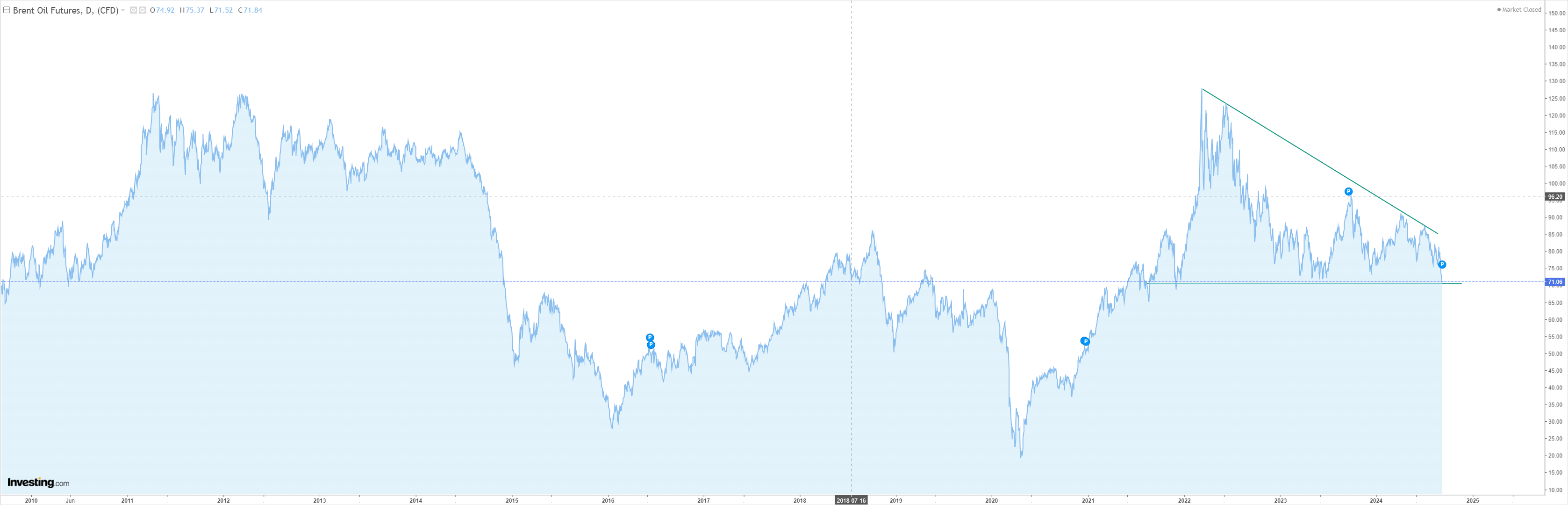

Oil has about the worst bearish descending triangle chart I have ever seen:

It takes a lot to make Wall Street bearish on oil but it has happened. Goldman:

- The 8 OPEC+ countries agreed yesterday to extend their extra voluntary production cuts for two months until the end of November, underscoring the flexibility of the producer group.

- We still expect three months of OPEC+production increases, but have pushed out the start date to December (vs. October previously).

- We stick to our $70-85 Brent range and our December 2025 Brent forecast of $74/bbl.

- We expect the tightening impact of modestly lower OPEC+ supply incoming months to be roughly offset by the easing effect from ongoing softness in our China demand nowcast and from a quicker than previously expected recovery of Libya supply.

- We still see the risks to our $70-85 range as skewed to the downside given high spare capacity, and downside risks to demand from weakness in China and potential trade tensions.

Advertisement