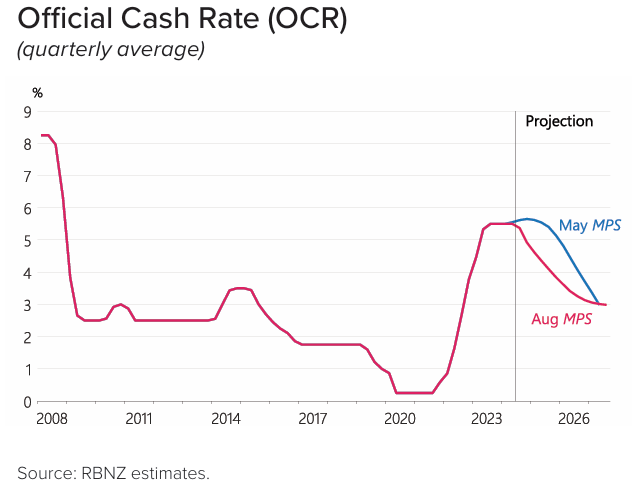

The Reserve Bank of New Zealand has projected around 2% of official interest rate (OCR) cuts over the next two years:

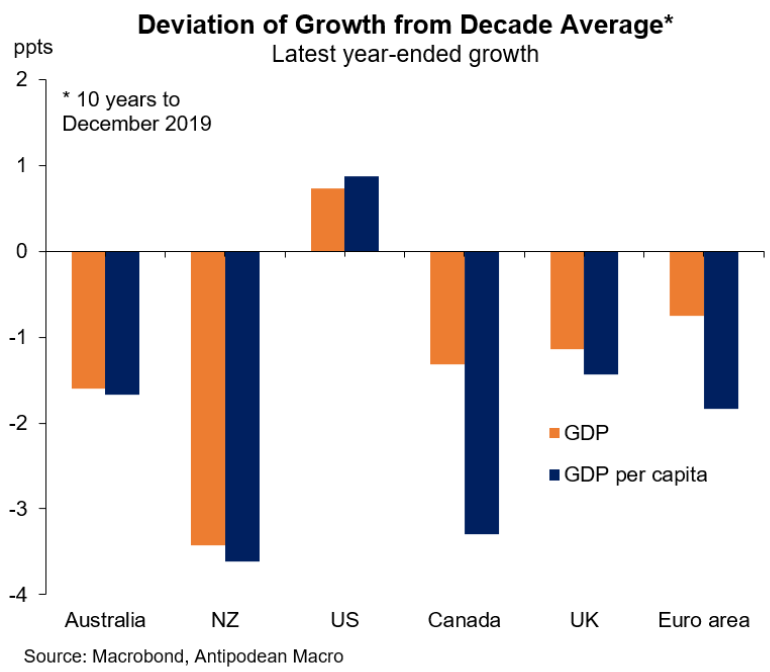

The latest employment data series suggests that the Reserve Bank must bring forward cuts to stave off the deepening recession, which is already the most severe in the Anglosphere:

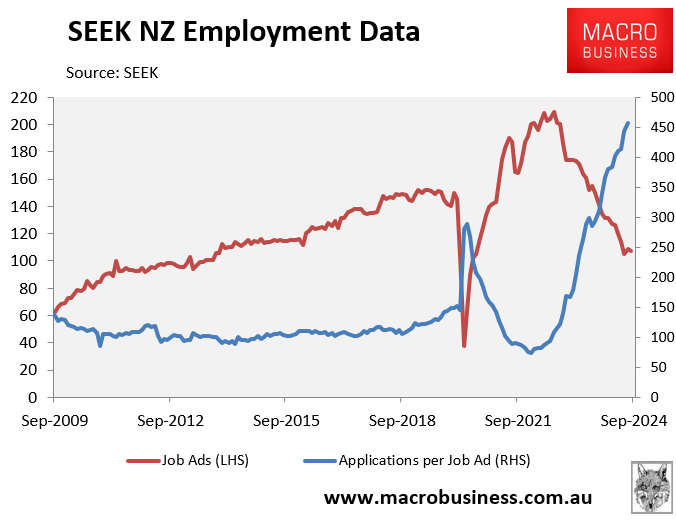

On Friday, SEEK released its employment report for August, which showed that while the level of job ads has levelled out at around decade lows excluding the pandemic, the number of applications per job ad has risen for 10 consecutive months and is tracking at unprecedented levels:

