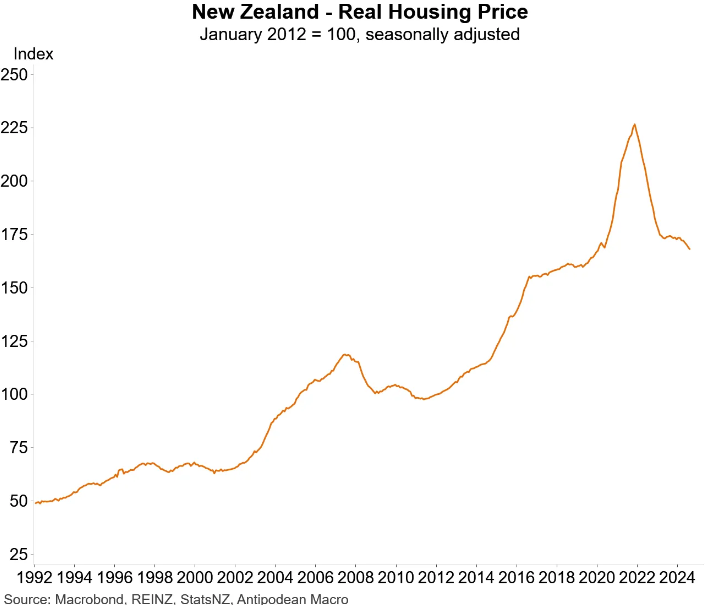

The Real Estate Institute of New Zealand’s (REINZ) House Price Index (HPI) reported a 16.7% decline nationwide from the market peak in 2021.

This has brought real inflation-adjusted housing prices back to pre-pandemic levels at the start of 2020.

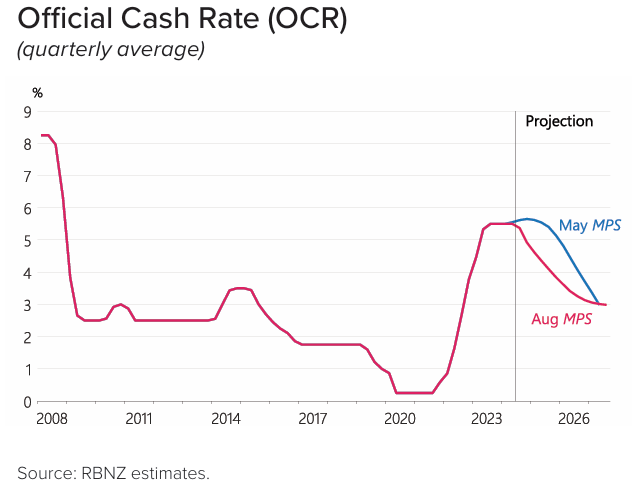

The Reserve Bank of New Zealand commenced an interest rate easing cycle last month with an initial 0.25% cut to the official cash rate.

The Reserve Bank has also projected around 2.5% of rate cuts over a 2.5 year period:

Historically, a reduction in the official cash has resulted in a rise in home prices owing to the resulting increase in borrowing capacity and mortgage serviceability.

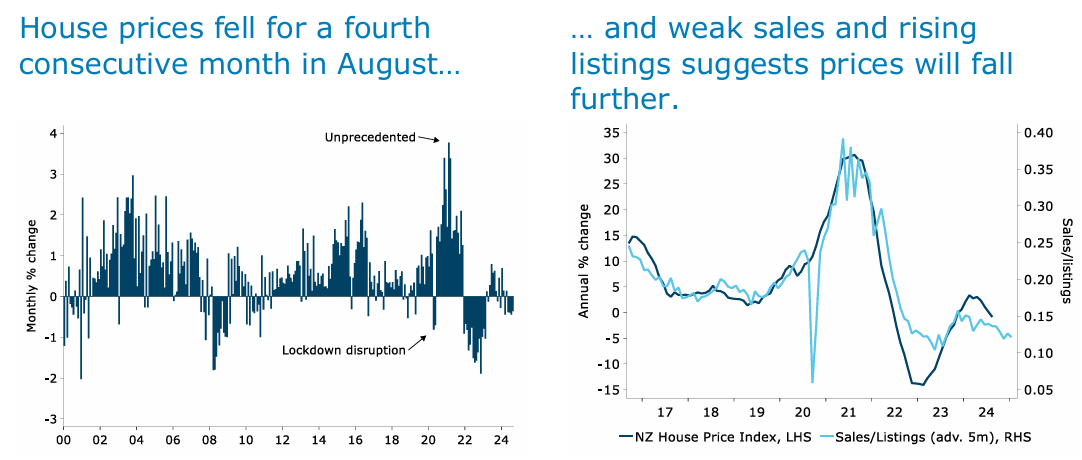

However, ANZ’s latest New Zealand Property Focus projects that home values will fall further in the near term, even as mortgage interest rates continue to decline.

