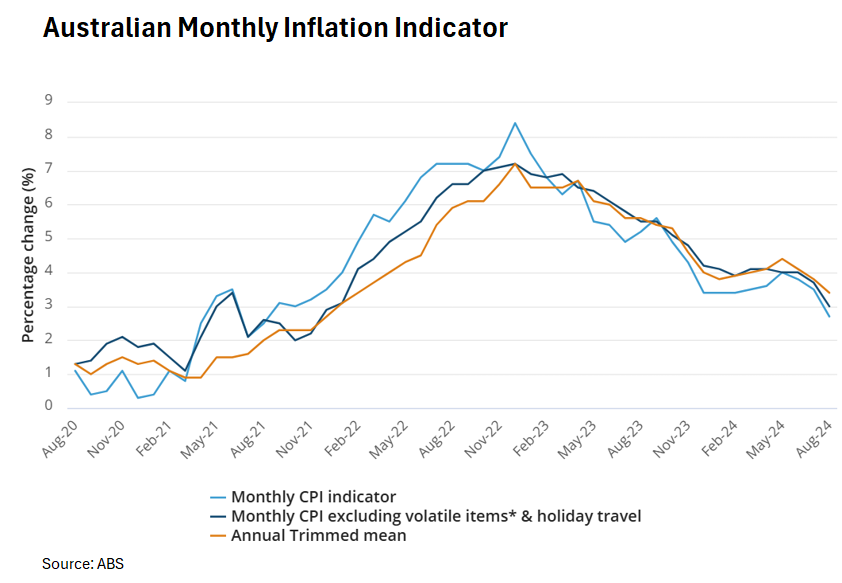

Reserve Bank of Australia (RBA) governor Michele Bullock said that she would “look through” the result, but the ABS monthly inflation indicator has been released with CPI inflation rising by 2.7% in the 12-months to August, down from a 3.5% rise in the 12 months to July:

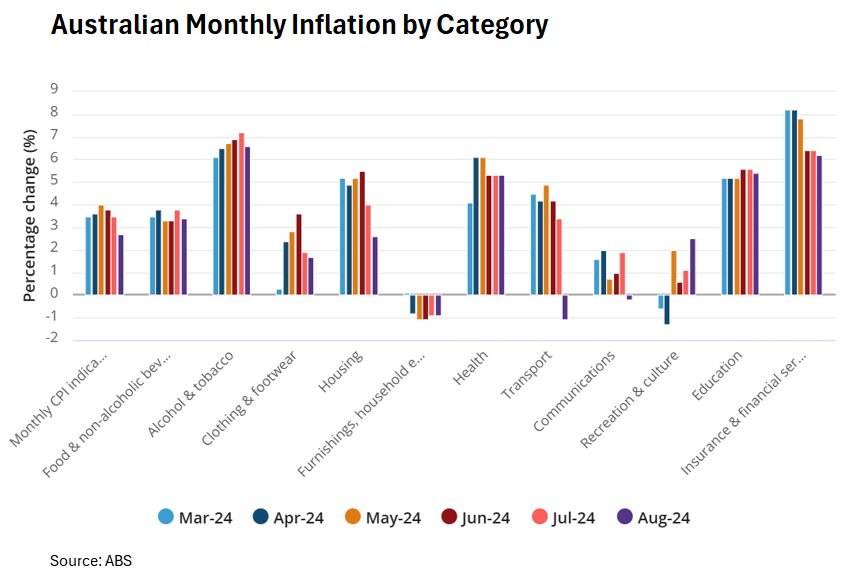

The most significant price rises at the group level were Housing (+2.6 %), Food and non-alcoholic beverages (+3.4 %), and Alcohol and tobacco (+6.6 %). Partly offsetting the annual increase was Transport (-1.1 %).

The Trimmed mean, which reduces the impact of irregular or temporary price changes (i.e., excluded both the falls in Automotive fuel and Electricity, alongside other large price rises and falls) was 3.4% in August, down from 3.8% in July.

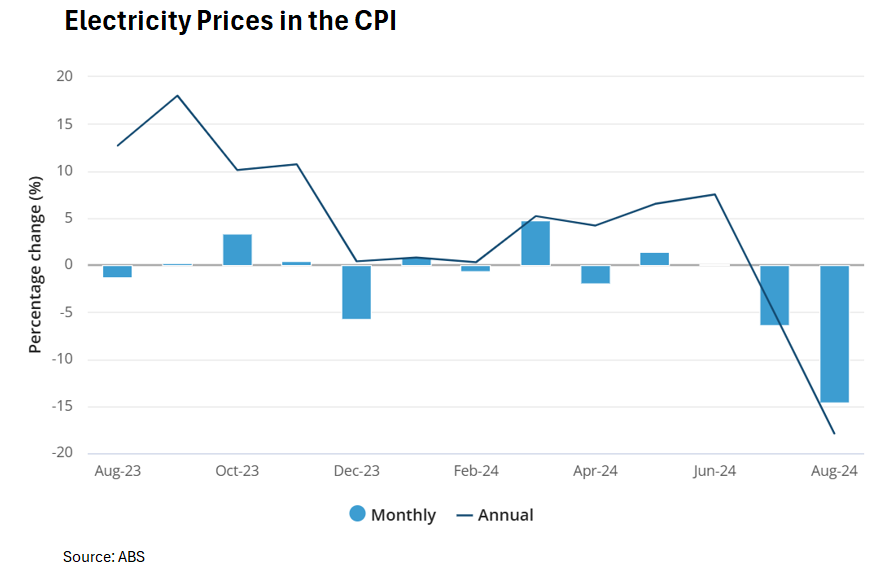

Electricity prices fell 17.9% in the 12 months to August, down from a 5.1% annual fall in July. This is the largest annual fall for Electricity on record.

