Breakouts galore across all risk and equity markets in the wake of the “surprise” 50bps rate cut from the Federal Reserve as Wall Street hits a new record high and the USD is sold off resoundingly. The S&P500 hit a new record high with the NASDAQ not far off, spurred by foreign buying as recovered well above the 1.11 handle while the Australian dollar broke through the 68 cent level.

10 year Treasury yields moved higher again to a two week high through the 3.7% level while oil prices launched higher as Brent crude almost broke through the $75USD per barrel level. Gold snapped out of its funk to push back up towards the $2600USD per ounce level.

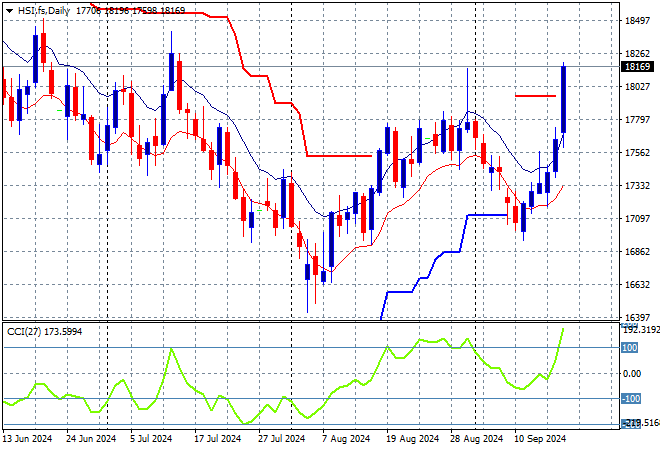

Looking at markets from yesterday’s session in Asia, where mainland Chinese shares rebounded with the Shanghai Composite up 0.7% while the Hang Seng Index reopened to soar 2% higher, closing at 18013 points.

The Hang Seng Index daily chart was starting to look more optimistic a few months back but price action has slid down from the 19000 point level and continues to deflate in a series of steps as the Chinese economy slows. Short term resistance is finally being pushed away here, as this break above the 18000 point level sets up for a run at the 20000 level:

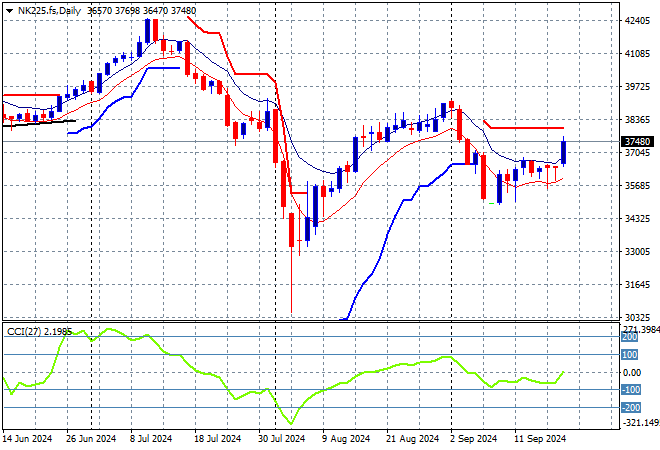

Japanese stock markets followed suit with the Nikkei 225 lifting over 2% to 37155 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June not on the cards although positive momentum is finally starting to build:

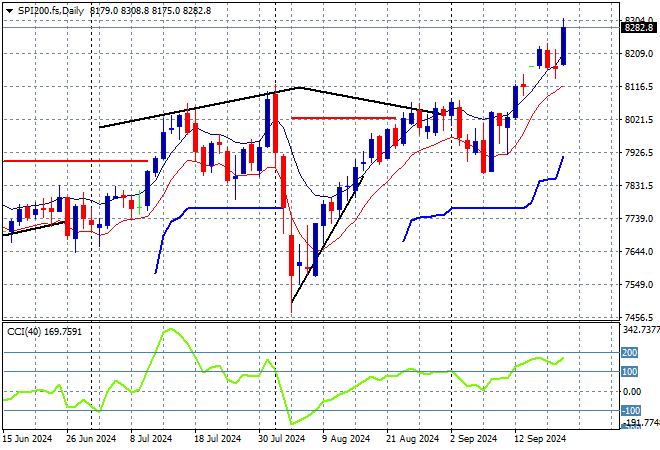

Australian stocks were the poorest performers relatively speaking in the wake of the unemployment print as the ASX200 closed 0.6% higher to 8191 points, a new high.

