A sea of red across Asian share markets as they respond to the overnight rout on Wall Street as growth concerns from China and the US through their respective manufacturing PMI surveys combined with bond market volatility is not helping risk markets overall. Commodities are taking the biggest hits but the Australian dollar remains surprisingly resilient as today’s GDP print underwhelmed, with the Pacific Peso staying just above the 67 cent leve.

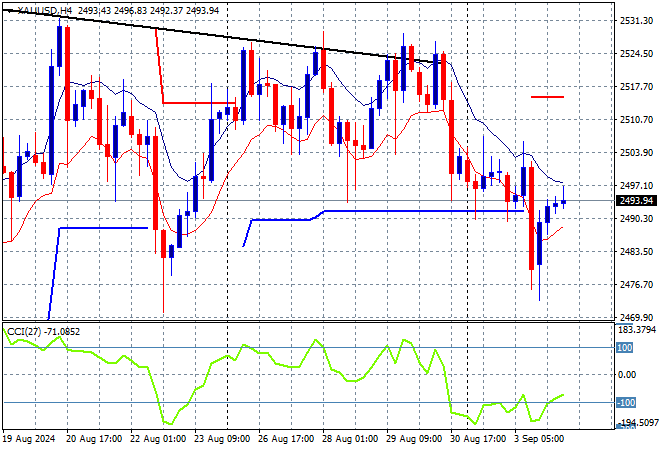

Oil futures are looking very weak as Brent crude hovers around the $73USD per barrel level while gold is also trying hard to return above the $2500USD per ounce level after the last night’s retreat but is still losing that battle:

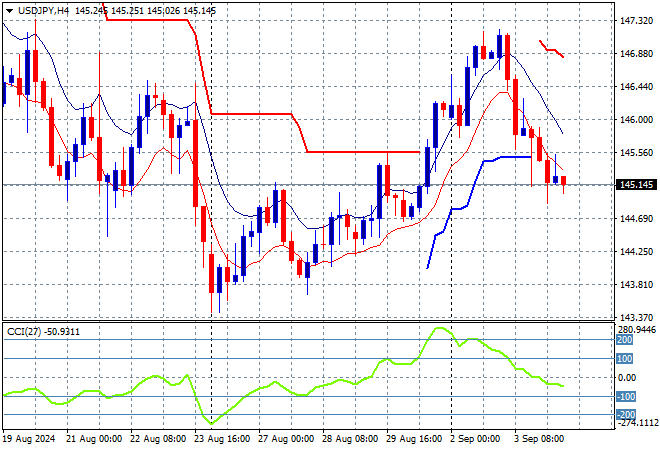

Mainland Chinese share markets are pulling back with the Shanghai Composite down 0.5% while the Hang Seng Index is currently off more than 1% at 17426 points. Meanwhile Japanese stock markets are taking the biggest hits with the Nikkei 225 losing more than 4% to 36987 points while trading in USDPY has seen a small retracement down to the 145 level on BOJ rate hike speculation:

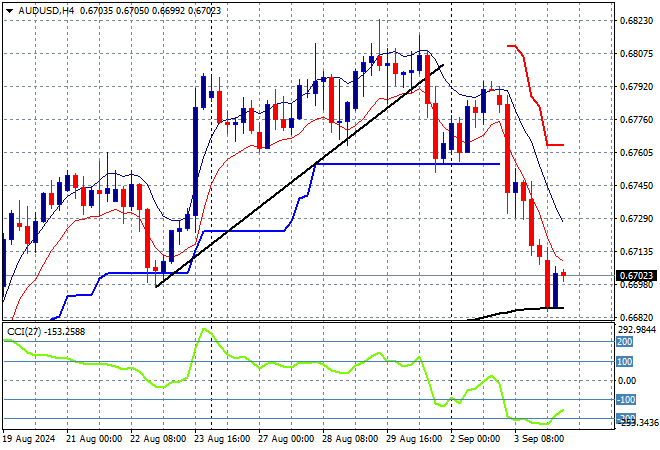

Australian stocks had one of the better sessions in the region, relatively speaking with the ASX200 closing more than 1.8% lower at 7950 points while the Australian dollar is trying to stabilise just above the 67 cent level in the wake of today’s GDP figures and risk off mood:

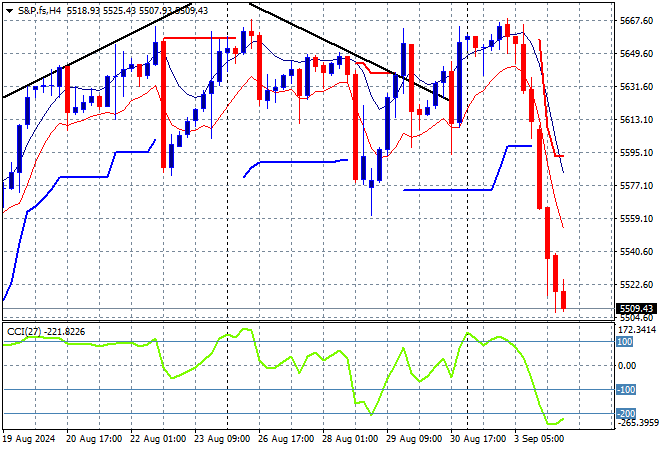

S&P and Eurostoxx futures are pulling further with the S&P500 four hourly chart showing momentum very oversold here as price action looks overextended from last night’s rout:

The economic calendar is fairly light on with a Canadian focus as their central bank meets for their monthly meeting.