Several federal government sources have confirmed that the Albanese government is examining scaling back negative gearing and capital gains tax concessions, which it could take to the upcoming federal election.

The Albanese government has tasked the Treasury for advice on potential changes amid growing pressure from the Greens to clamp down on property tax concessions.

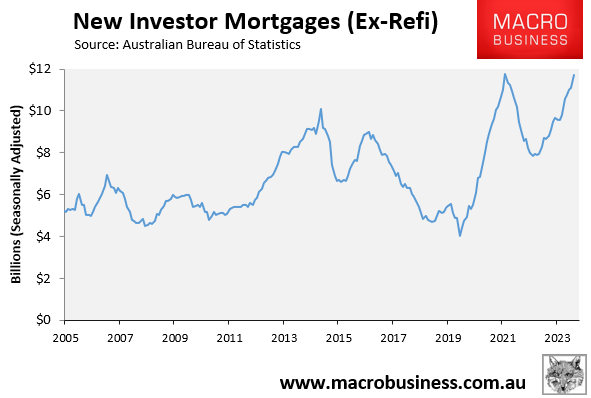

It comes as investor mortgage demand has risen to an equal record high level:

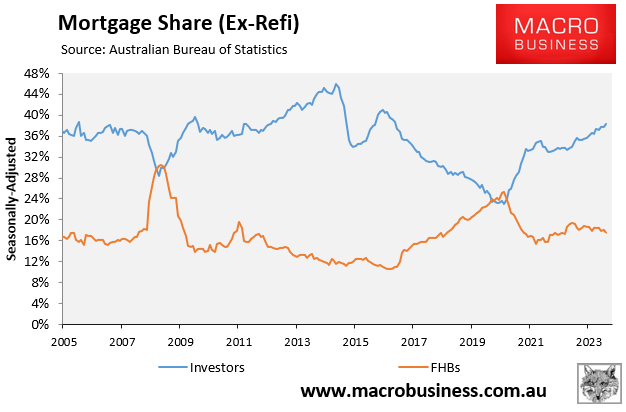

This surge in investor demand has crowded-out first home buyers:

“This is what Labor needs and wants – they need to have a fight on policies that shows what they stand for”, a Labor official said.

“This will give the government something big and positive to talk about, it will be a major talking point in the campaign”.

Labor is reportedly modelling modest changes, such as capping the number of properties a taxpayer could negatively gear. It would also grandfather the changes so that existing investors are not impacted.

MB has always supported reforms to property tax concessions, as they are likely to put modest downward pressure on prices and lift the home ownership rate by shifting purchases toward first home buyers from investors.

The Coalition will inevitably run a scare campaign and argue that reducing investor demand will push up rents by reducing supply.

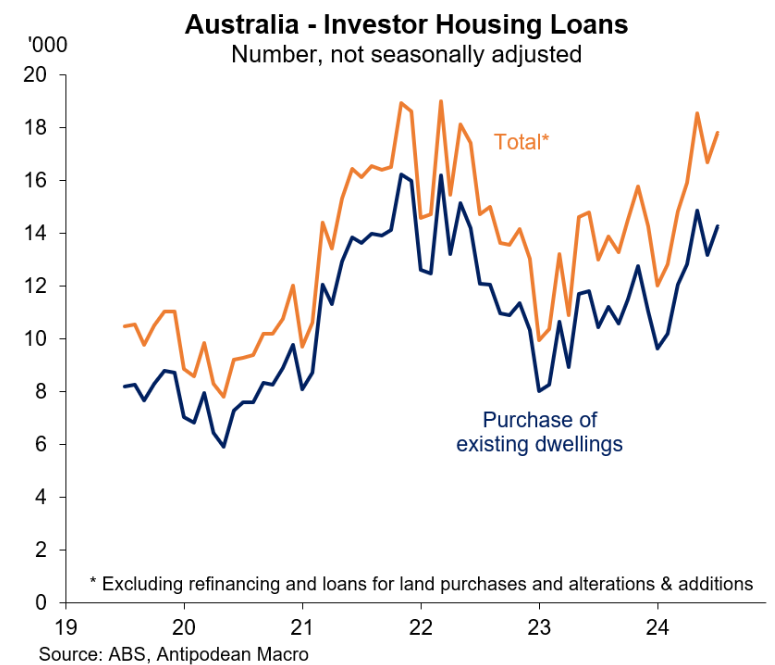

This argument has always been fallacious, as the overwhelming majority of investor purchases are for established dwellings:

Therefore, investors mostly turn homes for sale into homes for rent and do not impact the supply-demand balance in the rental market.

