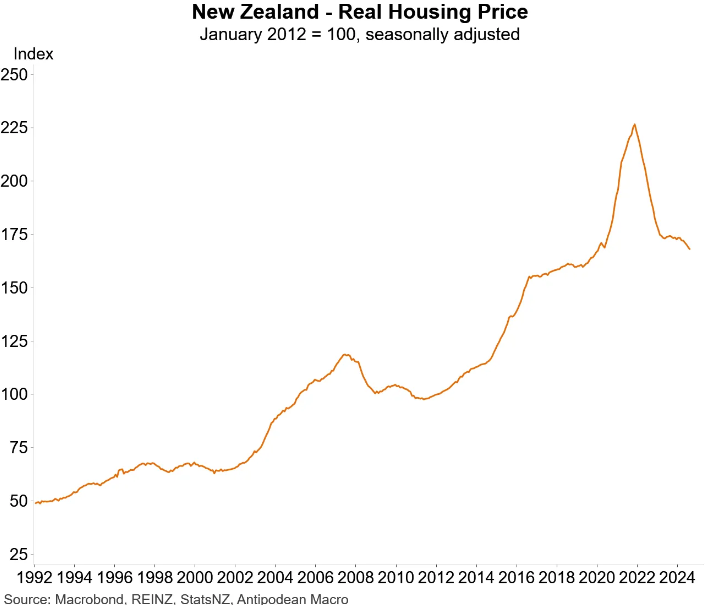

The Real Estate Institute of New Zealand’s (REINZ) House Price Index (HPI) reported a 16.7% decline nationally from the market peak reached in 2021.

This has taken real inflation-adjusted house prices back to their pre-pandemic level at the start of 2020:

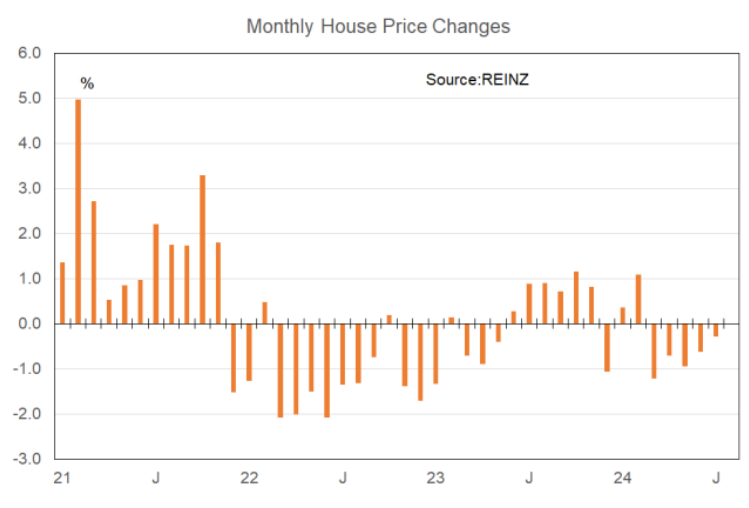

Independent economist Tony Alexander has released a report arguing that “the pace with which prices are falling on average around the country has slowed and may even have stopped”, and predicting “average prices to start consistently rising each month very shortly”.

Alexander notes “strong rises in most of the measures gathered in my surveys of real estate agents and mortgage brokers” and believes “we are at a turning point in the house price cycle”.

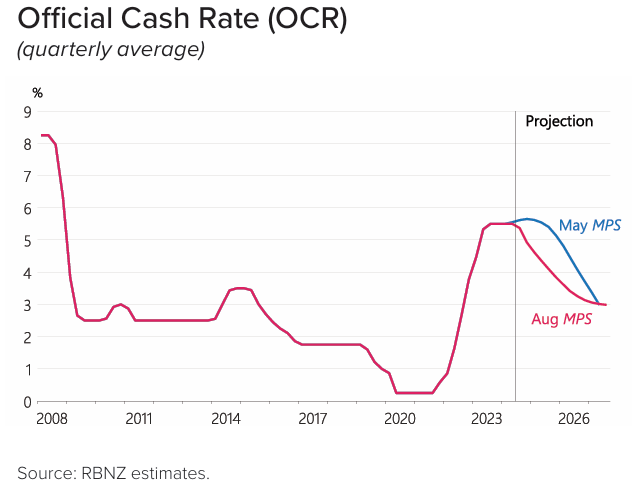

The turnaround is being driven by the Reserve Bank’s decision to commence an interest rate-cutting cycle.

The Reserve Bank of New Zealand cut the official cash rate by 0.25% in August and projected that significant further cuts would be made over the next 18 month:

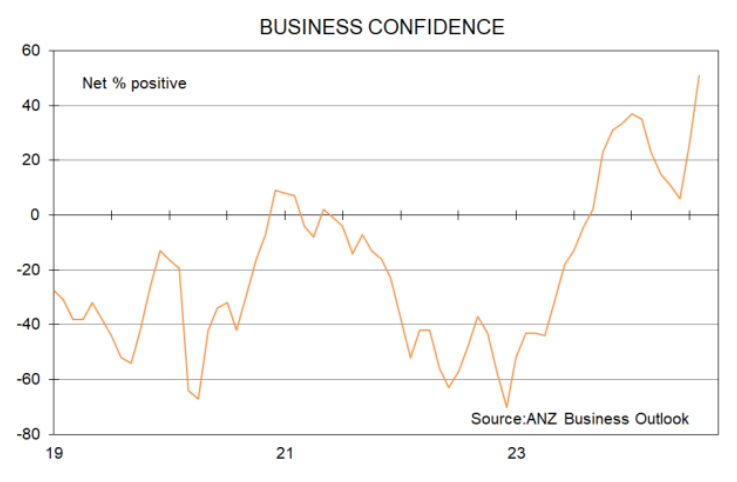

As a result, business confidence across New Zealand has bounced to a net 51% positive from just 6%:

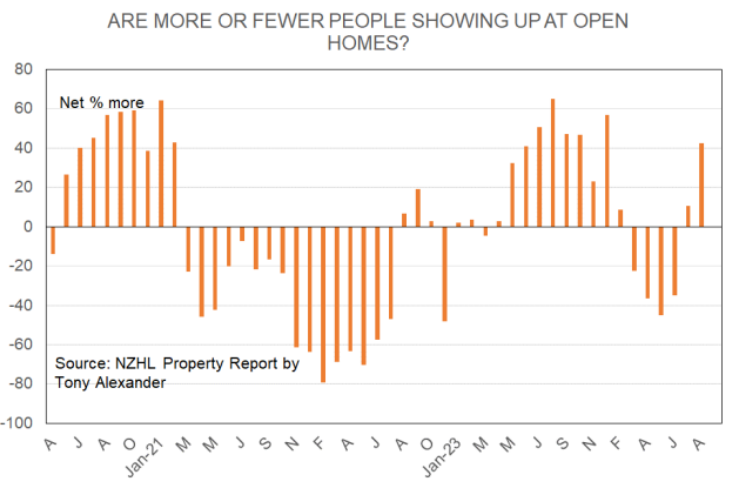

Homebuyers are also feeling more confident, with a net 42% of agents saying they are seeing more people attending open homes and a net 12% seeing more people are at auctions.

Two months ago, these readings were -35% and -37% respectively:

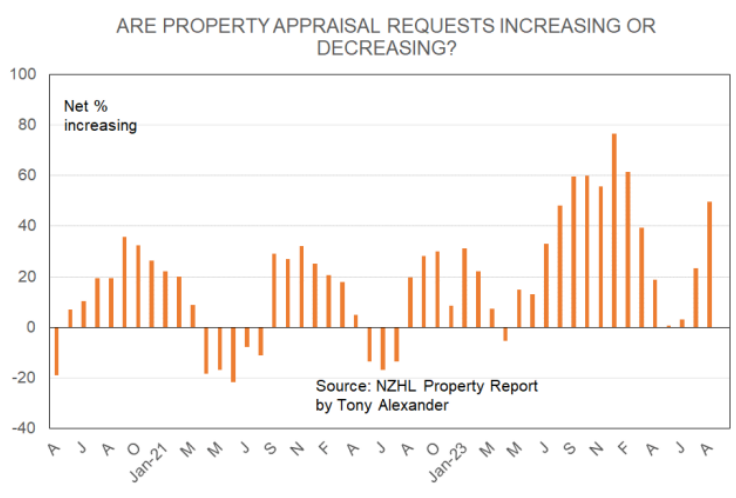

That said, supply is also rising, with a net 50% of agents saying that they are receiving more requests for property appraisals:

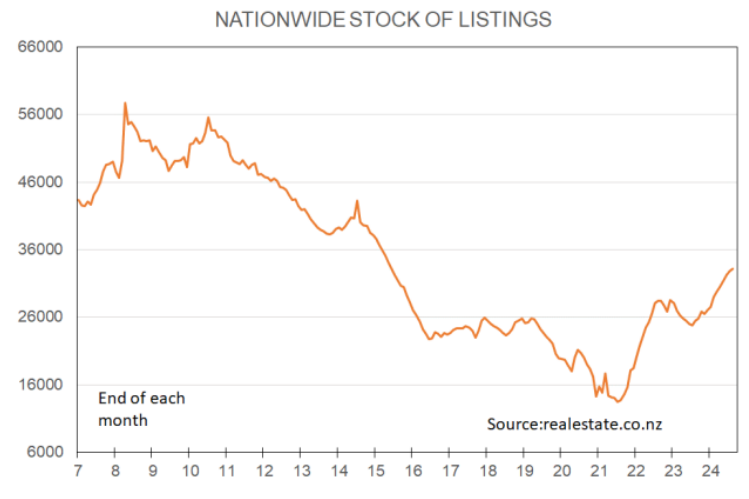

The stock of listings is also around 30% higher than a year ago and at the highest level since 2015:

“So, both demand and supply are rising at the same time”, notes Tony Alexander.

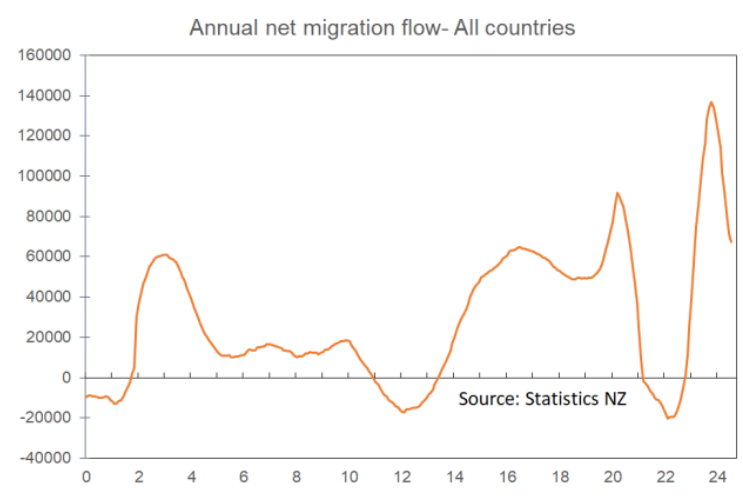

Alexander also notes that “net migration flows are falling away rapidly”:

So, while New Zealand’s housing market is likely bottoming out, the factors above “will constrain the pace of price rises this cycle”.

That seems like a fair and balanced assessment from Tony Alexander.