The new trading week and month is getting underway for Asian share markets which are absorbing the mixed results from the weekend release of the latest Chinese PMI surveys, plus the Japanese capital expenditure print. With Wall Street closed tonight, most risk markets are listless with currencies drifting along although action in Yen on that capex print is picking up while the Australian dollar is struggling to get back above the 68 cent level.

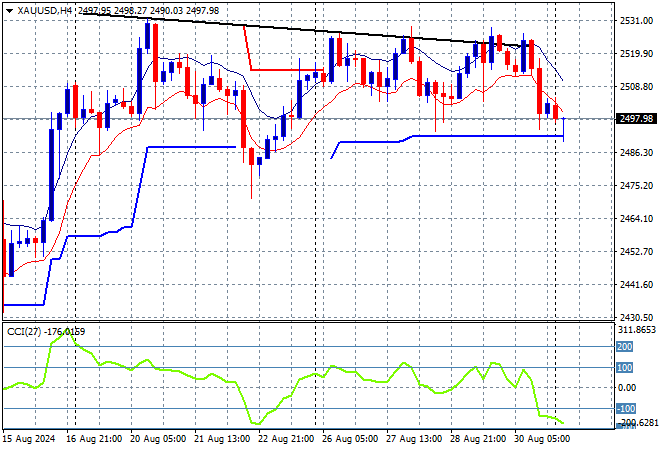

Oil futures are looking weak as Brent crude drops to the $76USD per barrel level while gold is also trying hard to return above the $2500USD per ounce level after the last week’s retreat but is slowly losing that battle:

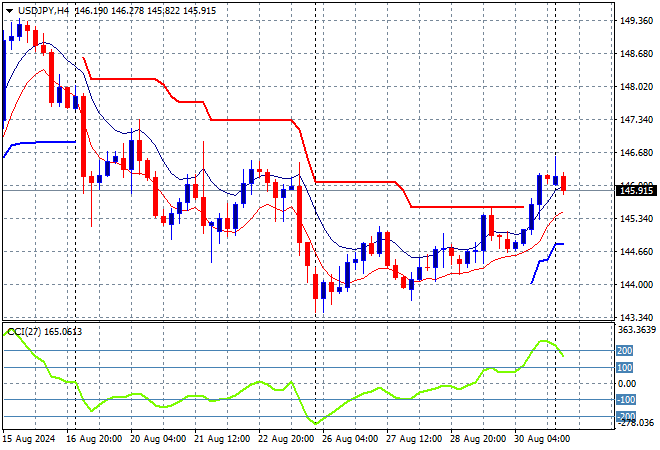

Mainland Chinese share markets are pulling back again with the Shanghai Composite down 0.6% while the Hang Seng Index is having a bad start, currently down nearly 1.8% to 17672 points. Meanwhile Japanese stock markets are also somewhat weak with the Nikkei 225 losing nearly 0.4% to 38527 points while trading in USDPY jumped out the gate on the weekend gap but has pulled back below the 146 level on BOJ rate hike speculation:

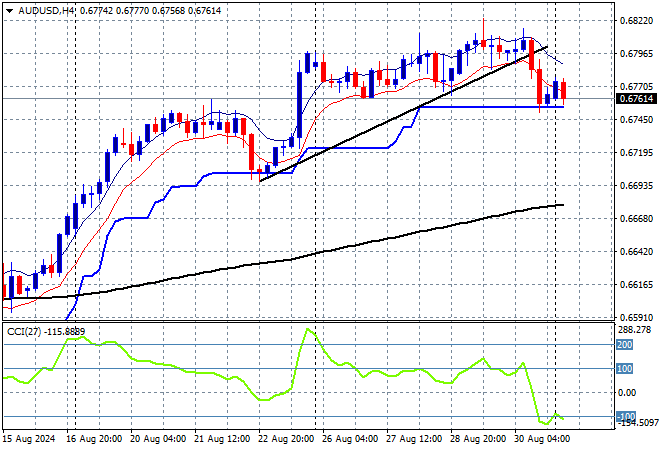

Australian stocks are having a sideways session with the ASX200 looking to close down a few points to the 8080 points while the Australian dollar is holding but no longer that robust against the USD, unable to get back to the 68 cent level as short term support looks tenuous:

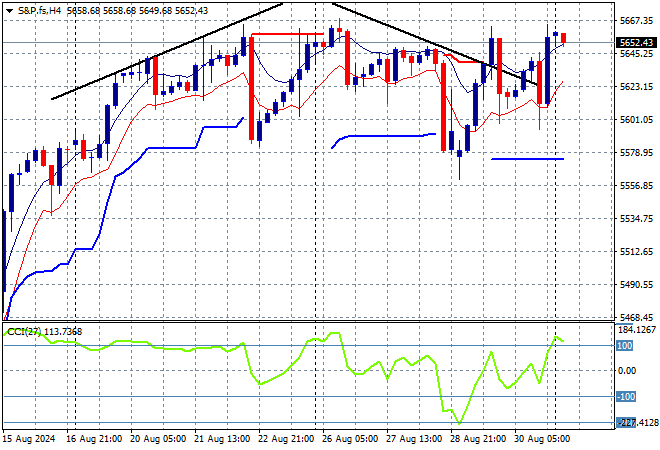

S&P and Eurostoxx futures are a bit mixed but still buoyant with the S&P500 four hourly chart showing momentum remaining in the overbought zone but I still contend that price action overall looks a bit toppy:

The economic calendar starts the week with nothing of note on the calendar due to the long weekend in the US.