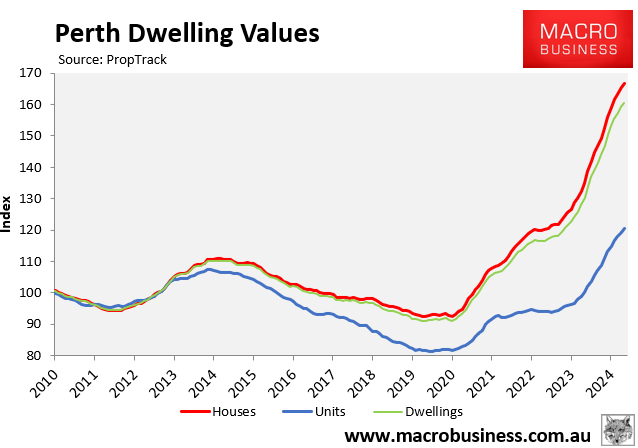

Perth house prices are booming, with values increasing by 23% in the year to August to be up 76% since the beginning of the pandemic in March 2020:

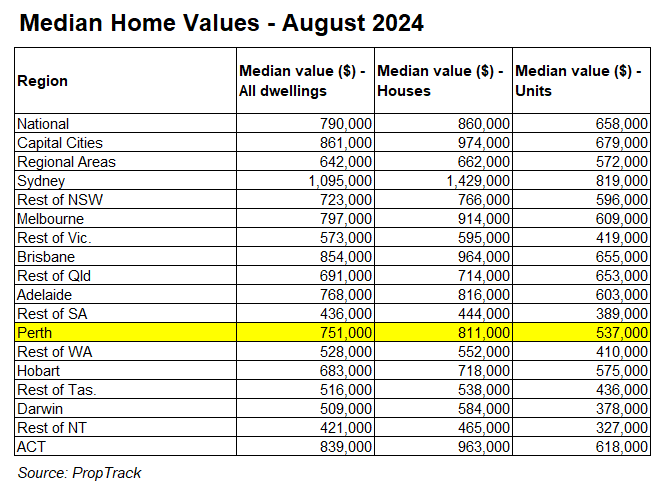

Despite the surge in values, Perth’s housing market remains relatively affordable, with median dwelling values tracking $110,000 below the national capital city average in August:

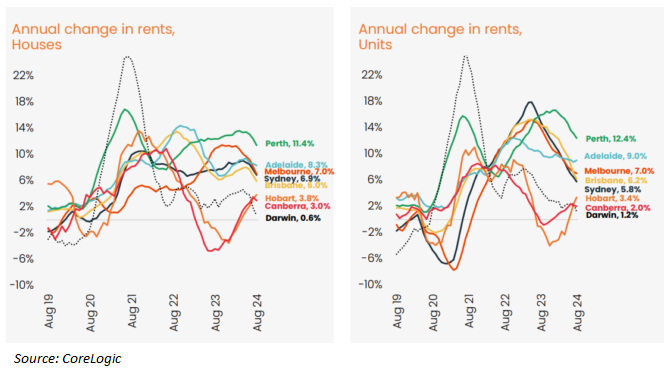

Perth has also experienced the nation’s strongest increase in rents, with house rents rising 11.4% in the year to August and unit rents surging by 12.4%:

This surge in rents is being driven by a growing shortage of housing.

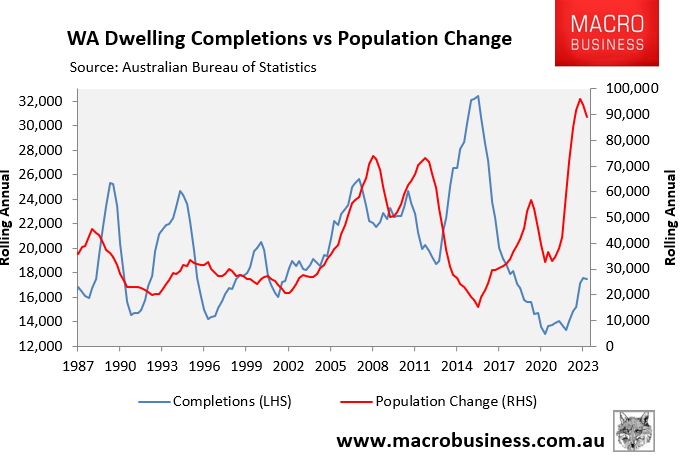

As illustrated in the next chart, Western Australia’s population grew by 89,000 in the year to March against a dwelling completion rate of only 17,500:

Perth’s relative affordability, growing shortages, and strong rental growth has made it a honeypot for interstate investors.

