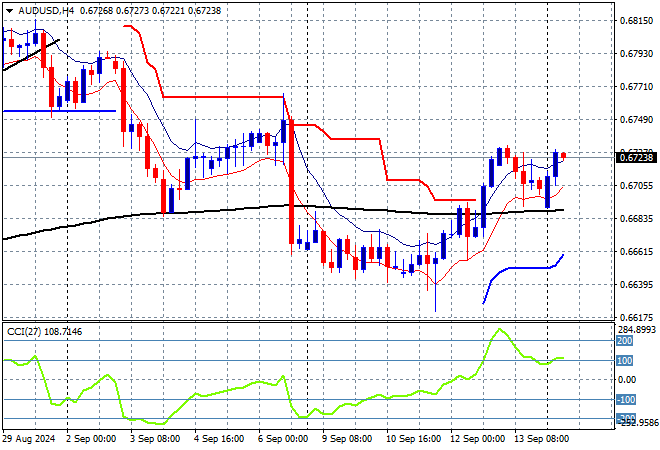

Most Asian share markets were closed today with local stocks carrying the weight of risk around the region as the USD slips a little versus almost all the majors, particularly Yen. All eyes are on central banks this week so expect more currency volatility ahead. The Australian dollar is pushing above the 67 cent level to match its previous weekly high.

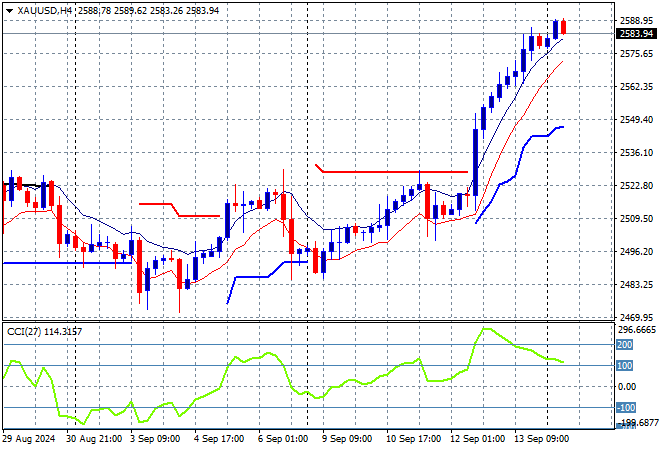

Oil futures are slowly rolling over following the weekend gap as price action overall remains very weak as Brent crude steadies at the $72USD per barrel level while gold is pushing higher as it eyes the $2600USD per ounce level, looking very positive:

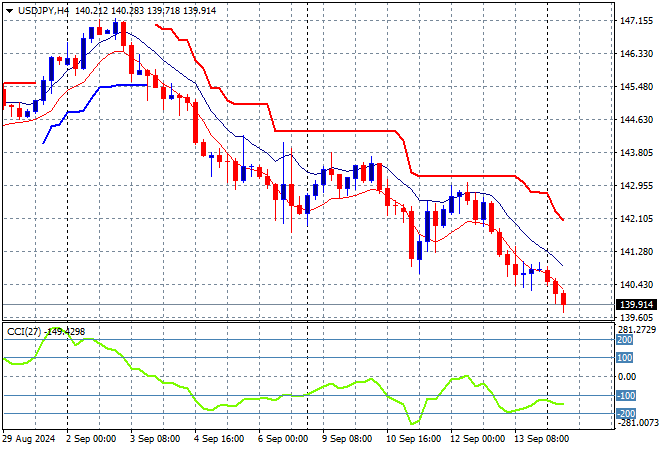

Mainland Chinese share markets are closed while the Hang Seng Index is dead flat in response. Japanese stock markets are also closed for the day but that hasn’t helped Yen which continues to appreciate against USD for a new low for the USDPY pair below the 140 level:

Australian stocks were able to put in some minor gains as the ASX200 closed 0.3% higher to extend above the 8000 point level at 8127 points while the Australian dollar is also extending its gains above the 67 cent level to match the mid week high from last trading week:

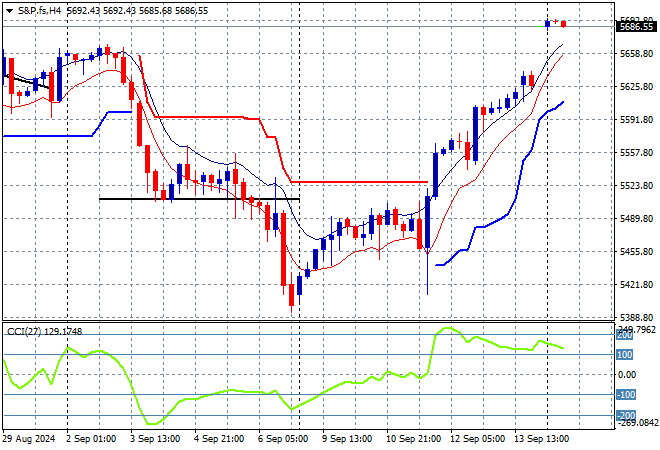

S&P and Eurostoxx futures are slowly building going into the London session with the S&P500 four hourly chart showing momentum remaining nicely overbought as resistance at the 5500 point level becomes a distant memory:

The economic calendar starts the week relatively quiet with the latest German ZEW Survey the only release of note.