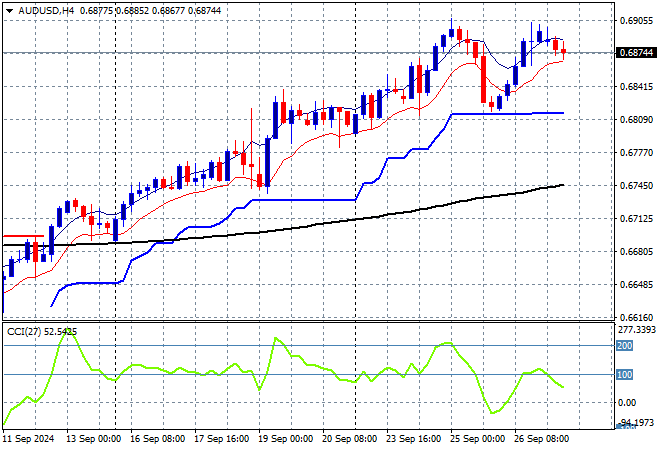

It’s still green across the board as Asian share markets as the PBOC pushes through with its rate cut agenda, although local shares barely moved in response. The pullback in USD has continued although Yen is moving around due to localised inflation prints while the Australian dollar is stalling out just below the 69 cent level.

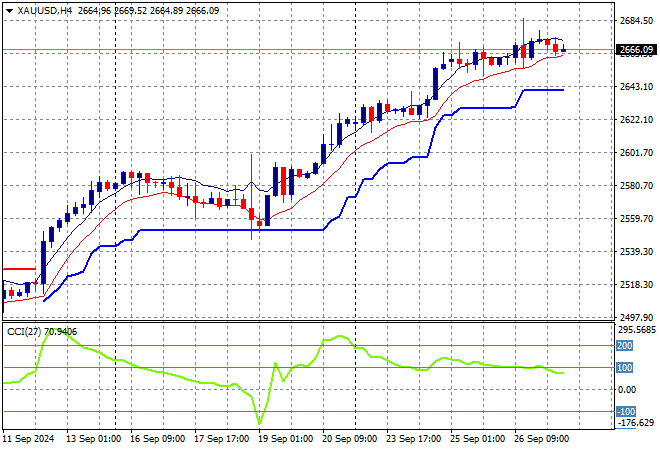

Oil futures are rolling over as Brent crude breaks through the $72USD per barrel level while gold is holding strong and steady at its recent record high well above the $2600USD per ounce level:

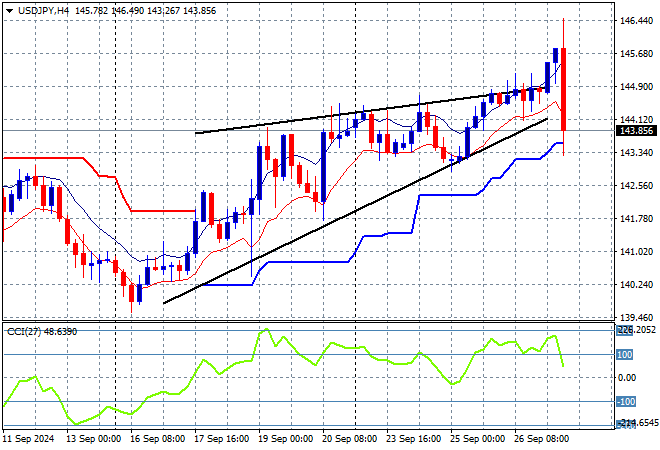

Mainland Chinese share markets are launching higher again with the Shanghai Composite up nearly 3% while the Hang Seng Index is up about the same as it breaks through the 20000 point barrier. Japanese stock markets are also doing well with the Nikkei 225 gaining more than 2% to 39329 points while the USDPY pair had a big breakdown following the Tokyo CPI print and is now battling just below the 144 level with the four hourly chart indicating a bearish rising wedge pattern:

Australian stocks are trying to be pushed along by Chinese equities but the ASX200 only managed a 0.1% lift to finish the week at 8212 points while the Australian dollar has pulled back slightly to stay just below the 69 cent level this afternoon:

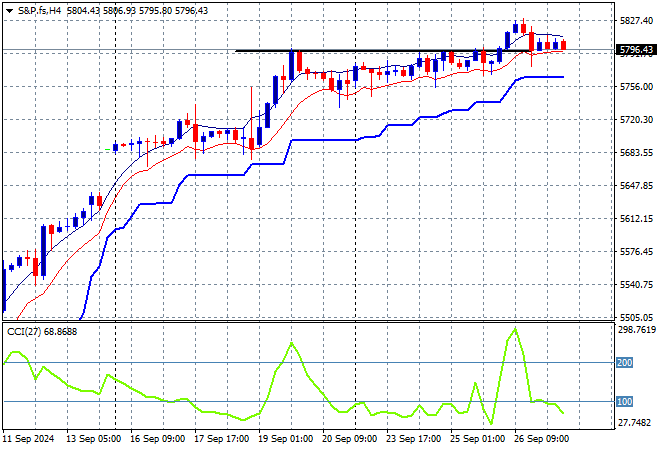

S&P and Eurostoxx futures are flat going into the London session with the S&P500 four hourly chart showing momentum still looking good although price action wants to breakout above the recent highs:

The economic calendar finishes the trading week with some European CPI prints on the continent.