CoreLogic has recorded flat rental growth across Australia for the second straight month in August, with Sydney recording its second consecutive monthly decline.

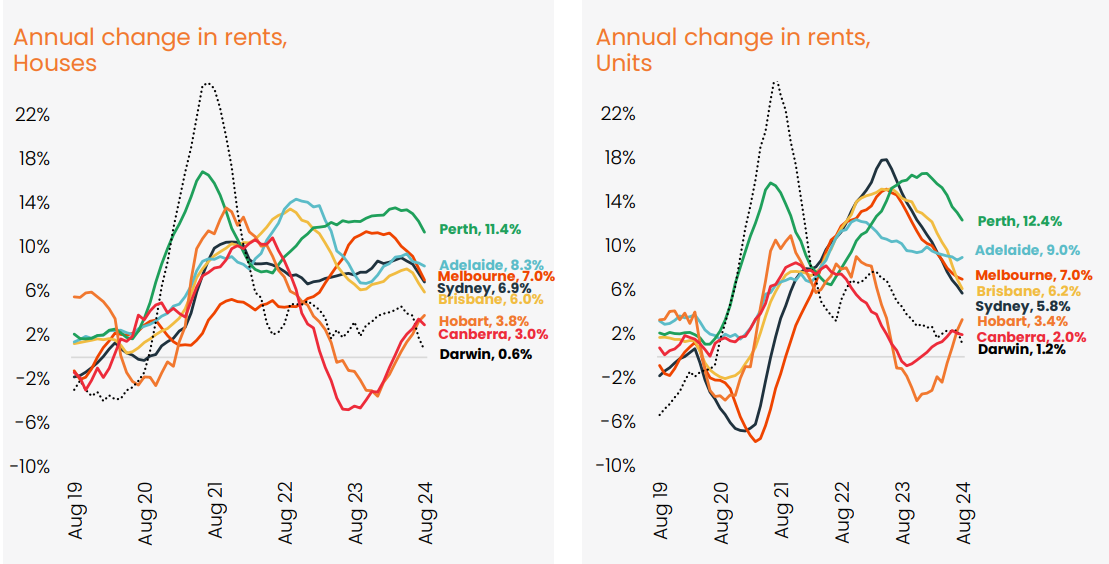

The annual rental growth rate also declined across most markets:

Source: CoreLogic

Nationally, rental values were up by 7.2% in the year to August, which is the lowest annual growth rate since May 2021.

Annual rental growth is now slowing in every capital city market, except for Hobart, which is rebounding off a dip in rent values through 2023.

Eliza Owen from CoreLogic attributed the slowing in rents to a combination of demand and supply-side factors:

On the demand side, net overseas migration has dropped, with ABS data showing a decline from 165,000 in the March quarter of 2023 to 107,000 in December quarter, and overseas arrivals data suggests a fall in international student arrivals.

