Asian share markets didn’t reflect the somewhat positive mood on Wall Street overnight as bond market volatility overshadowed, as all eyes look to tonight’s US CPI print. The USD remains very strong against all the majors except Yen, which had another sharp appreciation this afternoon, hurting Japanese stocks while the Australian dollar continues its inability to get back above the 67 cent level.

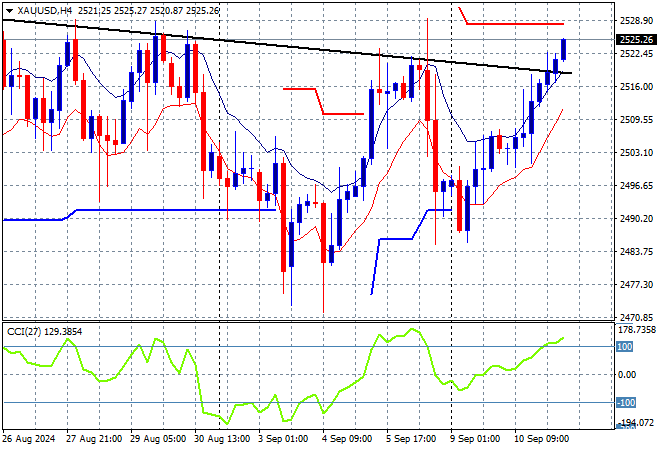

Oil futures remain very weak as Brent crude remains below the $70USD per barrel level while gold is surging after getting back above the $2500USD per ounce level, now matching its previous weekly high in a solid move this afternoon:

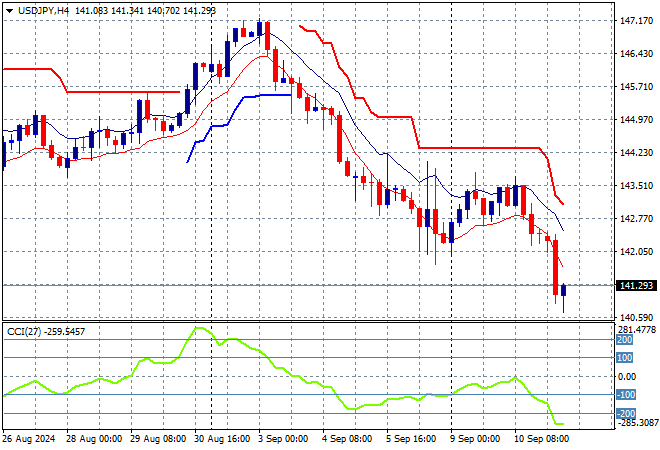

Mainland Chinese share markets were down initially and are failing to recover going into the close with the Shanghai Composite off by more than 0.8% while the Hang Seng Index has lost more than 1% to 17047 points. Japanese stock markets meanwhile are falling sharply again on Yen appreciation with the Nikkei 225 closing nearly 2% lower to 35619 points while trading in USDPY has seen another sharp fall back towards the 141 level:

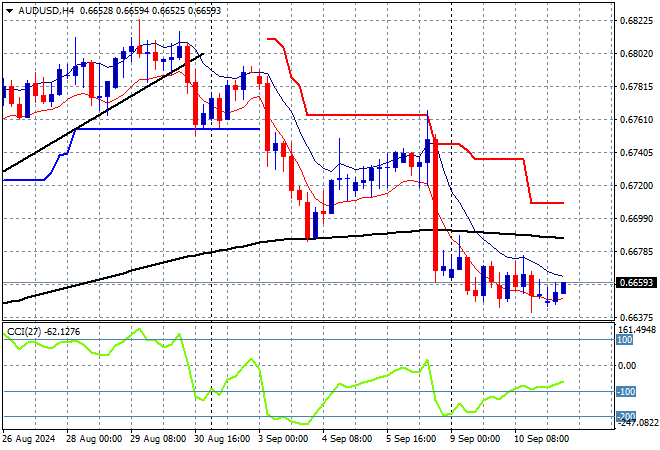

Australian stocks were again the most positive in the region but it was all relative as the ASX200 closed 0.3% lower to retrace back below the 8000 point level at 7987 points while the Australian dollar is trying hard to stabilise just above the mid 66 cent level after recently slumping in the wake of last Friday night’s US jobs report:

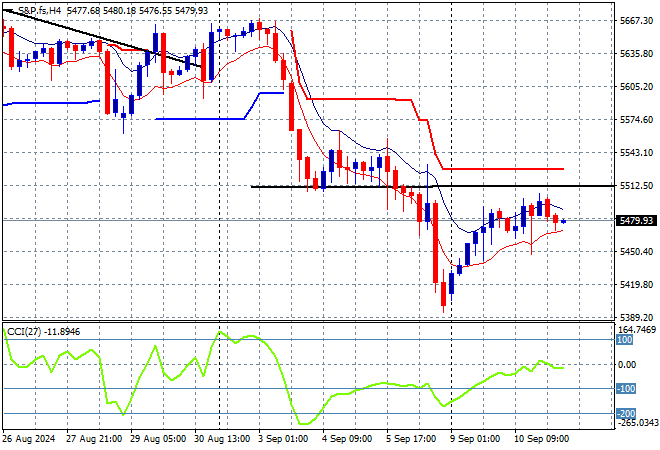

S&P and Eurostoxx futures are slowly retracing again going into the London session with the S&P500 four hourly chart showing momentum unable to get out of its negative funk with price action rolling over as it comes up against resistance at the 5500 point level:

The economic calendar will focus squarely on the US August CPI print tonight.