Asian share markets are finally catching the positive mood from Wall Street helped along by some very supportive comments from the BOJ, inciting depressed Japanese shares to soar higher. The USD remains very strong against all the majors in the wake of the CPI print although the Australian dollar is finding life as it almost cracks the 67 cent level.

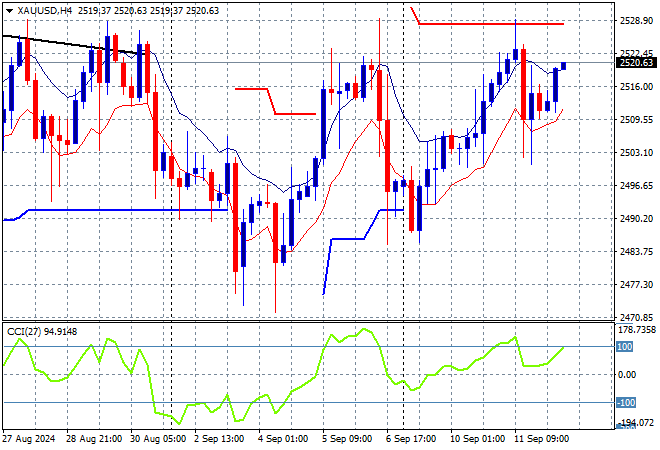

Oil futures have bounced back slightly but price action overall remains very weak as Brent crude pushes above the $71USD per barrel level while gold is holding on to it overnight gains above the $2500USD per ounce level, but still unable to break through the previous weekly highs:

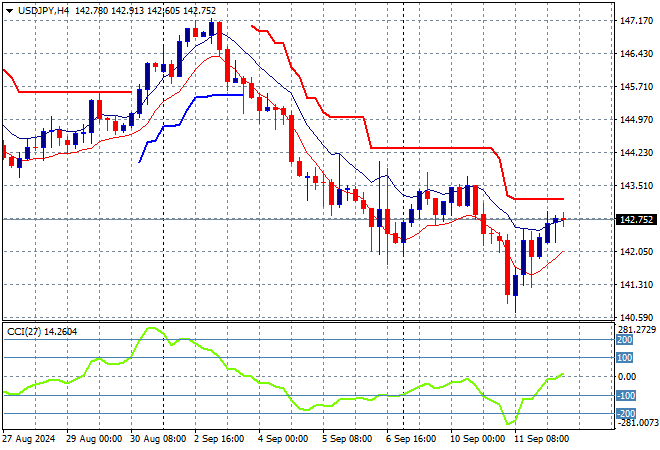

Mainland Chinese share markets were up initially but are failing to advance going into the close with the Shanghai Composite barely up while the Hang Seng Index has gained more than 1% to 17291 points. Japanese stock markets meanwhile are soaring higher after a spate of recent sharp falls with the Nikkei 225 closing nearly 3.5% higher at 36891 points while trading in USDPY has seen a small lift back above the mid 142 level:

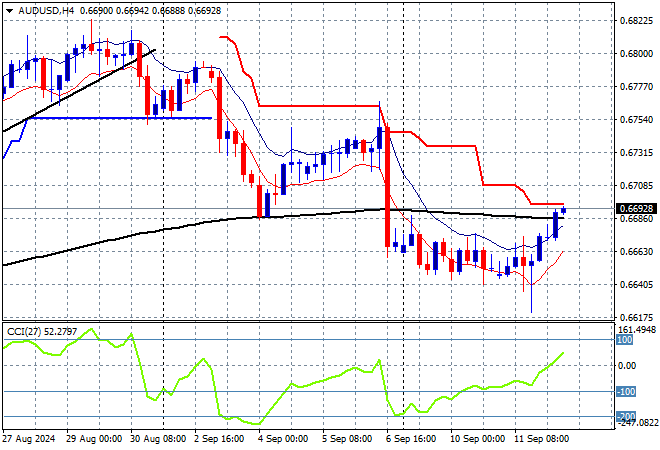

Australian stocks were able to put in solid gains as well as the ASX200 closed 1% higher to extend above the 8000 point level at 8075 points while the Australian dollar is pushing higher to almost breach the 67 cent level in afternoon trade:

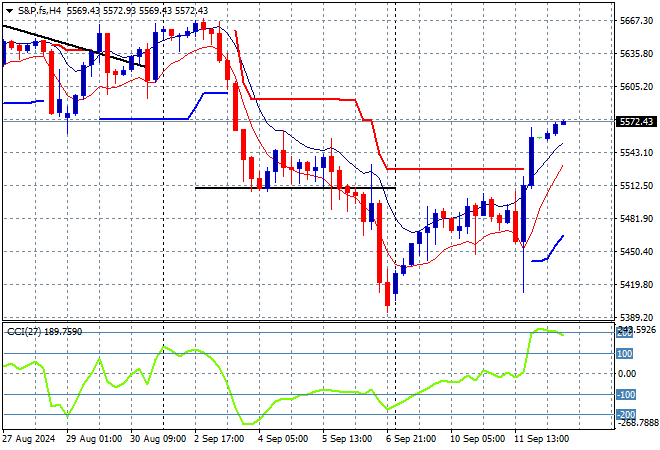

S&P and Eurostoxx futures are slowly building going into the London session with the S&P500 four hourly chart showing momentum remaining nicely overbought after last night’s breakout as it pushed aside resistance at the 5500 point level:

The economic calendar will focus squarely on the latest ECB policy meeting tonight.