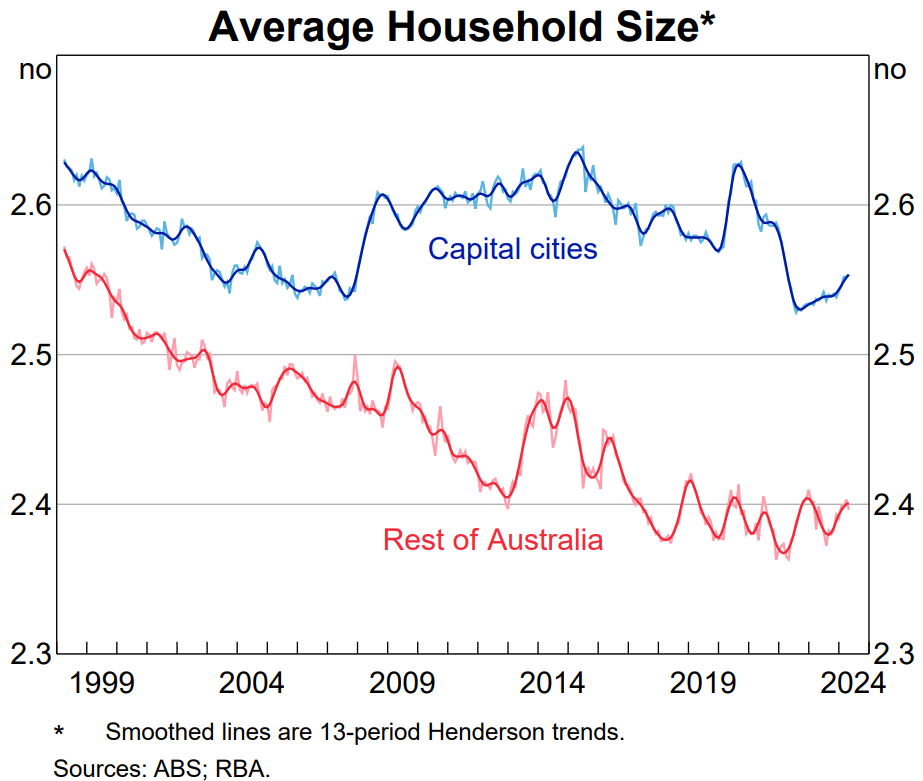

Additionally, the latest RBA reporting on average household size showed a slight uptick, suggesting share housing or multi-generational family homes may be back on the rise in response to high rents.

