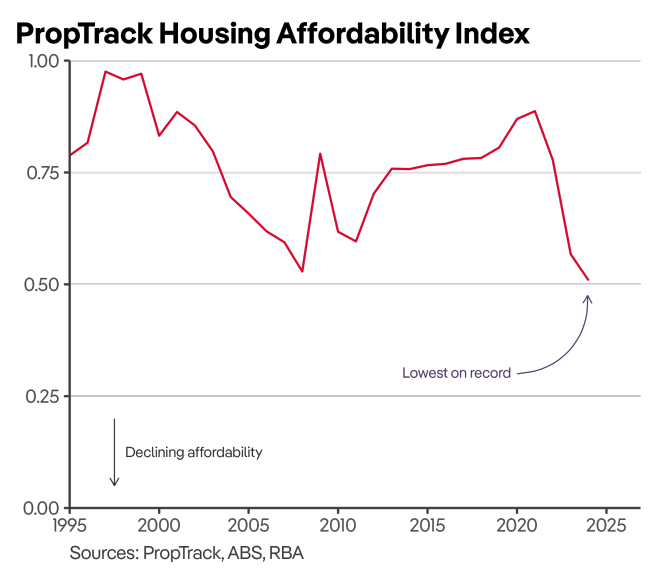

Courtesy of Treasurer Jim Chalmers comes the least affordable housing market on record. PropTrack:

Housing affordability deteriorated further over the past year to reach its worst level on record, driven by high mortgage rates and increasing home prices.

A median-income household earning around $112,000 could afford just 14% of homes sold in the 2023-24 financial year, the smallest share of homes since records began in 1995. This share has declined from 43% in just three years.

Affordability is worst in New South Wales, Tasmania and Victoria. A median-income household can afford just 10% of homes sold in New South Wales, and mortgage costs are higher than any other state.

South Australia recorded the biggest decline in affordability over the past year, with a median-income household able to afford just 16% of homes sold in the 2023-24 financial year, down from almost half (49%) in 2020-21.

A median-income renting household could afford just 11% of homes sold over the past year. In comparison, a median household with a mortgage could afford 34% of homes sold over the past year.

Mortgage costs are as high as seen in 2008 and only just below the historical peaks reached in 1989-1990. An average-income household would need to spend a third of their income on mortgage repayments to buy a median-priced home.

That is what you get when your economic strategy is to:

- Boost immigration off the charts.

- Crowd-out dwelling construction with public works.

- Refuse to regulate energy cartels that are openly rorting the Australian people of their own cheap gas.

- Artificially boost employment by dropping a fiscal bomb on unnecessary healthcare via the NDIS.

That’s Jim Chalmer’s stagflation economic model, which privileges foreigners over Australians, corporate rent-seekers over Australians, and fiscal irresponsibility over Australians.

In particular, it is an outrageous war on youth via low wages, marginalisation from the human right to housing, and the return-free depletion of national resources.