Chinese stocks have soared higher in one of their best one day performances in a decade as traders don’t want to miss out before the week long holiday. The reaction to the PBOC stimulus has been considerably overdone but not yet stopped! Local shares gained in sympathy while Japanese shares slumped on the back of further speculation that the BOJ has more rate rises planned. USD has continued its weakening trend with Yen further moving higher while the Australian dollar is pushing further higher above the 69 cent level.

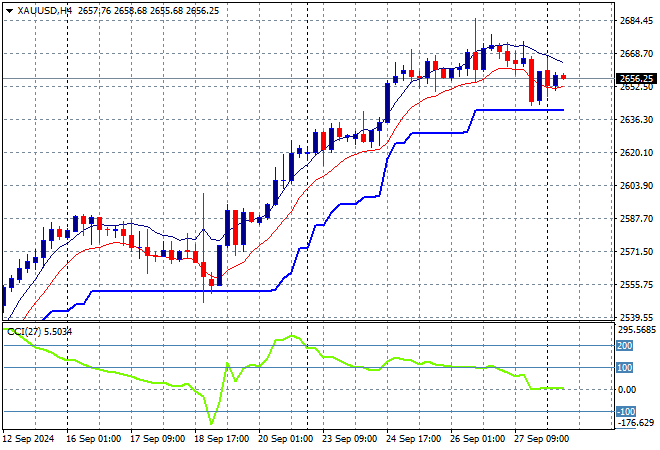

Oil futures are fairly steady as Brent crude remains stuck at the $72USD per barrel level while gold is holding strong and steady but a little below its recent record high well above the $2600USD per ounce level:

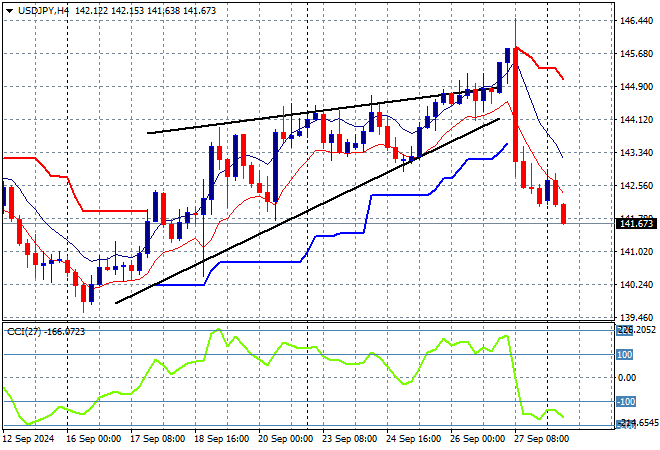

Mainland Chinese share markets are going to the Moon with the Shanghai Composite up more than 7% while the Hang Seng Index is nearly 4% to extend way past the 21000 point level. Japanese stock markets however are cratering with the Nikkei 225 down nearly 5% to 37919 points while the USDPY pair continues its big breakdown and is now battling to stay just above the 141 level with the four hourly chart indicating a completed bearish rising wedge pattern:

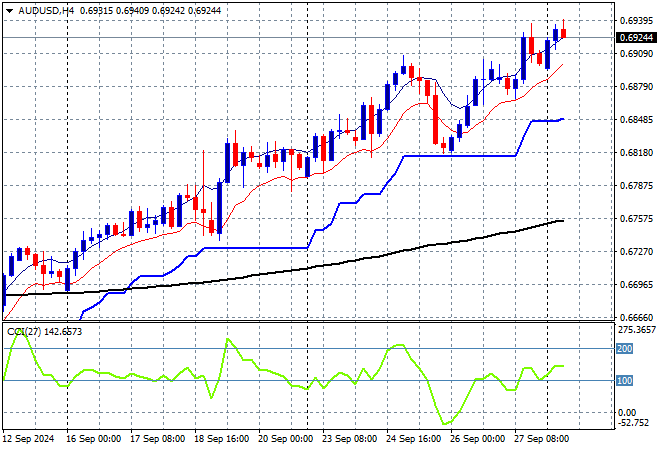

Australian stocks are trying to be pushed along by Chinese equities with the ASX200 managing a 0.7% lift to close at 8269 points while the Australian dollar has pushed further up to stay above the 69 cent level this afternoon:

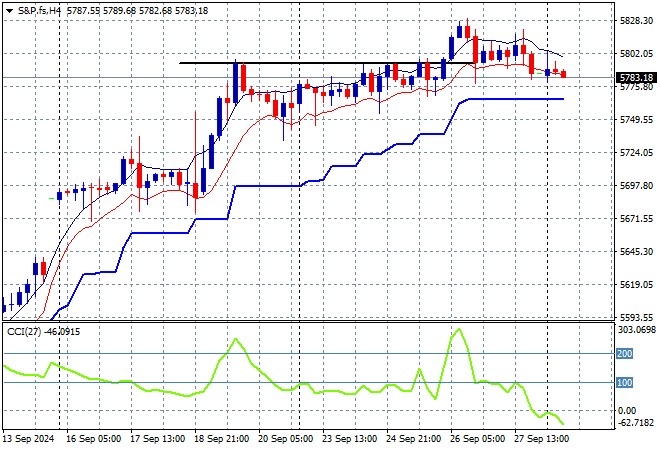

S&P and Eurostoxx futures are flat going into the London session with the S&P500 four hourly chart showing momentum still looking good although price action wants to breakout above the recent highs:

The economic calendar starts the trading week with a bang as its the end of the month and quarter, with lots of European inflation releases plus UK GDP data.