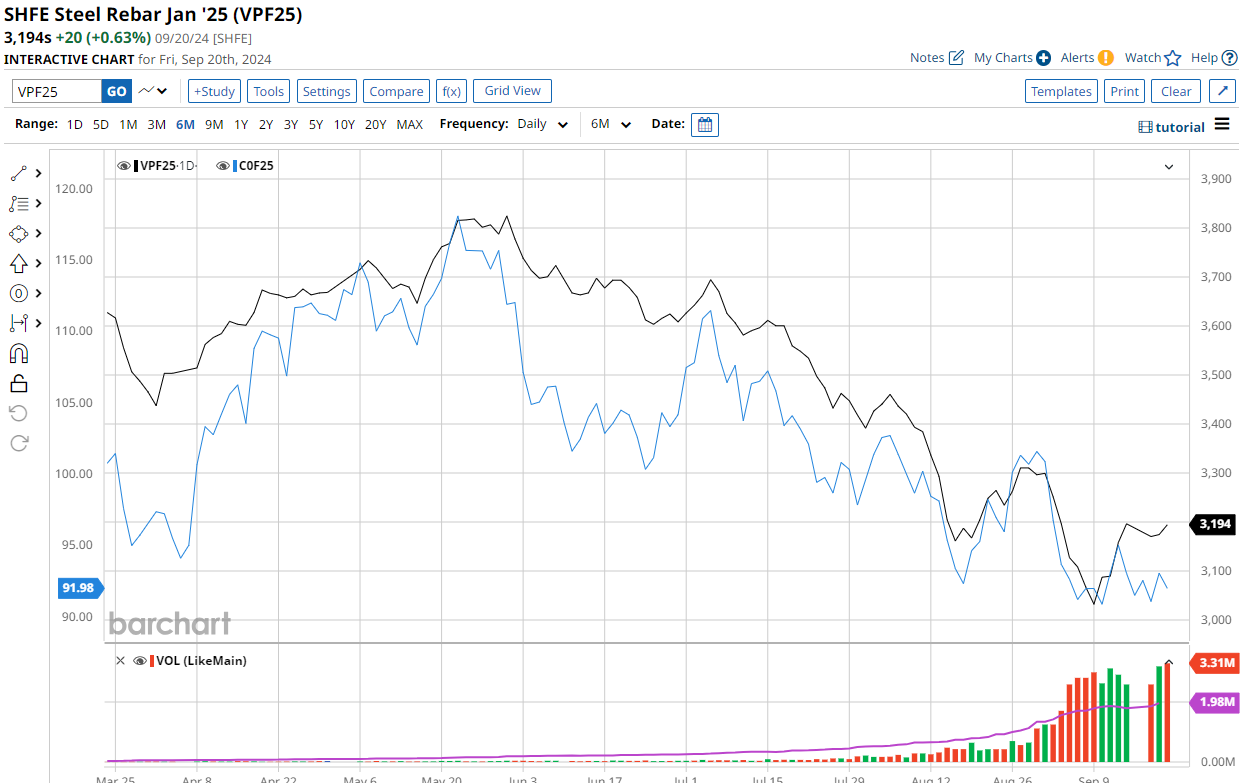

SHFE and SGX are still pretending everything is OK:

But Mad Dalian broke down completely Friday and Friday night and is at new closing lows:

Coking coal also rolled:

It’s not clear what the trigger was. Maybe more shrinkulus:

China is considering removing some of the largest remaining restrictions on home purchases after previous measures failed to revive a moribund housing market, according to people familiar with the matter.

Yawn:

A plunge in revenue from land sales has been a particular drain on budgets. Local governments earned just 245.5 billion yuan from them last month, an annual drop of 41.8% that renewed a record decline booked in July.

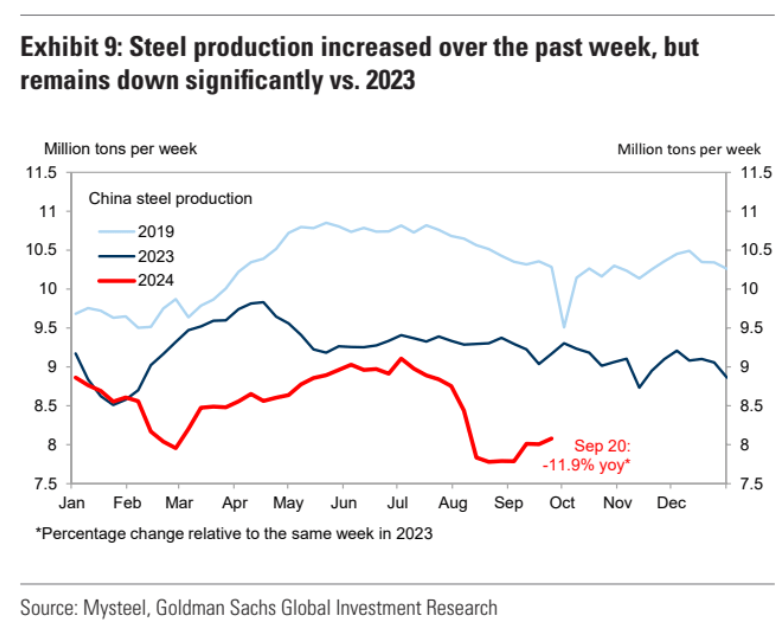

Maybe it was just an outbreak of sense. Steel output is a disaster:

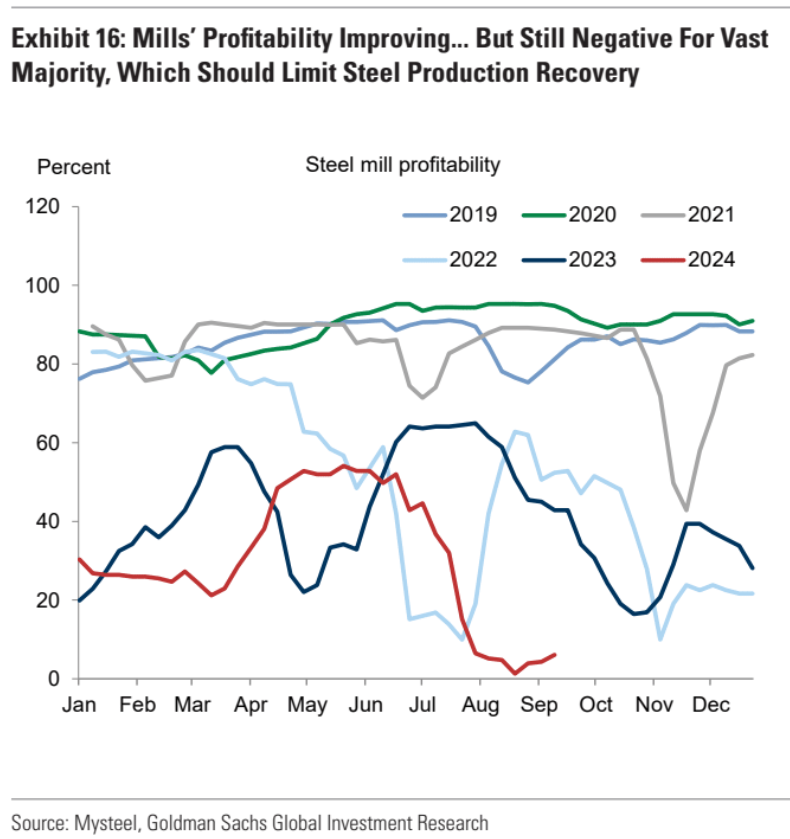

Profitability the same:

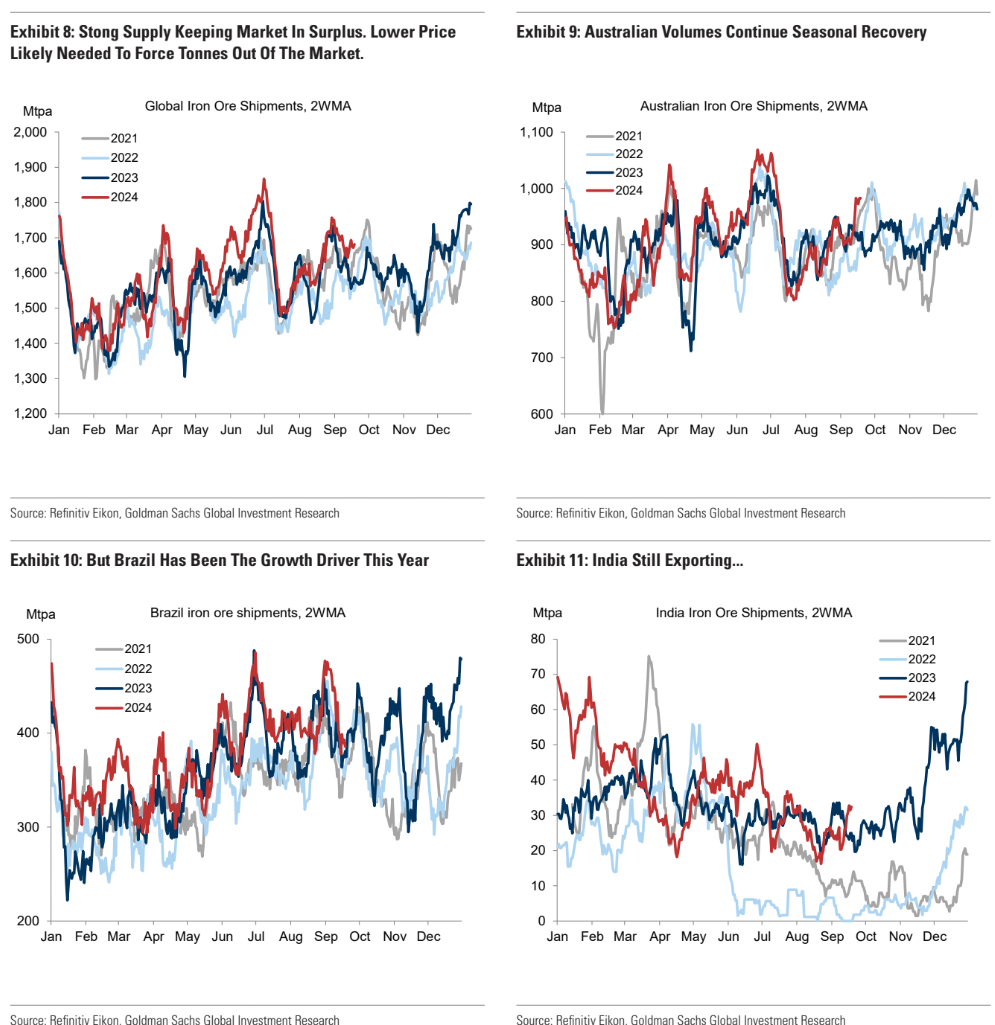

And iron ore supply has not adjusted at all at $90:

$80 at least needed.