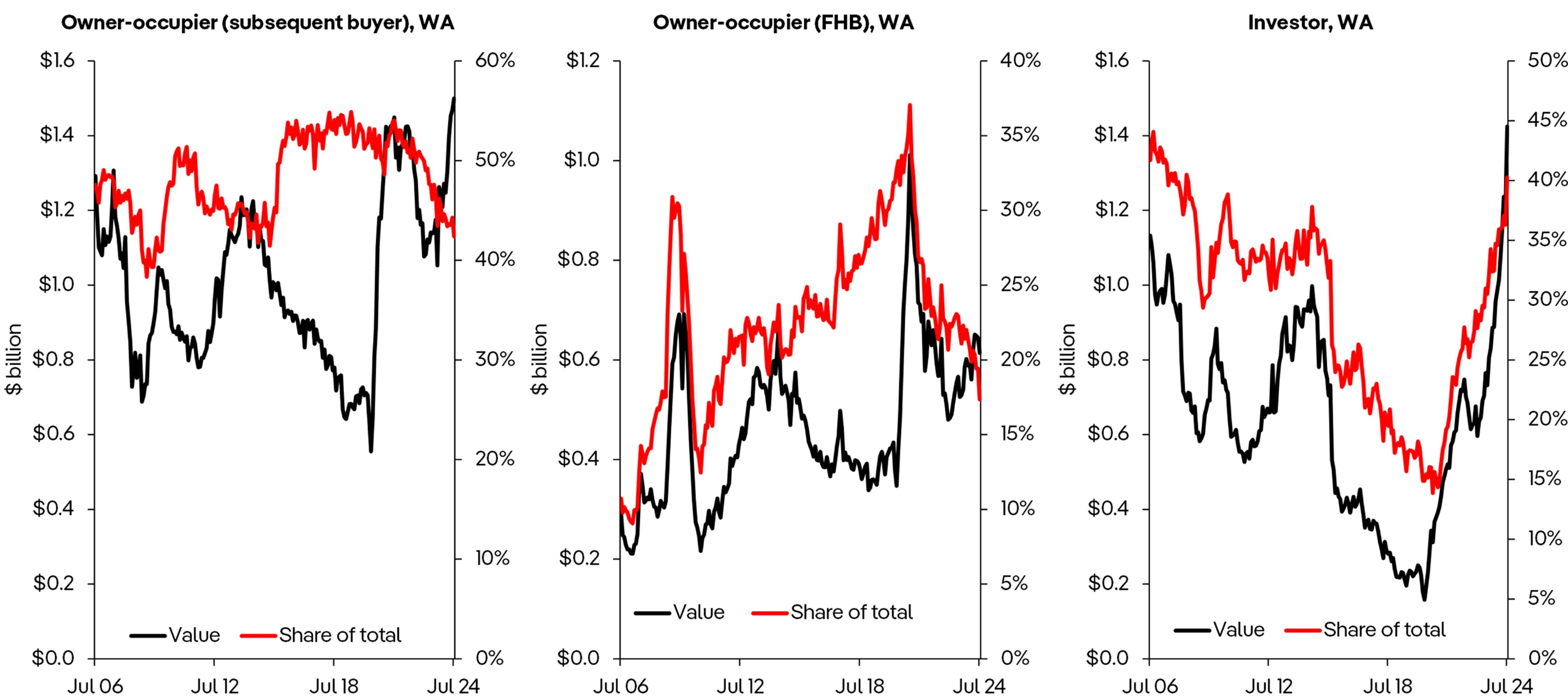

As illustrated below by Cameron Kusher from PropTrack, new lending to investors in Western Australia was 94.5% higher year-on-year, with investors comprising a 40.3% share of new lending—the highest percentage since May 2008:

Source: PropTrack

While Perth’s housing market appears to be a one-way bet, there are storm clouds building on the horizon.