“Housing market momentum continued to weaken in August, with no sign as yet of a flurry of sales following the RBNZ’s first OCR cut last month”, ANZ notes.

“Sales volumes remained weak, while inventories on the market rose further, suggesting that house prices are likely to correct further over the coming months in order to clear the backlog“.

ANZ cautions “that faster cuts from the RBNZ would likely occur in response to the economy underperforming the RBNZ’s already low expectations. In that scenario, lower interest rates may not be the boon for the housing market that many assume”.

“All up, there isn’t much to get excited about just yet for those anticipating a pick-up in the housing market from lower interest rates”, ANZ says.

“In fact, August’s data added further downside risk to our forecast for house prices to decline 1.0% y/y over 2024”.

However, ANZ does acknowledge that “anecdotal evidence over recent weeks has pointed to a pick-up in activity”, pointing to the bounce in the auction clearance rate following the fall in interest rates.

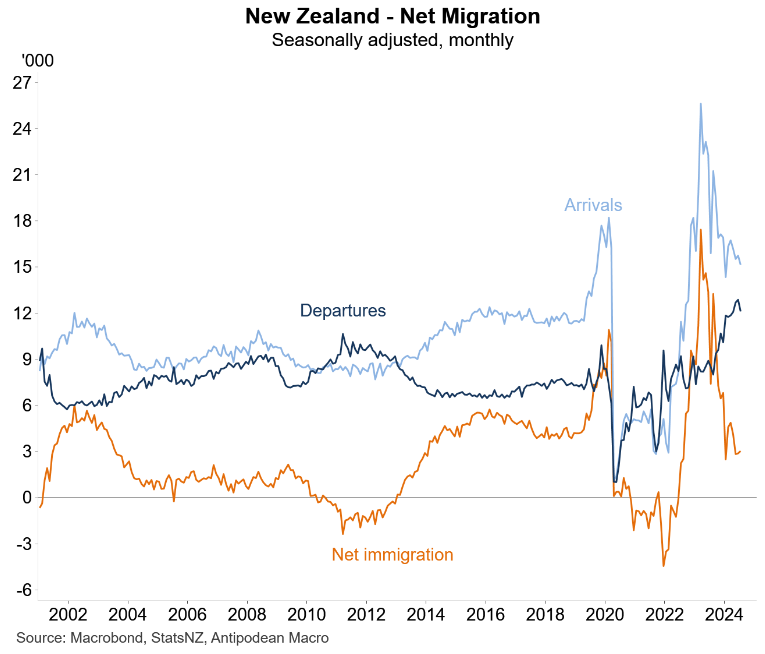

The recent sharp moderation in net overseas migration is one factor working against a house price rebound.