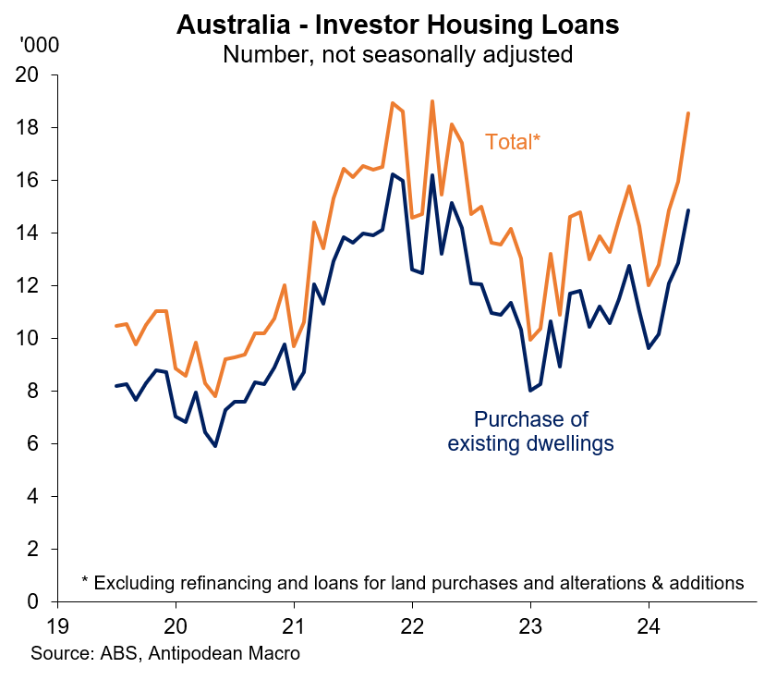

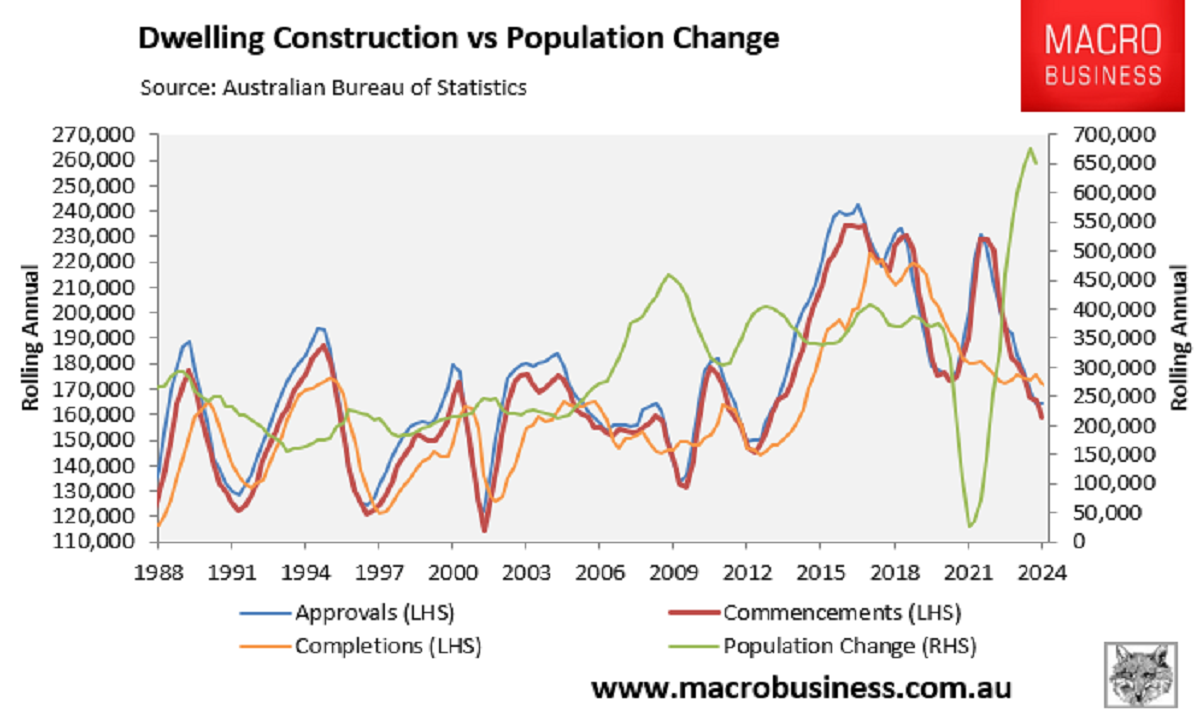

On the supply side, investor trends vary state-to-state, but nationally investor loans secured were up 10.7% in the year to June. Dwelling completions remain an issue, with a strained construction sector keeping a floor under both rent and purchase prices.

I don’t agree that investors have contributed to the easing of the rental crisis.

As shown in the data below from Justin Fabo of Antipodean Macro, the vast majority of investors buy established homes:

As a result, investors typically replace homes for sale with homes to rent, which does not help the overall rental supply-demand balance.

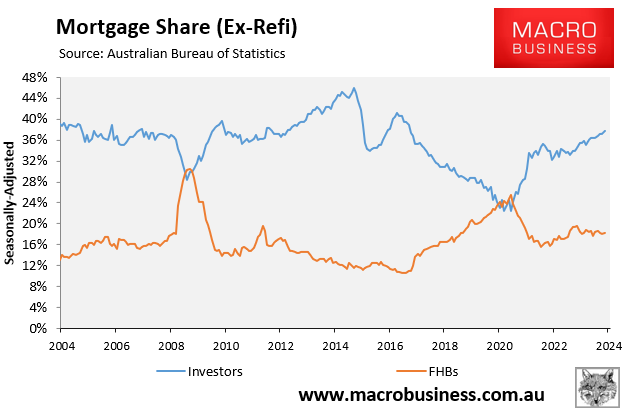

Indeed, the increase in investor borrowing has crowded out first homebuyer borrowing:

This means that outbid first homebuyers have been forced to rent from investors.

The more plausible explanation for the easing in rental growth is affordability.

Rents have skyrocketed in recent years, pushing more renters into shared housing.

According to the RBA’s most recent Statement of Monetary Policy (SoMP), “average household size has increased further in recent months, possibly in response to affordability constraints”.

It’s also worth noting that, unlike mortgages, rent cannot be leveraged. This implies that rental growth is more tightly linked to household income, limiting its potential increase.

Even so, given that net overseas migration remains historically high and housing construction rates are depressed, Australia’s rental market will remain under pressure for the foreseeable future.

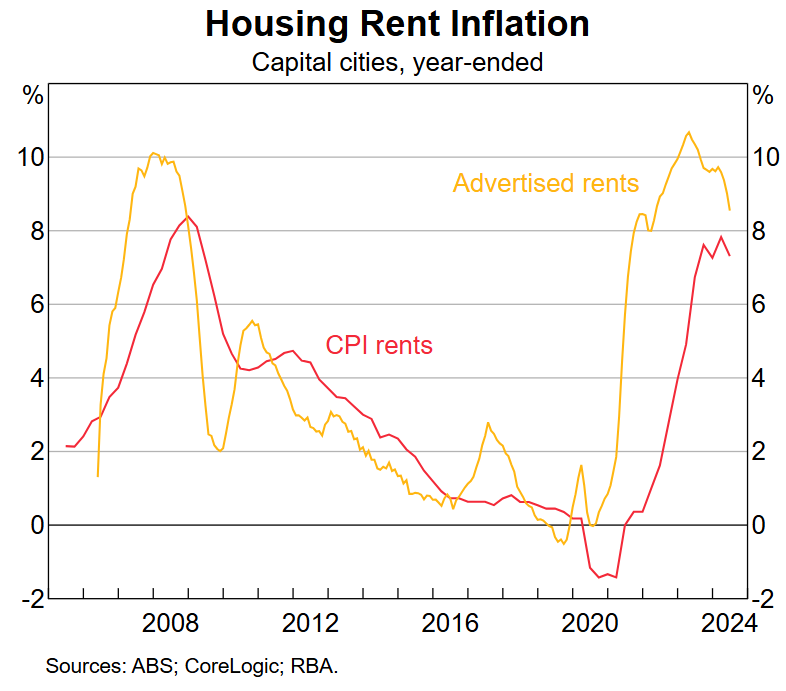

Indeed, the RBA SoMP warned that “CPI rents inflation is likely to be high for some time”.