Asian share markets are again dissecting the news and double speak from their respective central bankers with the PBOC pushing through a modest medium term cut helping Chinese stocks higher. Australian shares remain in flux due to the RBA’s inaction while it looks like a slow start to the European session tonight. Euro is holding from its overnight reversal while the Australian dollar has slipped slightly after cracking through the 69 cent level.

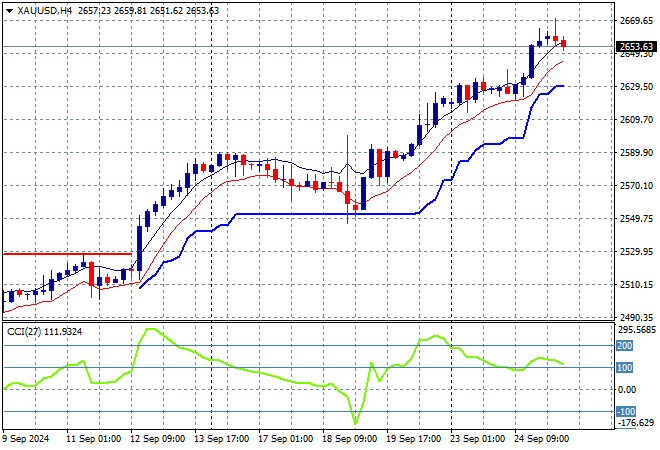

Oil futures are looking flat as Brent crude stays around the $74USD per barrel level while gold is retracing slightly from its recent record high but holding well above the $2600USD per ounce level:

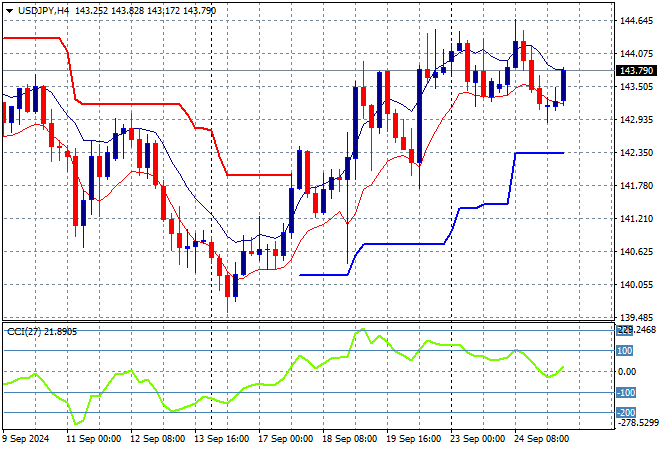

Mainland Chinese share markets are launching higher again with the Shanghai Composite up more than 2% at one stage, now up just 1% going into the close while the Hang Seng Index is up 0.7% to remain above the 19000 point barrier. Japanese stock markets are not doing so well with the Nikkei 225 losing 0.2% to 37870 points while the USDPY pair is still fighting overhead resistance above the 144 level:

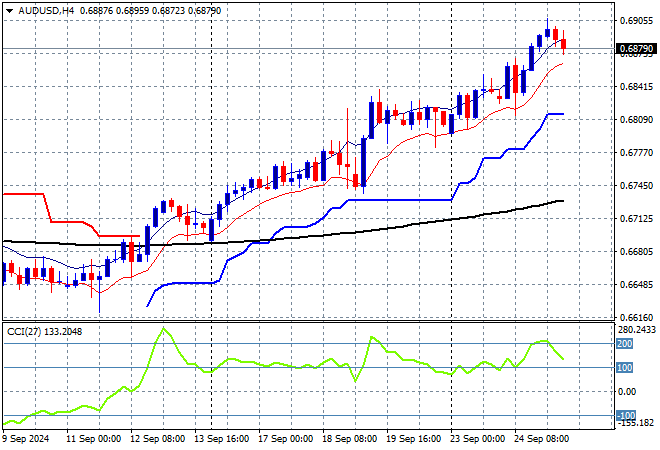

Australian stocks remain unphased with the ASX200 again closing some 0.2% lower at 8129 points while the Australian dollar slipped slightly just below the 69 cent level this afternoon:

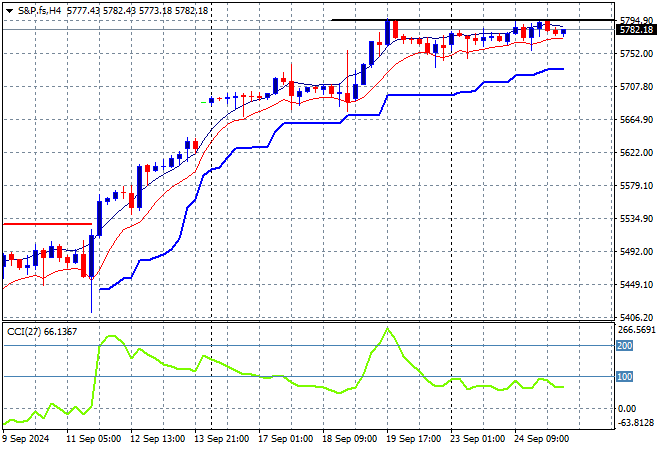

S&P and Eurostoxx futures are steady going into the London session with the S&P500 four hourly chart showing momentum remaining flat but still positive as price action stalls at the recent highs:

The economic calendar is very quiet tonight with no major or secondary releases of note.