Asian share markets are all reflecting their central bank positions today with local stocks slipping as the RBA held fire and looks like doing 2/5ths of you know what for the next 12 months, while the PBOC indicated a raft of rate cut measures which saw Chinese markets soar higher. Japanese shares returned from their holiday as the BOJ suggested speculation actions are almost done, with a modest gain as a result. European shares look to be well supported going into tonight’s session as Euro gains slightly from its overnight reversal while the Australian dollar is holding above the 68 cent level despite a false break following the RBA meeting.

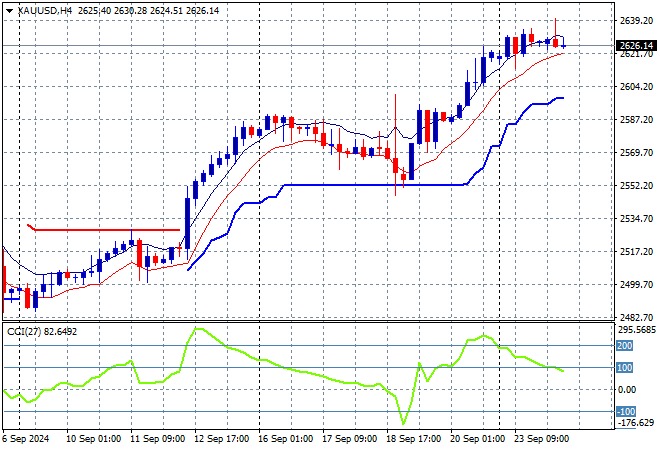

Oil futures are looking flat as Brent crude stays around the $74USD per barrel level while gold held on just below its recent record high still well above the $2600USD per ounce level:

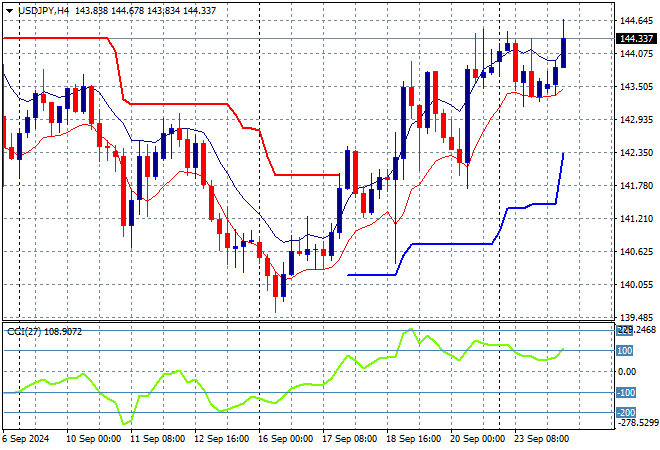

Mainland Chinese share markets are launching super higher this afternoon with the Shanghai Composite up more than 4% while the Hang Seng Index is up an equal amount, almost pushing through the 19000 point barrier. Japanese stock markets reopened from their holiday with the Nikkei 225 gaining 0.5% to 37940 points while the USDPY pair again hit overhead resistance above the 144 level:

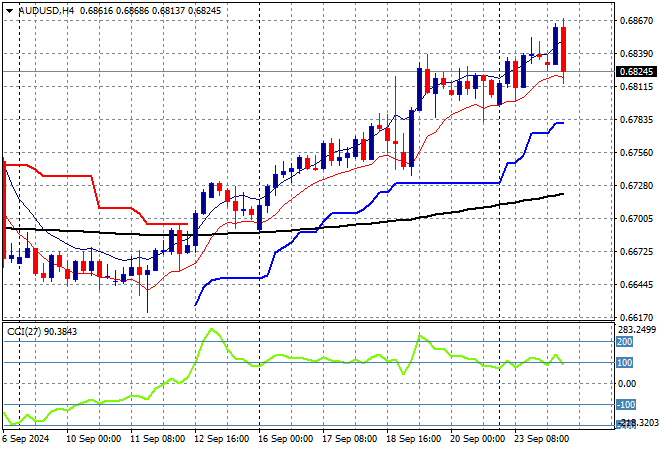

Australian stocks didn’t like the RBA meeting outcome with the ASX200 closing some 0.2% lower at 8142 points while the Australian dollar was able to hold on above the 68 cent level despite the RBA hold this afternoon:

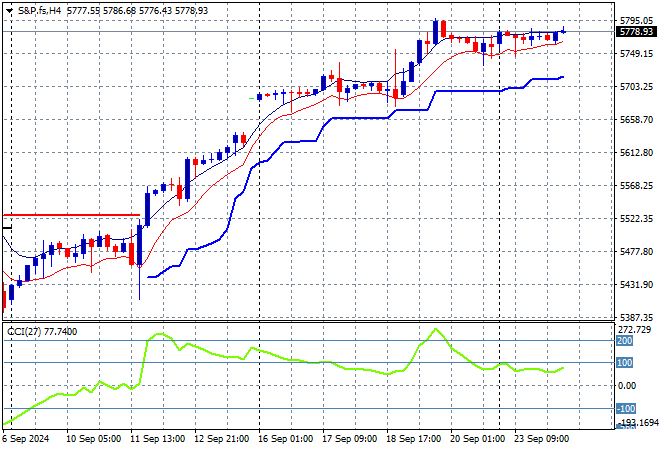

S&P and Eurostoxx futures are lifting strongly going into the London session with the S&P500 four hourly chart showing momentum remaining flat but still positive:

The economic calendar includes US home sales and US consumer confidence numbers for August.