It’s green across the board as Asian share markets ignore the mixed sessions overnight with Chinese stimulus helping lift all boats. Australian shares have finally moved higher after being in doubt following the RBA’s inaction with the higher USD also helping. Euro is struggling to make headway while the Australian dollar has rebounded slightly to the mid 68 cent level.

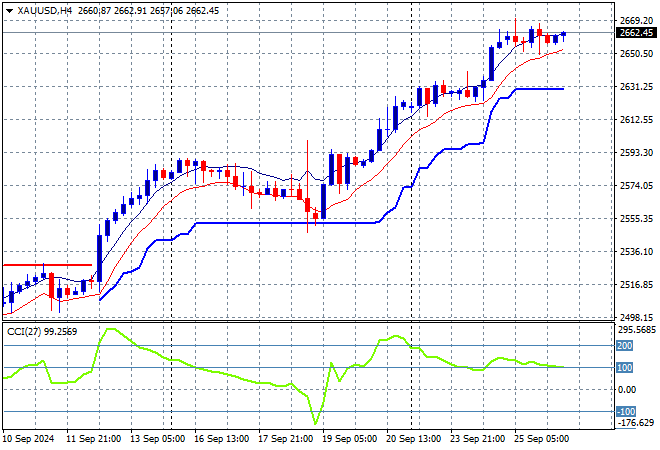

Oil futures are rolling over as Brent crude breaks through the $73USD per barrel level while gold is holding strong and steady at its recent record high well above the $2600USD per ounce level:

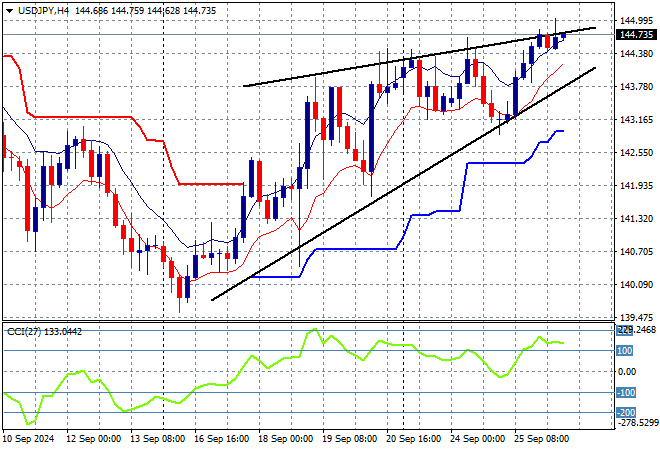

Mainland Chinese share markets are launching higher again with the Shanghai Composite up more than 1.6% while the Hang Seng Index is up more than 2% as it eyes the 20000 point barrier. Japanese stock markets are also doing well with the Nikkei 225 gaining more than 2% to 38675 points while the USDPY pair is still fighting overhead resistance above the 144 level with the four hourly chart indicating a potential bearish rising wedge pattern:

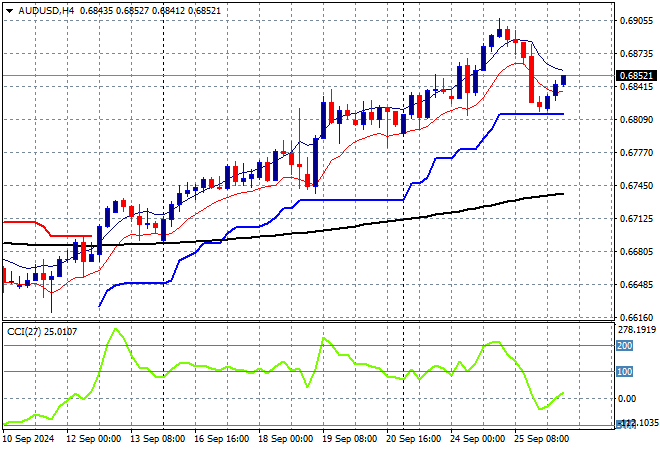

Australian stocks are being pushed along by Chinese equities with the ASX200 up more than 0.8% going into the close at 8198 points while the Australian dollar has taken back half of its overnight losses to get back to the mid 68 cent level this afternoon:

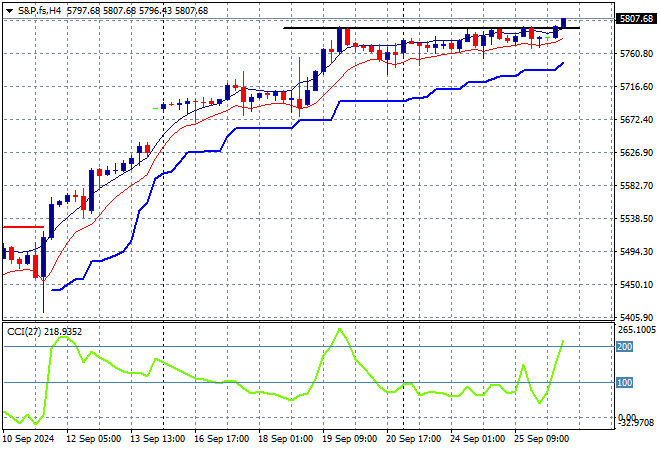

S&P and Eurostoxx futures are rising going into the London session with the S&P500 four hourly chart showing momentum picking up strongly as price action wants to breakout above the recent highs:

The economic calendar ramps up a bit tonight with the focus on the latest US initial jobless claims and home sales data.