SPI futures are up at least 0.5% due to the breakout on Wall Street overnight. Short term momentum and the daily chart pattern was potentially signalling a top here but this is no longer inplay as price action shows a clear breakout to new highs with momentum well overbought and ready to extend further:

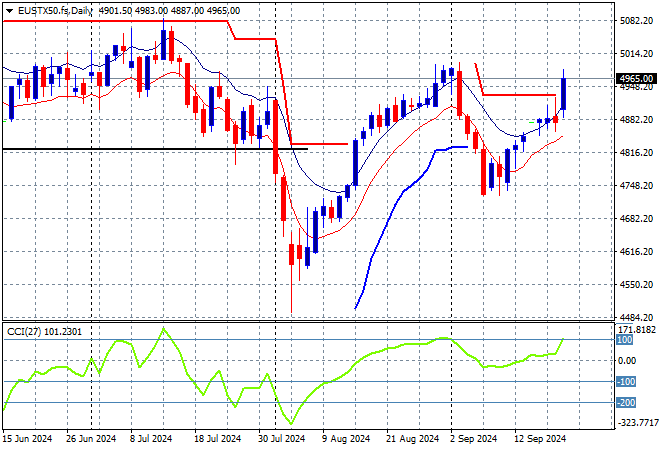

European markets were no longer struggling with a clear buying signal all across the continent as the Eurostoxx 50 Index closed more than 2% higher to 4943 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum is now nicely overbought, ready to engage higher:

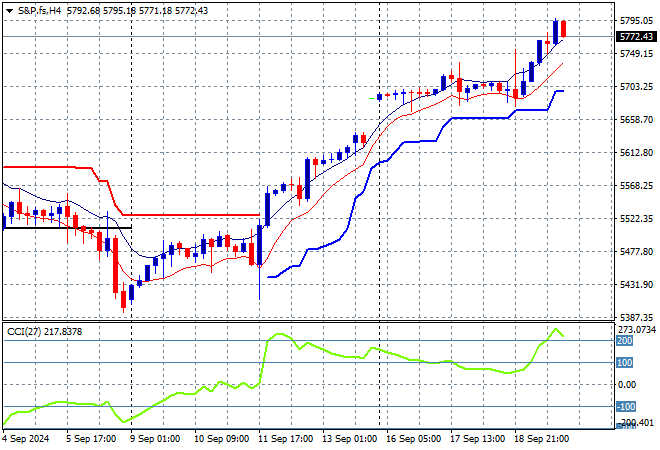

Wall Street all lifted in unison after absorbing the wider risk market good news reaction from the big cut from the Fed as the NASDAQ gained more than 2.5% while the S&P500 pushed some 1.7% higher, closing at a new record high at 5713 points.

The four hourly chart illustrates the series of breakouts since the early September lows as Fed signalling is doing its thing. Price action had a small pause before the Fed meeting but its now all systems go but watch for a potentially small pullback on too much exuberance too soon, as overbought momentum indicates:

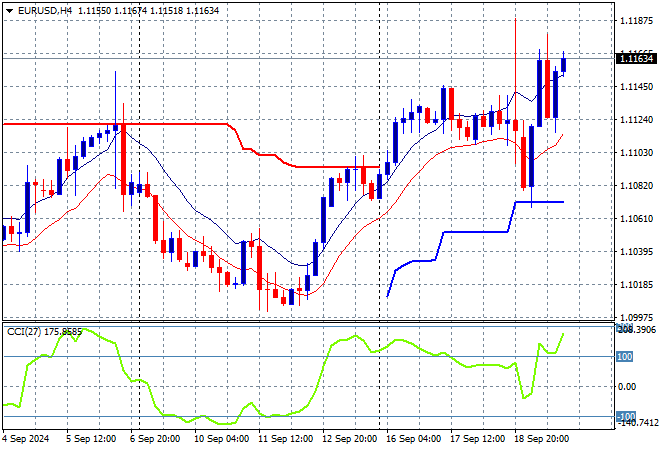

Currency markets have had a volatile 24 hours in the wake of the Fed meeting and through the intrasession volatility have returned to their anti-USD mood and then some as King Dollar is dethroned once again. Euro pushed back towards the 1.12 handle to make a new weekly high and is looking poised for more upside here.