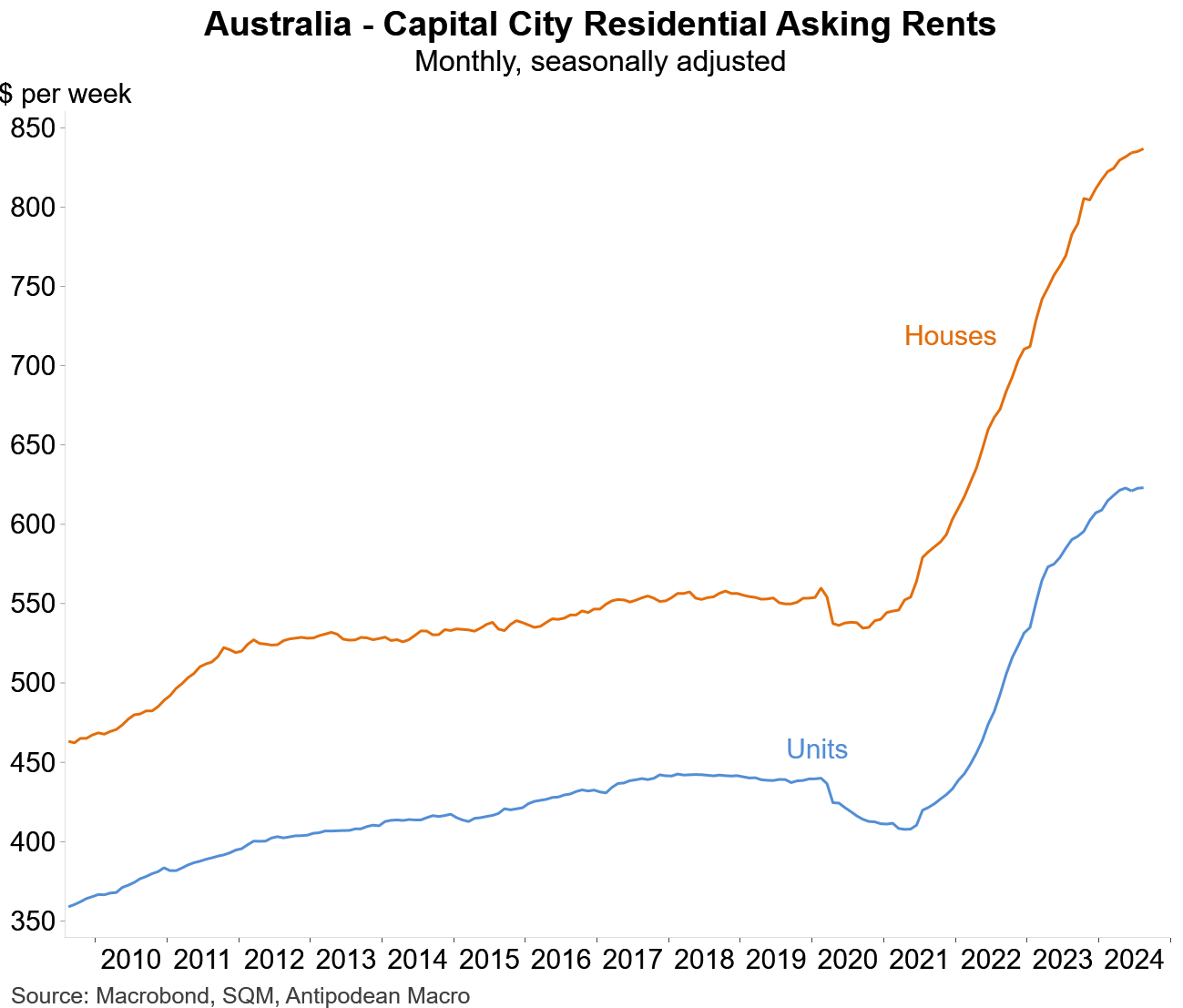

Indeed, the record demand from investors currently has occurred alongside the hyperinflation of rents, suggesting this argument holds little weight.

Concerns surrounding the impacts on supply from property tax reforms could be overcome by allowing full negative gearing for new builds. This would encourage investors to purchase new homes rather than established dwellings.

In this regard, we like the policy taken to the 2016 and 2019 federal elections, which would have limited negative gearing to new homes only and reduced the capital gains tax concession from 50% to 25%.

However, I doubt Labor will be brave enough to replicate that policy for a third time. Therefore, we are likely to see a watered-down version.

Regardless, it is good to see that reforms to property tax reforms might still be alive. Even though they are ‘small beer’ against significantly cutting immigration, which would achieve far greater affordability and livability benefits.