Treasurer Jim Chalmers recently claimed that the RBA was “smashing the economy” by keeping interest rates high.

On Tuesday, the RBA kept the official cash rate on hold at 4.35% and warned that rates are unlikely to come down this year.

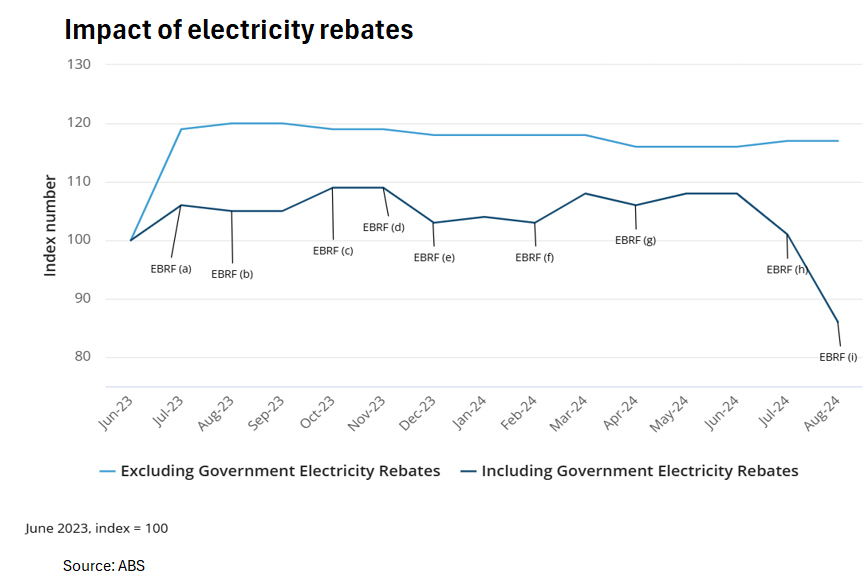

The RBA acknowledged that headline inflation will fall below the target on the back of energy and rent subsidies. However, it would look through the result and focus on quarterly underlying inflation, which remains well above target (i.e., 3.9% in Q2).

On Wednesday, the ABS released the August CPI indicator, which fell to 2.7% in the 12 months to August, down from a 3.5% rise in the 12 months to July.

The fall in the monthly CPI was driven by energy and rental subsidies, as well as lower petrol prices.

Electricity prices fell by 17.9% in the year to August. But without the energy rebates, they would have decreased 2.7% over the year.

Rents increased by 6.8% in the year to August, but without the Rent Assistance subsidies, they would have increased by 8.6%.

Trimmed mean inflation, which reduces the impact of irregular or temporary price changes, (i.e., the subsidies and petrol prices) was 3.4% in August, down from 3.8% in July. This was the lowest reading in 2.5 years.

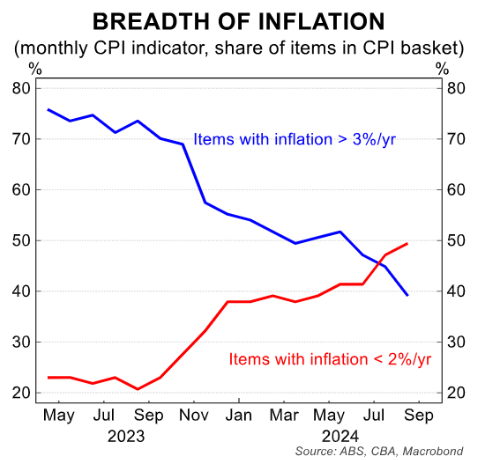

Analysis by CBA shows that outside of the subsidies and petrol prices, disinflation has broadened across the economy.

As illustrated in the following chart, the number of items with annual price rises above 3% continued to fall while the number of items with annual price changes below 2% continued to rise:

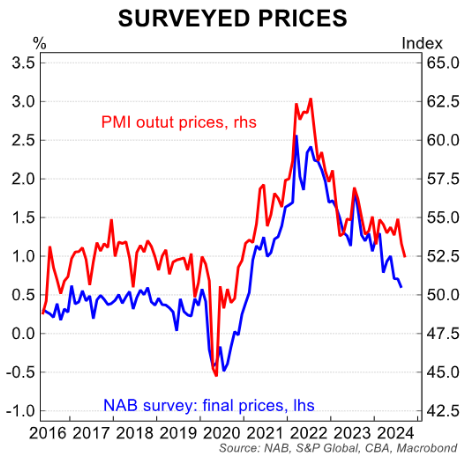

Surveyed price measures have also moderated. Growth in final prices in August in the NAB Business Survey fell to its lowest level since February 2021, whereas increases in output prices as measured by the PMIs eased to the slowest since December 2020:

CBA forecasts that trimmed mean inflation will fall to 0.7% in the September quarter, representing an undershoot relative to the RBA’s forecast.

Such an outcome would be within the RBA’s target. As this result would be delivered at the end of October, before the November monetary policy meeting, it would place the RBA in an awkward position, given that it has just said that rates are unlikely to be cut this year.

The Albanese government needs the RBA to cut rates before the federal election, which must be held by May 2025.

If underlying inflation falls within the 2% to 3% target, the government will ramp up pressure on the RBA to cut rates.

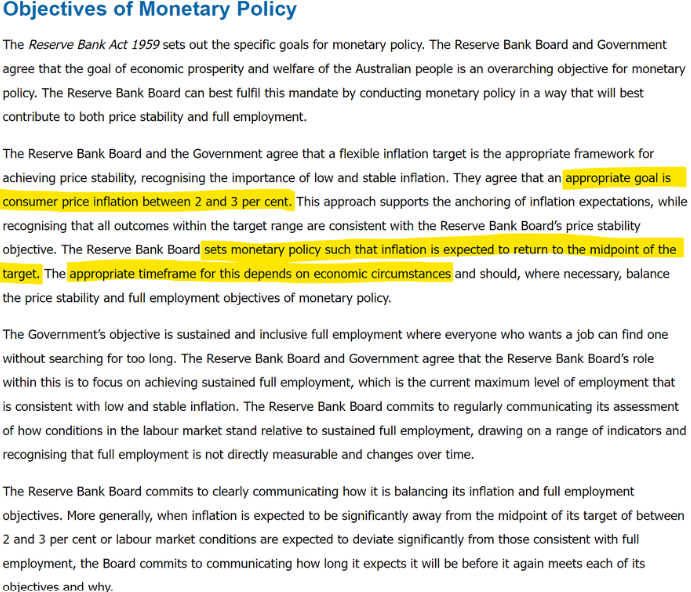

The government can also point to the “objectives of monetary policy” in the Reserve Bank Act. It refers to headline inflation being within the target range of 2% to 3%, not trimmed mean inflation:

Therefore, if the RBA refuses to cut rates at its November meeting, it would put it on a collision course with the government, which desperately needs cuts to avert disaster in the upcoming election.