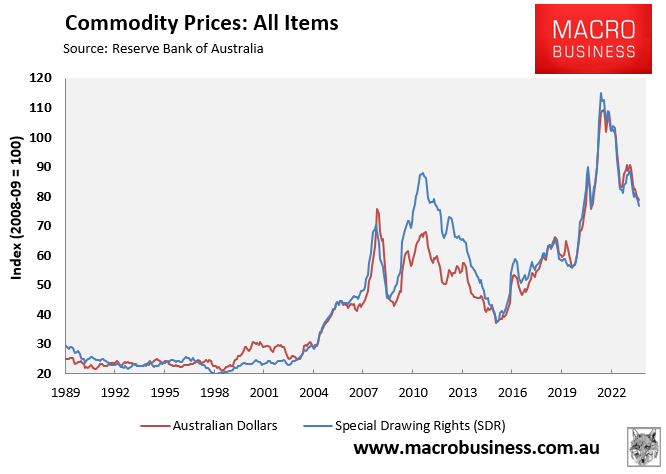

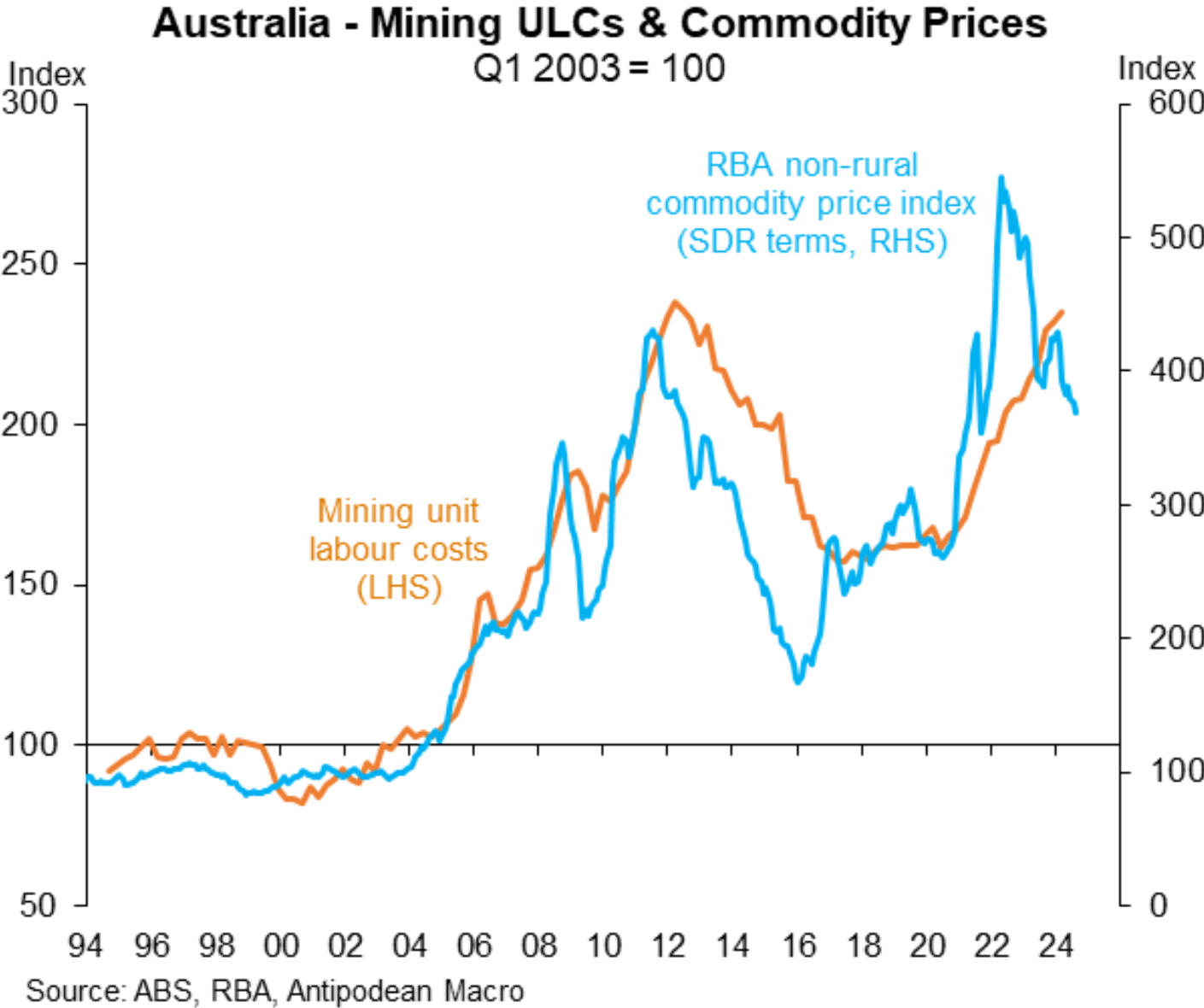

Perth’s economy and housing markets are heavily influenced by the mining sector. And commodity prices have fallen sharply, as illustrated below:

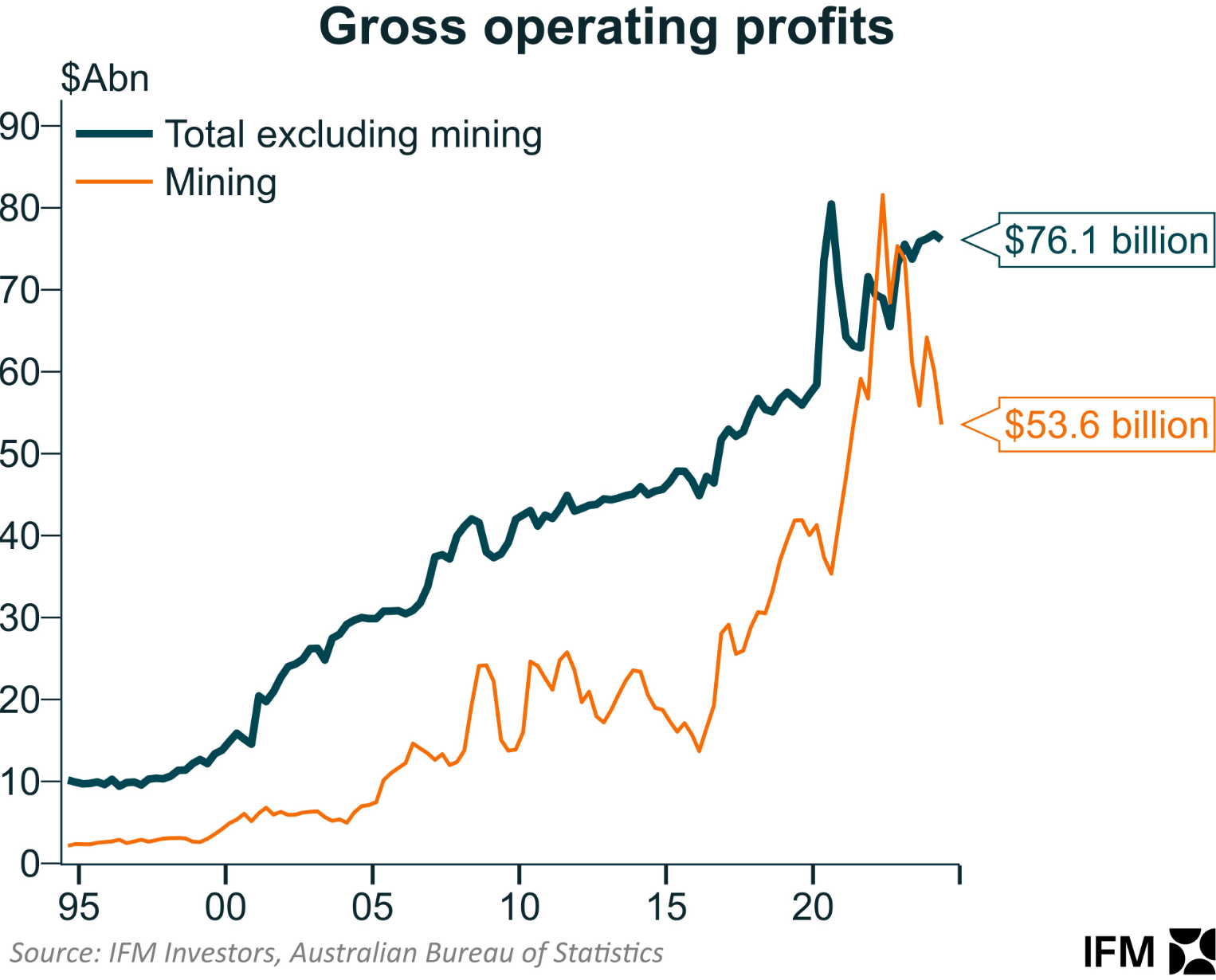

As a result, profitability across the mining sector is falling:

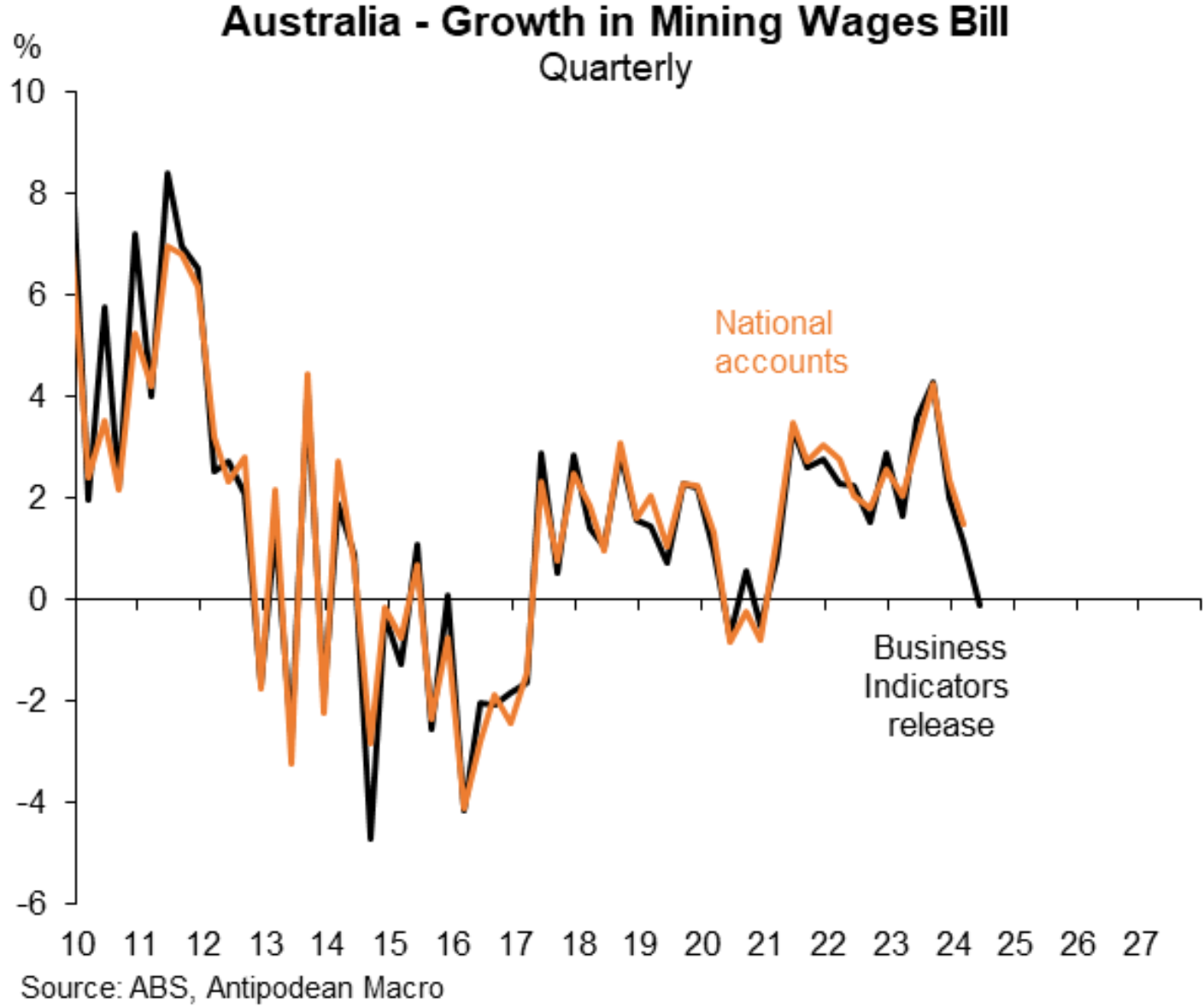

Total salaries are also falling across the mining sector:

Typically, when commodity prices and earnings fall, the sector responds with cost-cutting and rationalisation:

Perth has historically been a boom and bust housing market, mirroring the mining sector.

For example, the commodity bear market last decade drove an 18% decline in Perth dwelling values between 2014 and 2019 (and a much deeper decline in real terms).

So, while investing in Perth looks like a no-brainer, the housing market risks another extended decline in concert with the mining sector and commodity prices.

Investing in Perth should therefore be viewed as a risky proposition.