The union currency had been structurally supportive despite the start of week extended dip that reversed on built in expectations of this soft jobs print, with those expectations dashed and then some on the night. Momentum had been quite oversold in the short term but has picked up here to almost overbought with overhead resistance at the 1.11 handle now defeated:

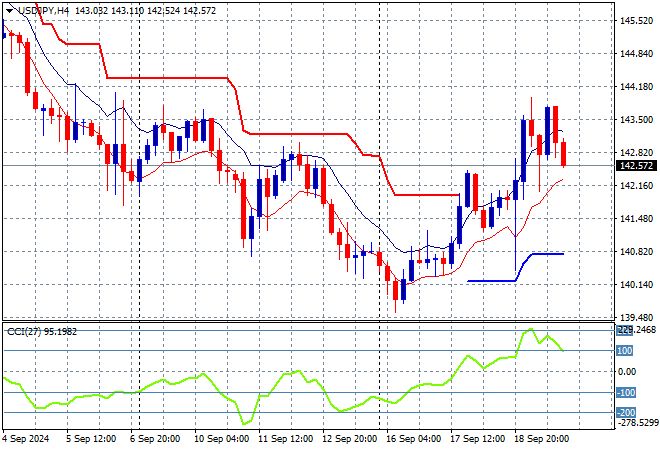

The USDJPY was trying to recover overnight with a solid surge through the 143 level before pulling back to the mid 142’s as short term momentum retraced out of overbought settings amid the risk market euphoria.

Longer term momentum was suggesting a possible bottom was brewing as the BOJ wants to get this volatility under control, so this bounceback could have legs to the 144 level or higher but could be dominated by shorter term positioning:

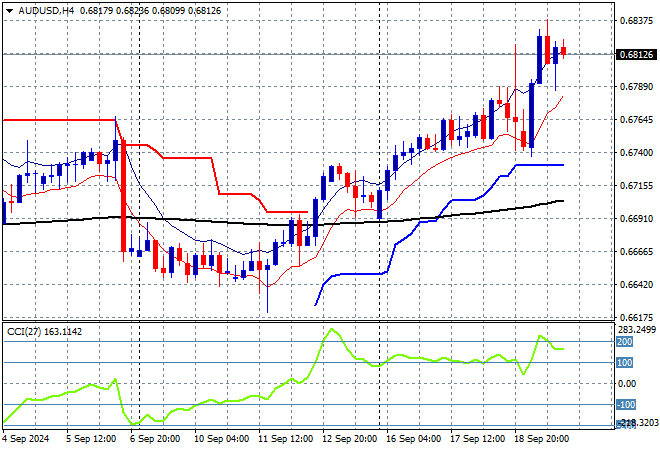

The Australian dollar is not just holding on but now extending its climb above the 67 handle as it breaks through the 68 level for a new monthly high overnight, after looking through the intrasession volatility.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. The potential for a pullback here has almost disappeared as resistance overhead is swept aside:

Oil markets remain depressed amid OPEC’s warning and while the relief rally continued overnight, with Brent crude pushing up to the $75USD per barrel level, it doesn’t look that convincing.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken with short term momentum remaining in negative territory, setting up for this sharp retracement and continued selloff:

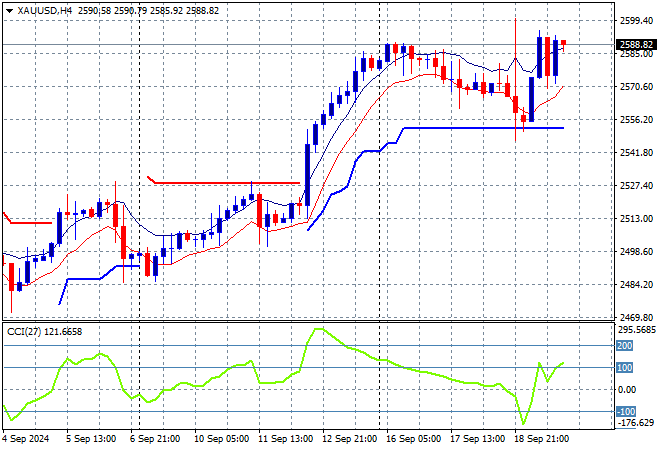

Gold was able to get back on track after retracing to short term support in the wake of the Fed meeting and almost got back to the $2600USD per ounce level in a much more convincing move overnight.

The longer term support at the $2300 level remained firm while short term resistance at the $2470 level was the target to get through last week and has been the anchor point for this week’s price action. Momentum is looking better in the short term here but watch for the low moving average area to be supported first:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!