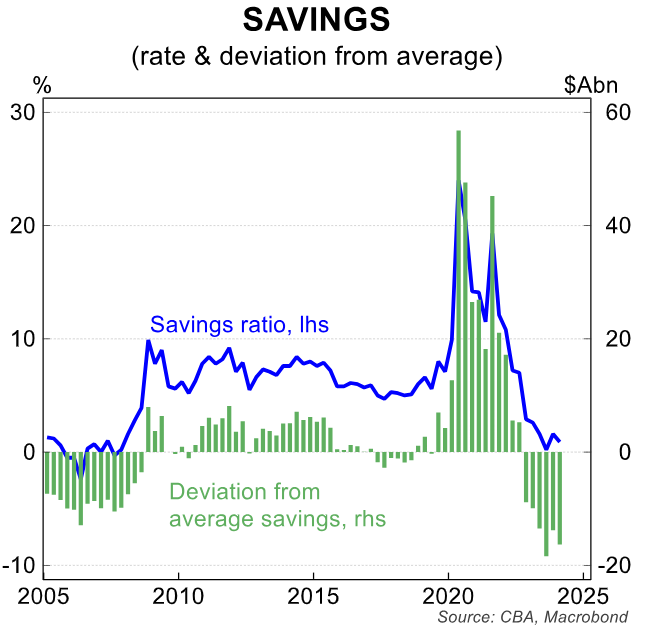

This may reflect, in part, the fact that the household savings war chest accumulated over the pandemic has been mostly run down, prompting households to rebuild their savings buffers.

This implies that the boost to consumer spending this financial year from the Stage 3 tax cuts will be partially offset by the decline of the tailwind on consumption from the savings drawdown, which has taken place since late 2022.