Asian share markets are fairly directionless as they await the lead from a closed Wall Street that will likely reopen tonight slightly in the red with all eyes on this Friday’s US jobs report. Before that we get the latest ISM manufacturing print whereas today there was a sneak peek in Australian GDP figures, which look flat at best. This caused the Australian dollar to pull back with the undollars also looking tenuous here.

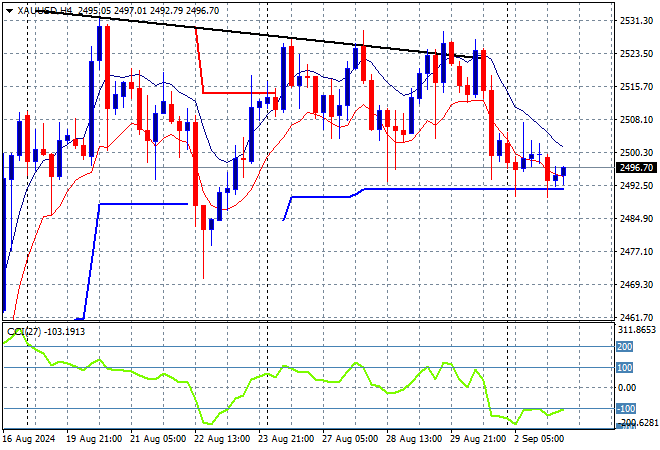

Oil futures are looking weak as Brent crude hovers around the $77USD per barrel level while gold is also trying hard to return above the $2500USD per ounce level after the last week’s retreat but is slowly losing that battle:

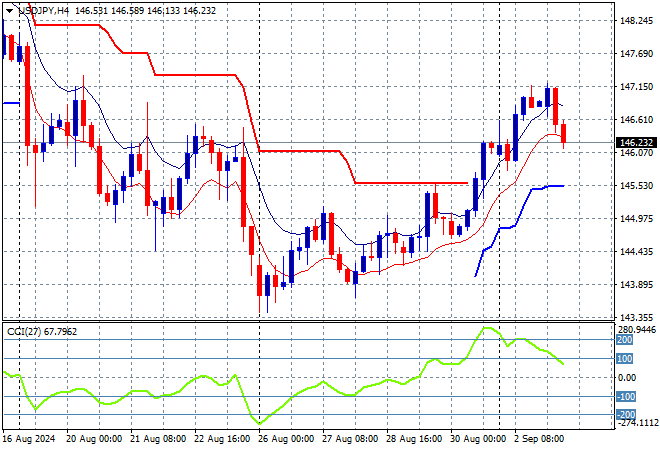

Mainland Chinese share markets are pulling back again with the Shanghai Composite down 0.3% while the Hang Seng Index is currently down 0.4% to 17617 points. Meanwhile Japanese stock markets are also quite weak with the Nikkei 225 listless at 38686 points while trading in USDPY has seen a small retracement after jumping out the gate on the weekend gap to pull back to the 146 level on BOJ rate hike speculation:

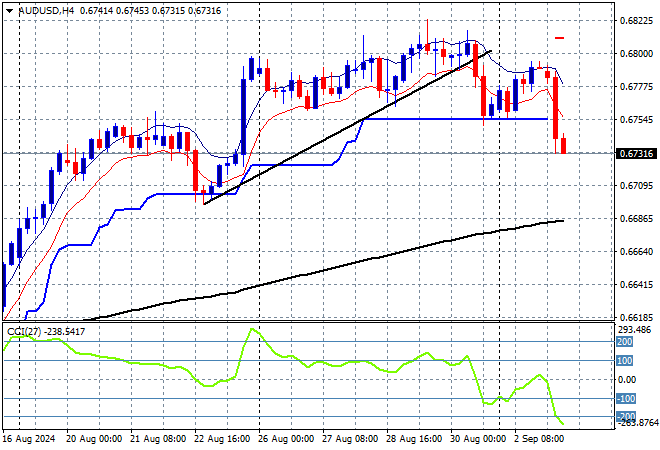

Australian stocks are having another sideways session with the ASX200 closing flat at 8103 points while the Australian dollar has broken below short term support at the mid 67 cent level to make a new two week low:

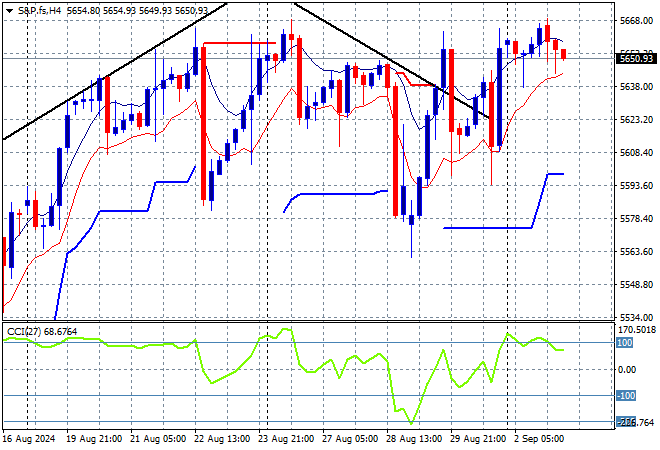

S&P and Eurostoxx futures are pulling back slightly as we await the return of US traders with the S&P500 four hourly chart showing momentum slipped out of the overbought zone as I still contend that price action overall looks a bit toppy:

The economic calendar is quiet tonight until the US session, where the focus will be on the latest ISM manufacturing survey.