Asian share markets were in a mixed mood today with the absence of Japanese shares due to a holiday coupled with some poor local domestic economic news mixed up with a rate cut by the PBOC keeping everyone on their toes. The USD remains under the pump following last week’s FOMC meeting while the Australian dollar is holding above the 68 cent level as traders await tomorrow’s RBA meeting.

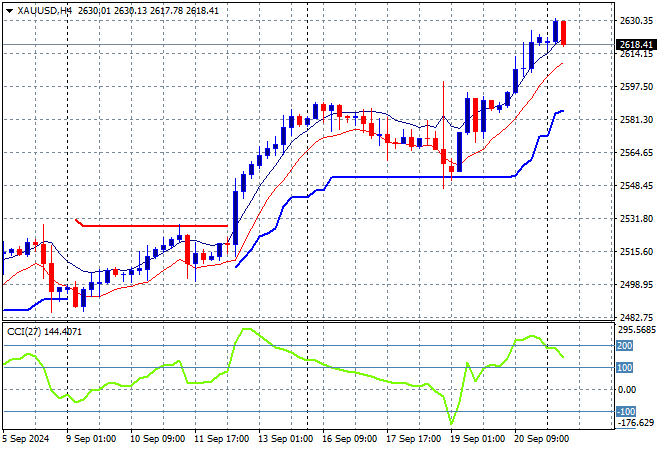

Oil futures are looking flat as Brent crude stays around the $74USD per barrel level while gold made another new record high out the gate but has pared back slightly this afternoon, still well above the $2600USD per ounce level:

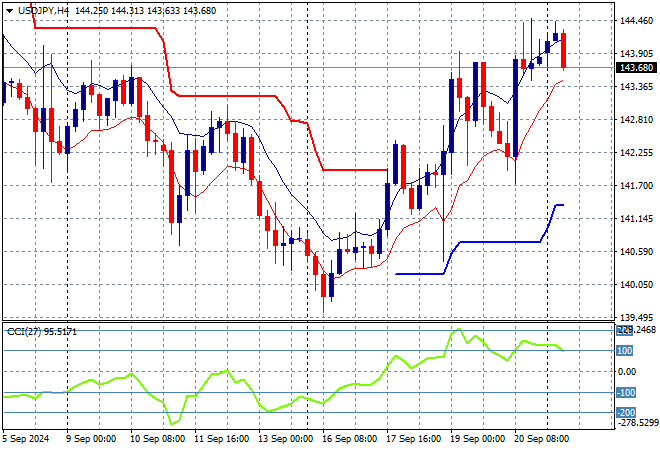

Mainland Chinese share markets have held on to some modest gains with the Shanghai Composite up 0.4% while the Hang Seng Index was slightly flat, falling 0.1% to finish at 18244 points. Japanese stock markets were closed for yet another holiday while the USDPY pair not surprisingly last some momentum to fall back below the 144 level:

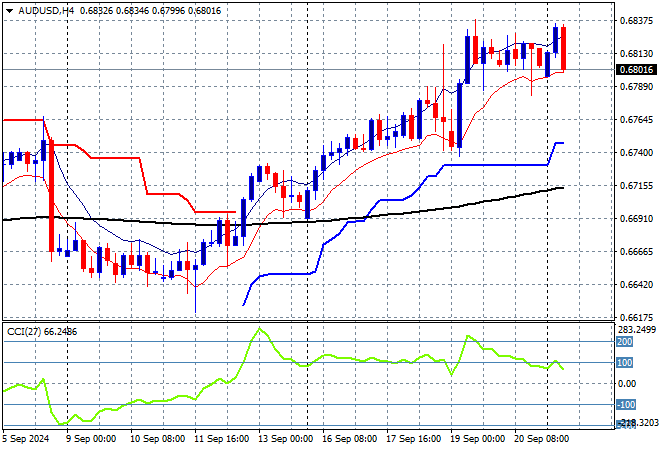

Australian stocks didn’t like the local PMI prints with the ASX200 closing some 0.7% lower at 8152 points while the Australian dollar was able to hold on above the 68 cent level despite a late reversal this afternoon:

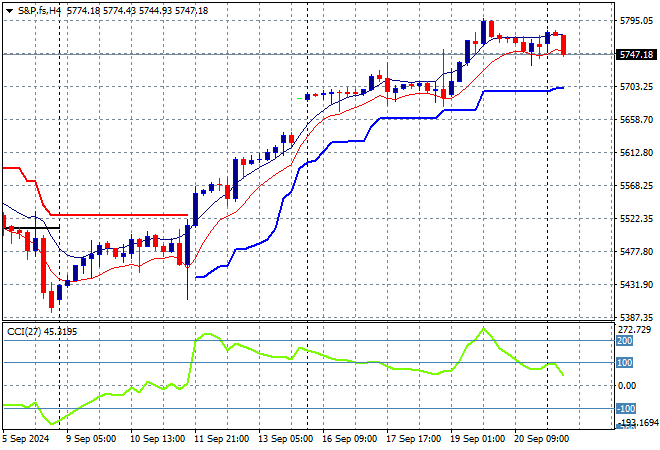

S&P and Eurostoxx futures are slipping slightly going into the London session with the S&P500 four hourly chart showing momentum remaining flat but still positive:

The economic calendar is relatively quiet tonight with a few flash PMI surveys and not much else.