After Friday’s short squeeze, iron ore fell sharply into the weekend. For once, steel margins improved:

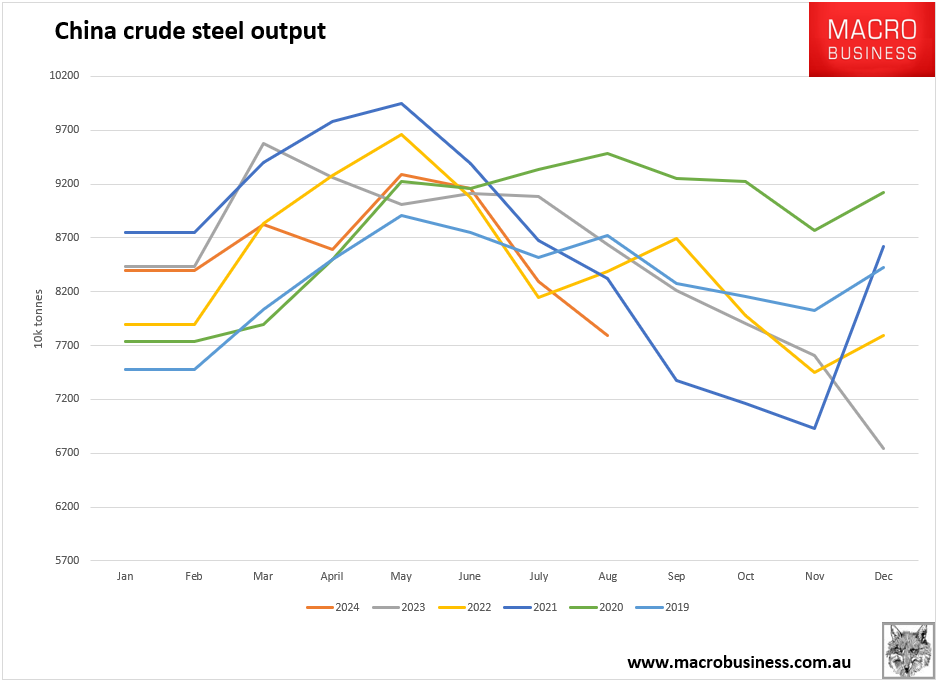

Weekend data was at least as bad as expected and probably worse. Steel output was bereft in August:

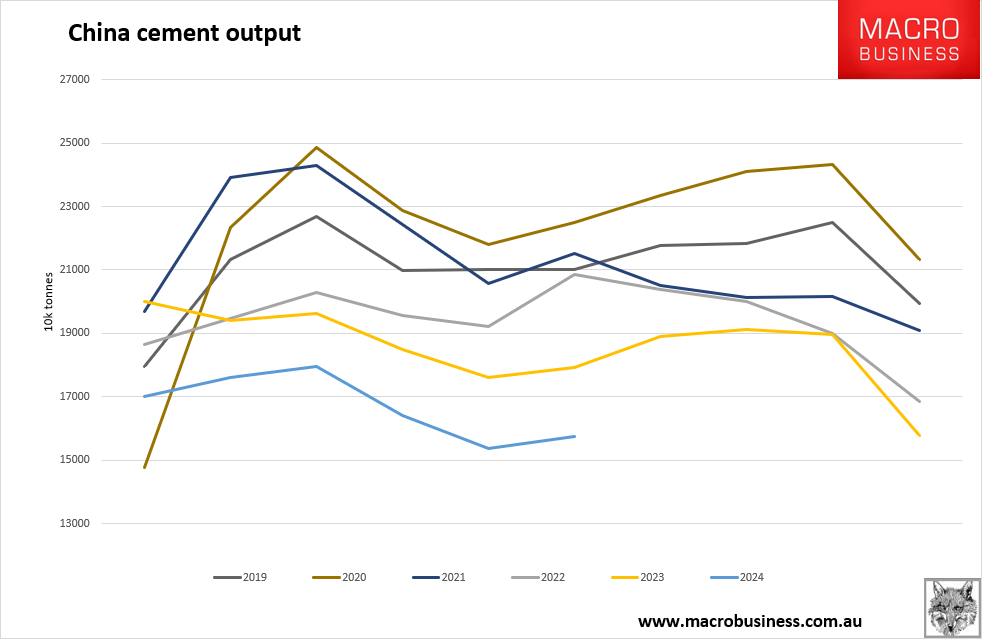

Along with cement:

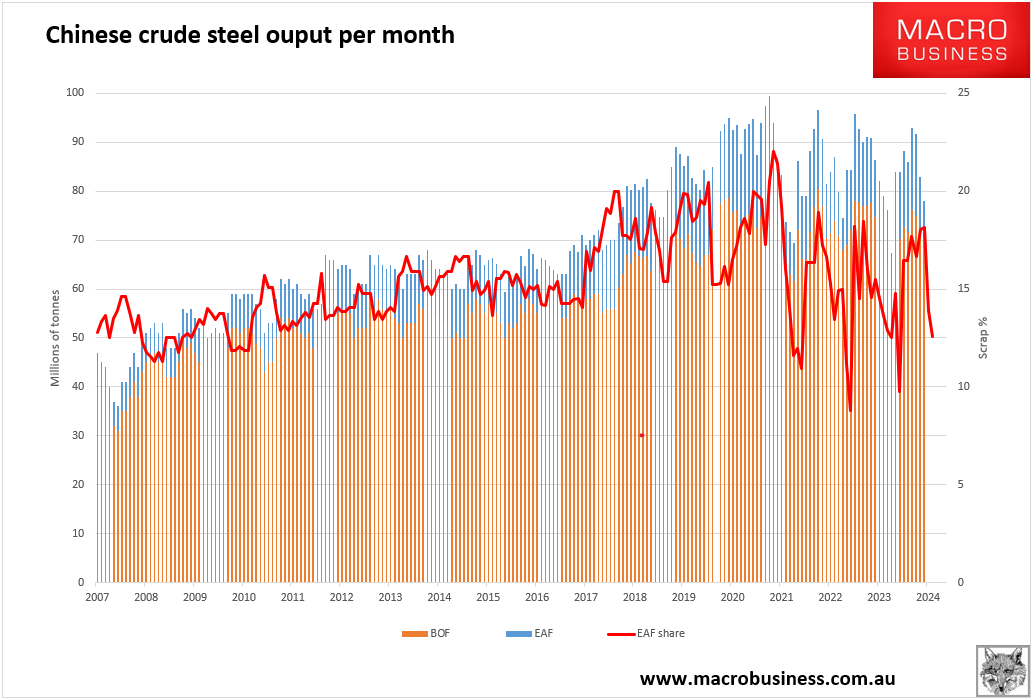

Once again, it is steel recycling that is most brutalised:

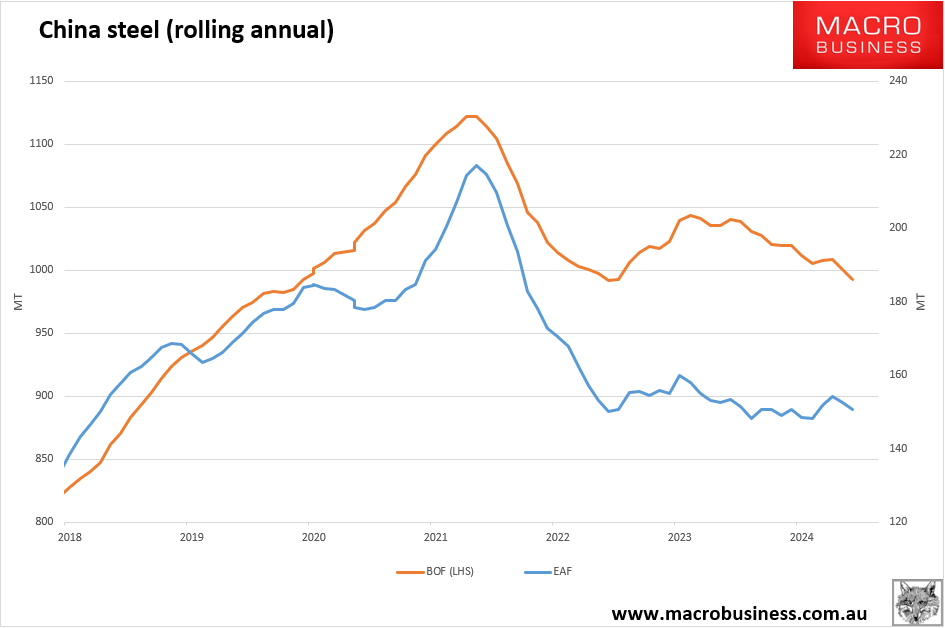

But pig iron ore output is steadily trending lower:

