A quiet but generally positive day for Asian share markets which haven’t translated the overnight bounce from Wall Street into anything exciting locally with all eyes on tomorrow night’s US CPI print. European stock futures are in fact down heading into the London open so risk remains quiet uneasy. Currency markets are still seeing a strong USD with the Australian dollar unable to get back above the 67 cent level.

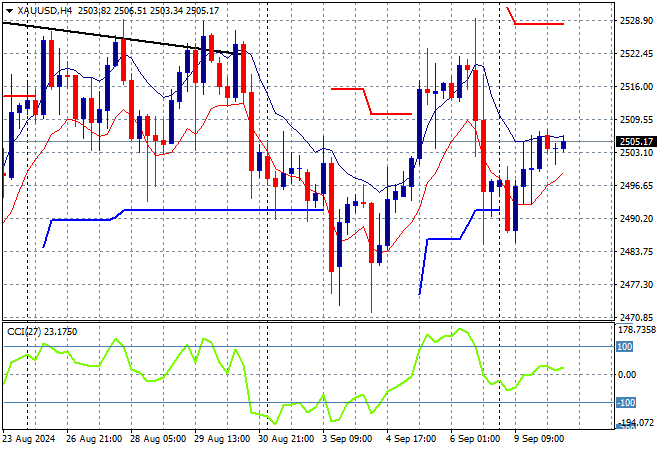

Oil futures remain very weak as Brent crude drops towards the $71USD per barrel level while gold is just hanging on above the $2500USD per ounce level after getting slammed on Friday night:

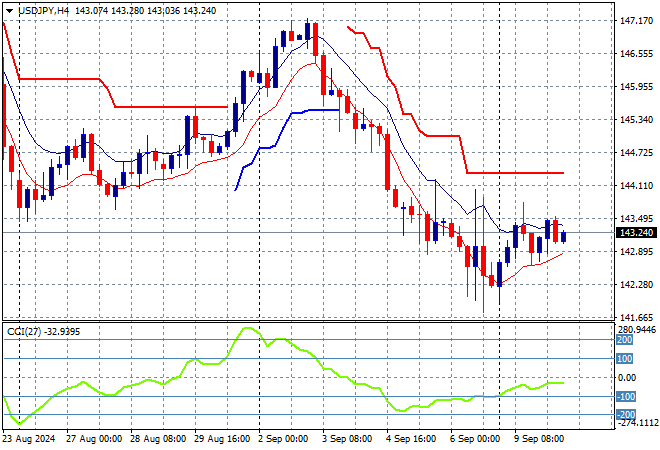

Mainland Chinese share markets were down initially but are recovering going into the close with the Shanghai Composite up 0.3% while the Hang Seng Index is up nearly 0.4% to 17273 points. Japanese stock markets meanwhile are still treading water with the Nikkei 225 closing 0.2% lower to 36159 points while trading in USDPY has seen somewhat of a slight bounce from the weekend gap but still holding at the monthly low around the 143 level:

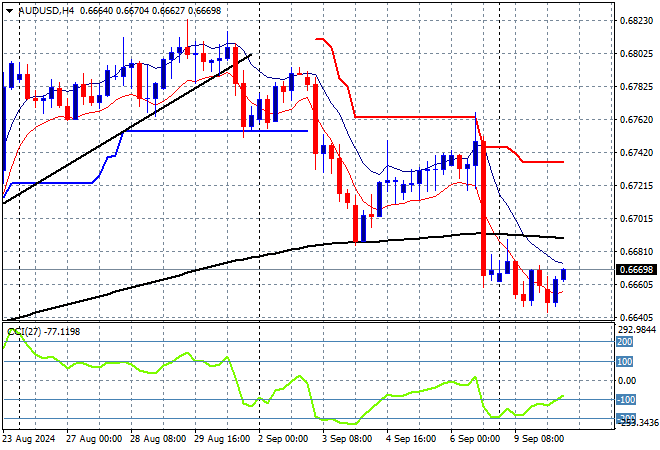

Australian stocks were the most positive in the region with the ASX200 closing some 0.3% higher to get back above the 8000 point level at 8011 points while the Australian dollar is trying to stabilise just above the mid 66 cent level after recently slumping in the wake of Friday night’s US jobs report:

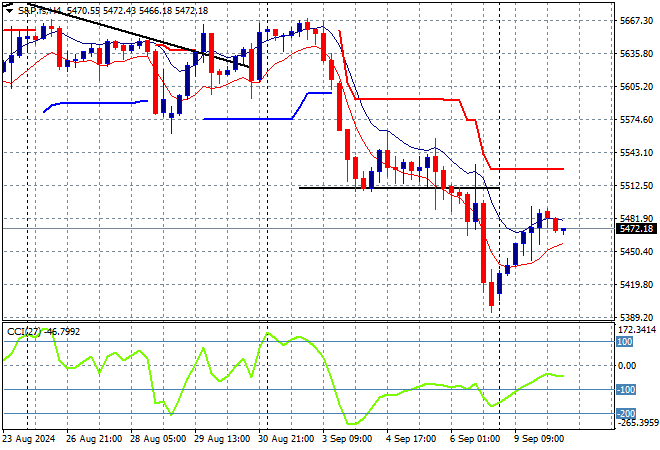

S&P and Eurostoxx futures are slowly retracing their overnight rebound going into the London session with the S&P500 four hourly chart showing momentum trying hard to get out of oversold conditions as price action in the medium term doesn’t look impressive:

The economic calendar is relatively quiet tonight with the latest UK unemployment figures the only release of note.