Separate job ad data from MBIE, published below by Justin Fabo at Antipodean Macro, paints a similar picture, pointing to rising unemployment:

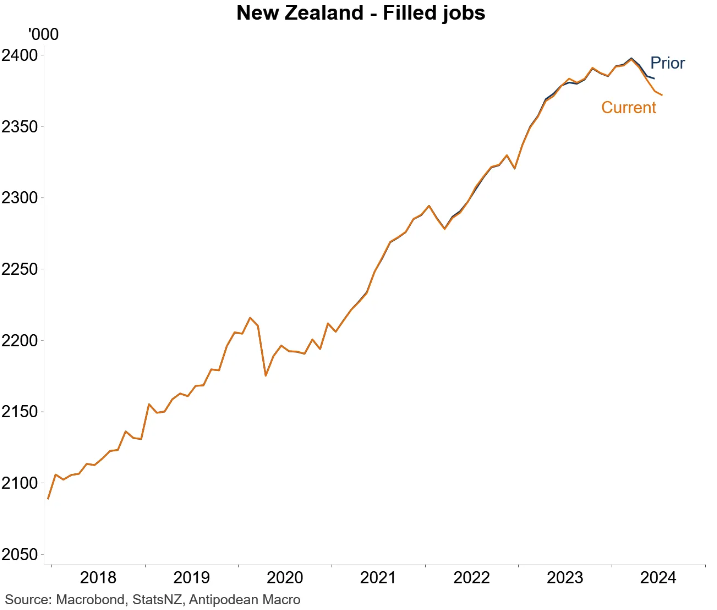

Statistics New Zealand’s filled jobs series fell by 0.4% in the June quarter and was also revised sharply lower:

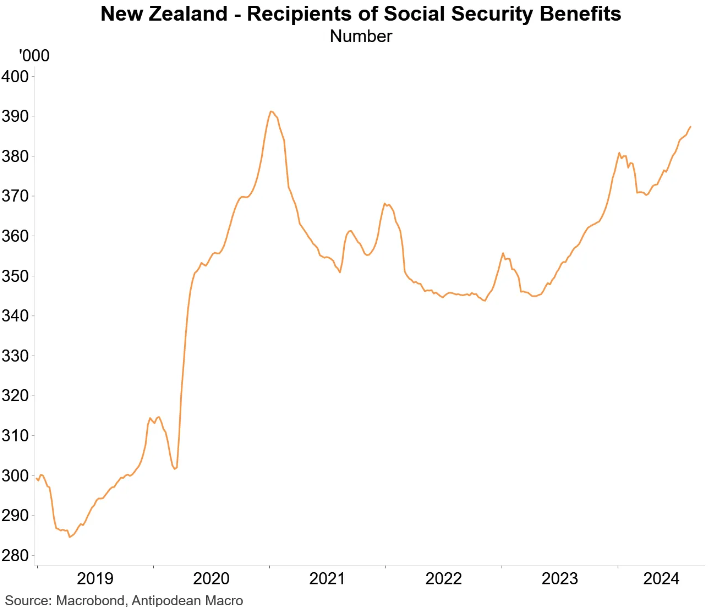

The number of social security recipients has also nearly returned to the pandemic peak:

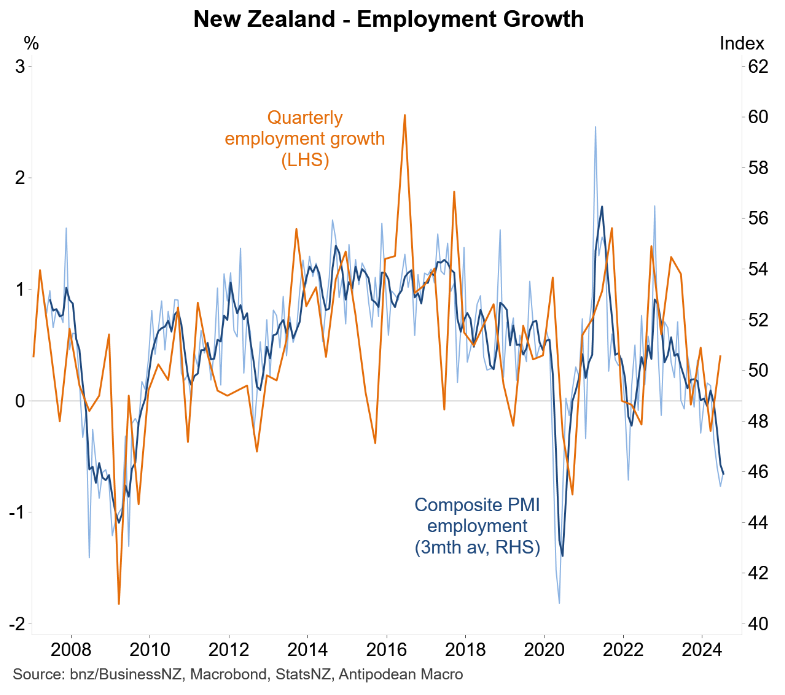

Finally, the composite PMI employment indicator has collapsed:

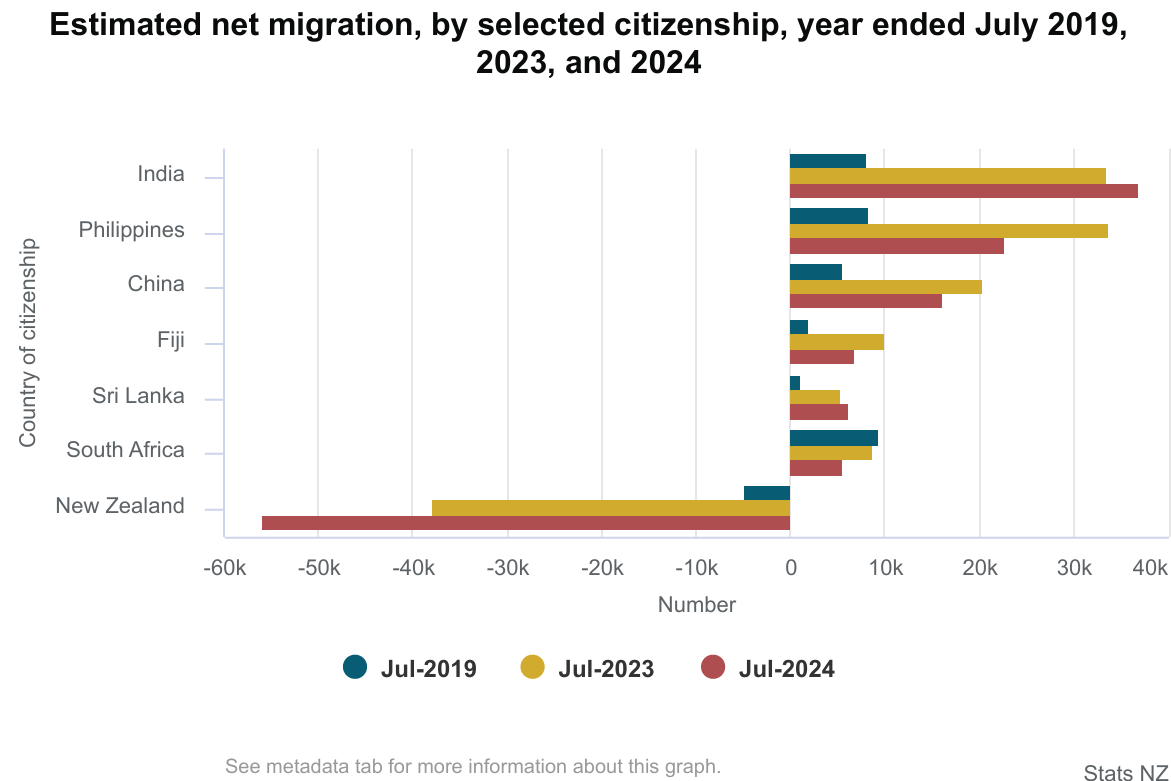

The above indicators are a budding disaster for New Zealand workers and explain why so many are now emigrating to Australia:

The Reserve Bank clearly needs to stem the recession and brain drain by cutting the OCR deeper and sooner than projected at its August monetary policy meeting.