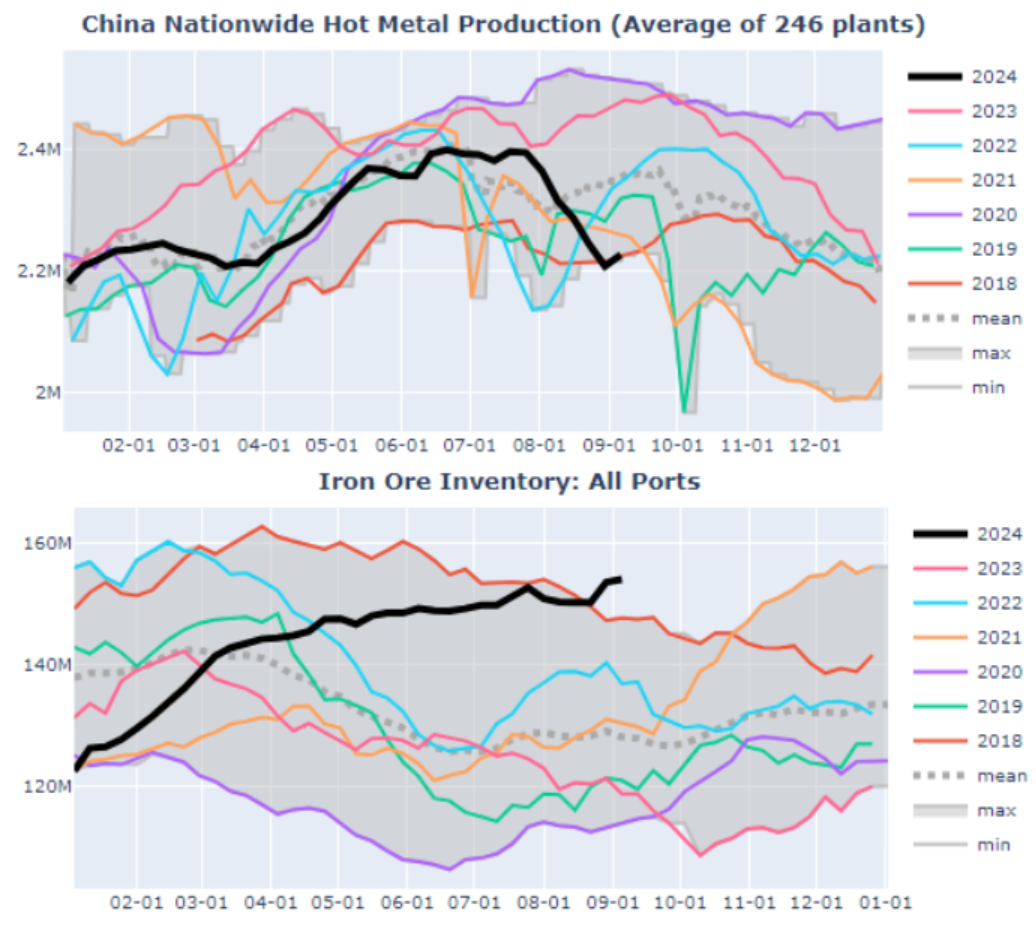

In high-frequency data, hot metal output is terrible:

Scuttlebutt is, once again, full of hope:

China is poised to cut interest rates on more than $5 trillion of outstanding mortgages as early as this month, Bloomberg News reported on Thursday.

“We would not expect anywhere close to a 1:1 transmission into retail sales, given consumer confidence is near all-time lows and households’ willingness to save was near historic highs. Nonetheless, it is a significant move that should provide real tangible benefits to households and support consumption,” ING analysts said in a note.

Meanwhile, inventories of five major finished steel products held by Chinese traders decreased for a ninth consecutive week over Sept. 6-12 to nearly eight-month lows, data from Chinese consultancy Mysteel showed.

The 6.3% week-on-week fall reflected further improvement in spot trading and a modest rise in replenishment needs among end-users before China’s Mid-Autumn Festival holiday, said Mysteel.

Chinese markets will be closed on Sept. 16-17 for the holiday and resume trading on Sept. 18.

The reduction in steel inventories is less bearish, notably so if we get new stimulus. But I doubt we will.

It is still early in the year to be expecting a new-year rebound.

I’m still inclined to fade the rally.