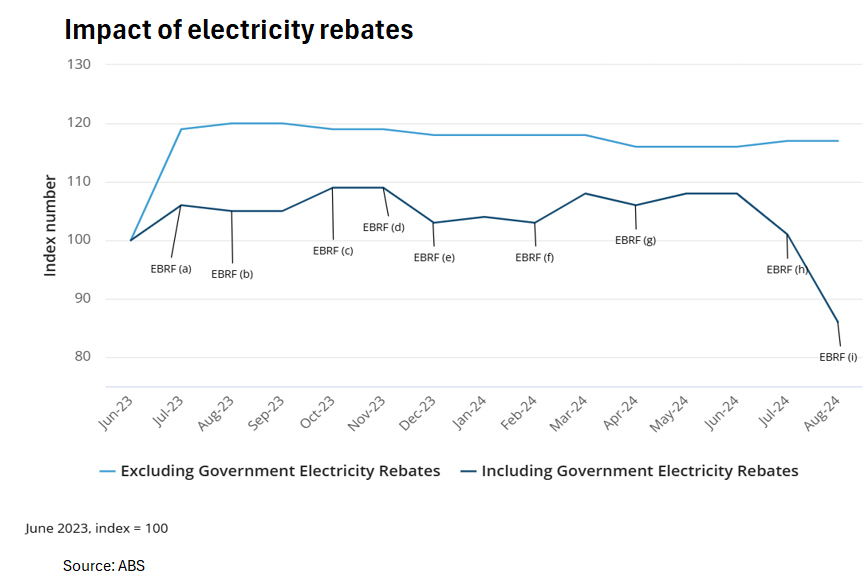

The combined impact of Commonwealth Energy Bill Relief Fund (EBRF) rebates in all States and Territories in addition to State rebates in Queensland, Western Australia and Tasmania drove the annual fall in electricity prices.

Households in Queensland and Western Australia received the first instalment of Commonwealth EBRF rebate in July 2024. Households in the remaining States and Territories received their first instalment in August 2024.

In addition to the Commonwealth rebates, households in Queensland, Western Australia and Tasmania continued to receive their respective State government rebates.

The impact of the electricity rebates is illustrated below:

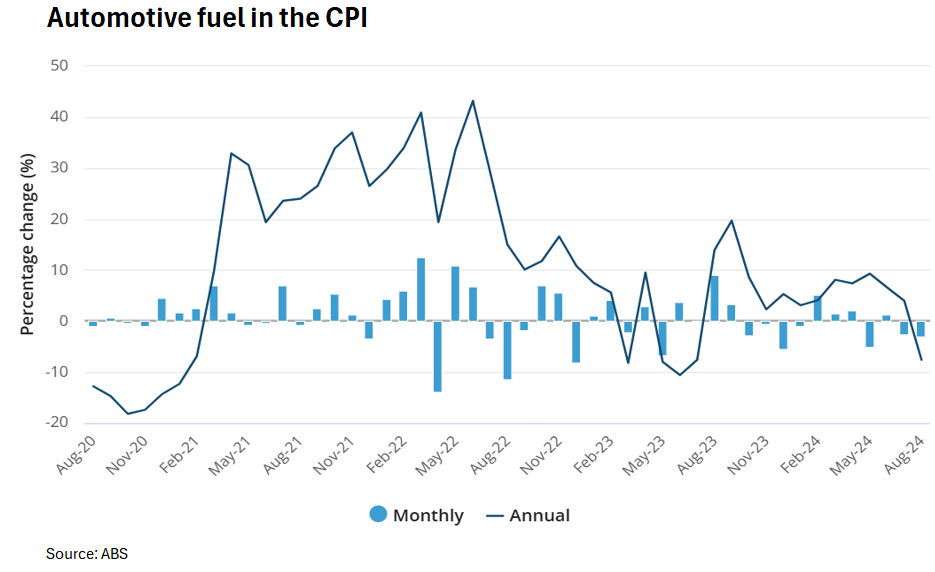

Falling petrol prices have also dragged the headline monthly CPI lower:

Automotive fuel was 7.6% lower than August 2023 after price falls in recent months.

In light of the sharp decline in headline CPI, driven by government subsidies, expect the Albanese government to increase pressure on the RBA to cut interest rates.

Based on Tuesday’s comments from Governor Michele Bullock, the RBA will not be bullied and will wait for underlying inflation to fall below target before cutting rates.