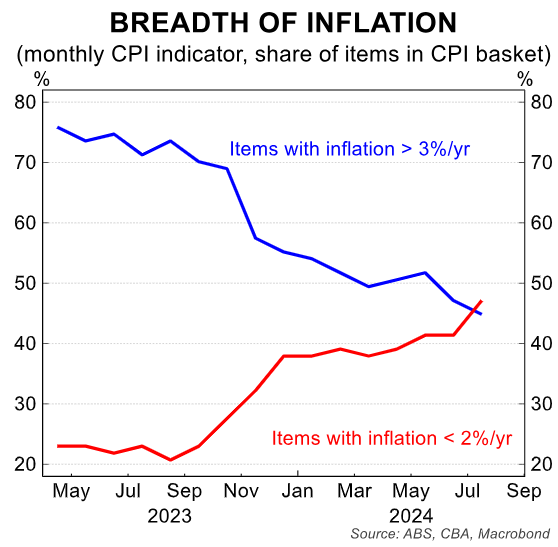

The July monthly inflation indicator from the ABS showed that the disinflationary impulse had broadened.

The number of items in the CPI basket with annual inflation below 2% rose above the number of items with prices growing faster than the RBA’s inflation target of 3%:

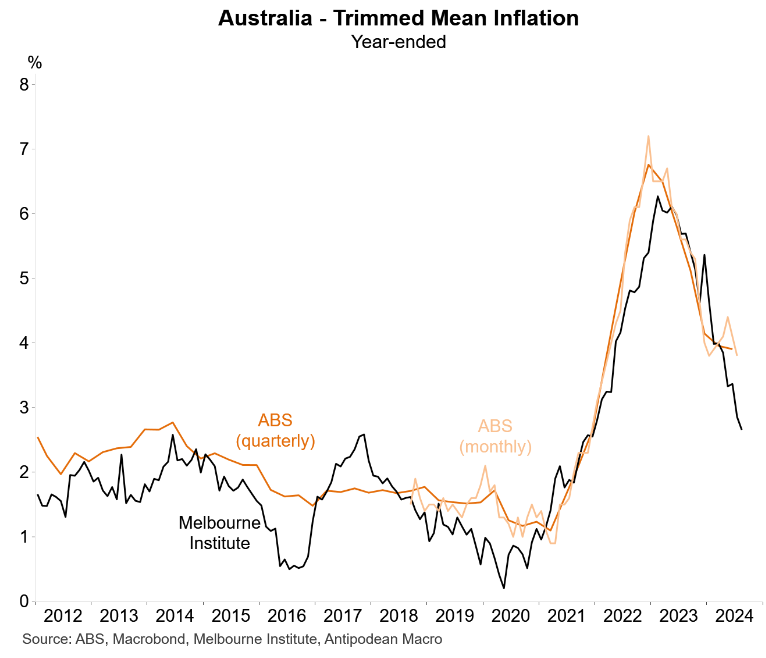

Last week, the Melbourne Institute inflation gauge recorded a sharp fall in trimmed mean inflation:

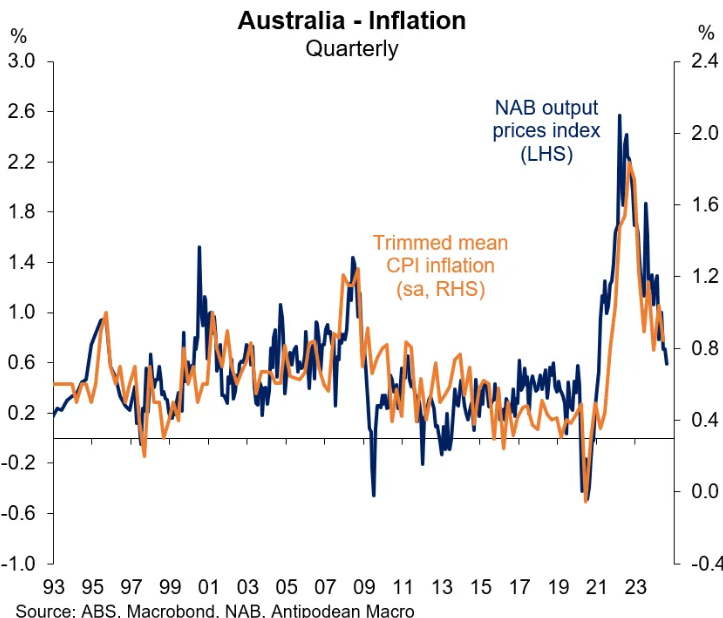

On Tuesday, the NAB business survey was released. As shown below by Justin Fabo at Antipodean Macro, output prices further declined in August, pointing to a further moderation in trimmed mean inflation:

Although the decline in CPI inflation has been slow and bumpy, progress is being made.

That said, I still believe that the RBA would need to see the official unemployment rate tick up toward 4.5% before it commences its next rate-cutting cycle.

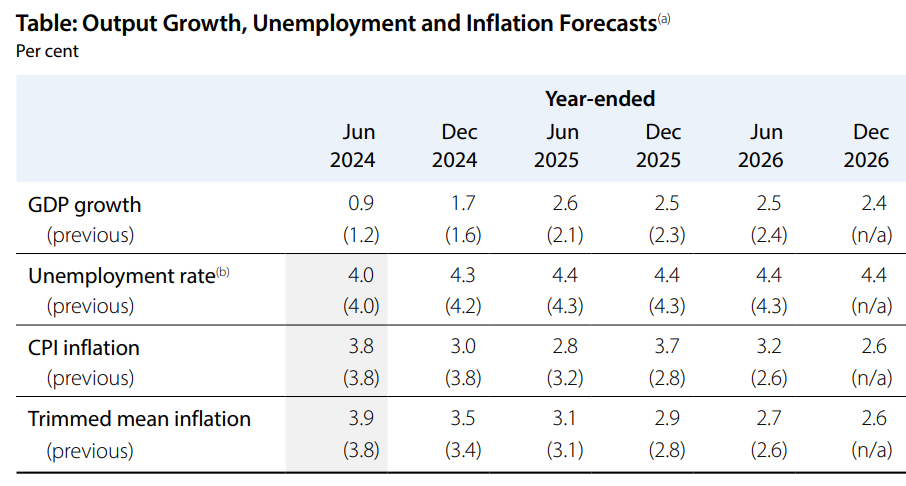

The latest Statement of Monetary Policy projected that Australia’s unemployment rate would be 4.3% by year’s end, versus 4.2% currently:

The RBA would likely need to see the unemployment rate rise materially above its forecast to compel it to cut rates before the end of the year.