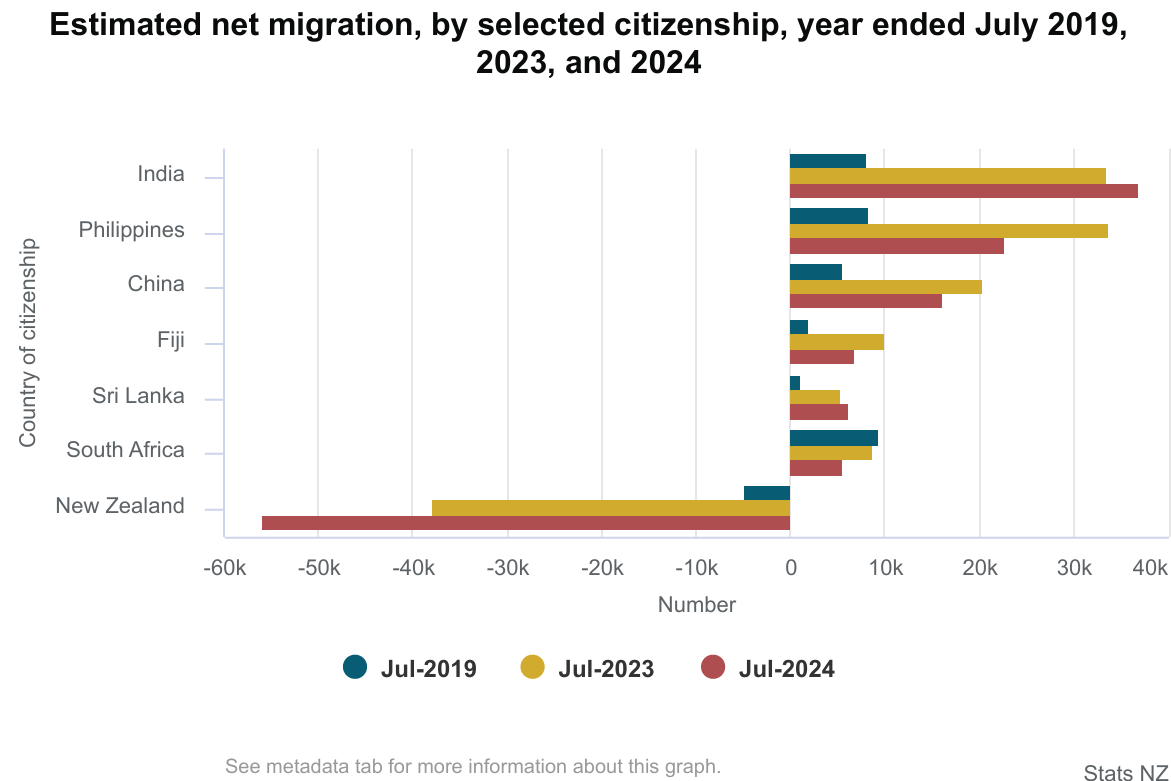

Large numbers of citizens are emigrating from New Zealand, replaced by poorer migrants from developing nations:

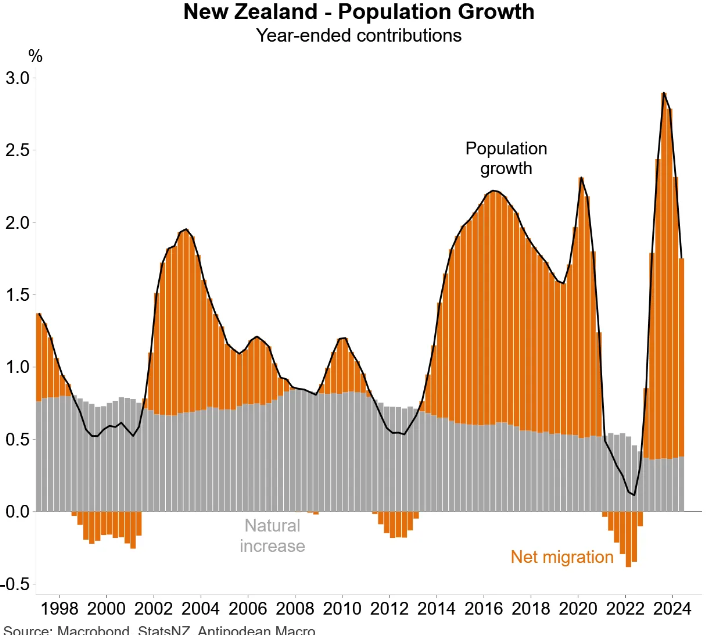

As a result, annual New Zealand’s population growth is slowing, which will moderate housing demand:

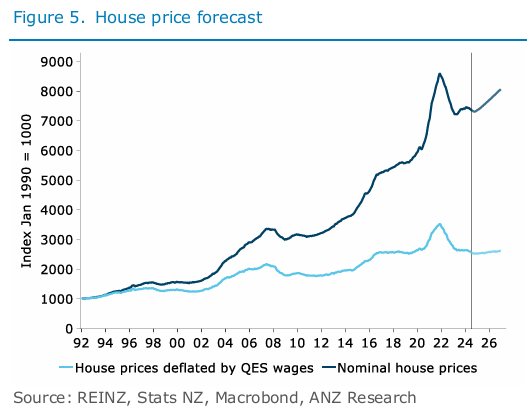

New Zealand’s economy is also stuck in a protracted per capita recession, and unemployment is rising fast.

Therefore, while I expect the housing market to respond to the cut in rates, the rebound will likely be sluggish.