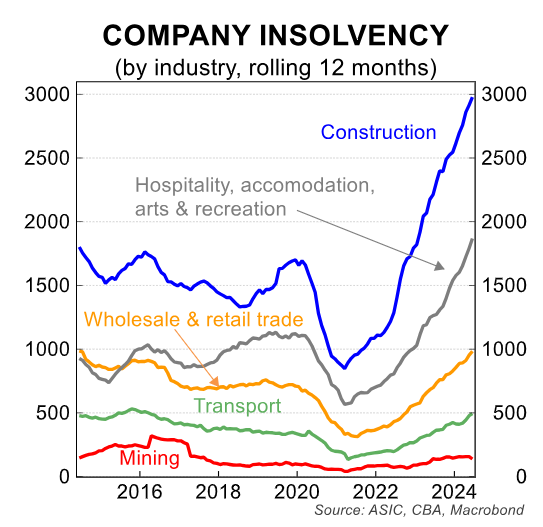

Insolvency data from the Australian Securities and Investments Commission (ASIC) shows that around 1,900 hospitality businesses collapsed last financial year amid rising food and energy costs, and the sharp decline in discretionary consumer spending.

The accommodation and food services sector saw the highest growth in insolvency appointments of any sector last financial year, increasing by 50% to a record 1667, surpassing the previous high of 1114 in 2023.

Restaurant and Catering Australia CEO Suresh Manickam stated that the hospitality sector was experiencing one of its most difficult periods in history.

“Higher interest rates, cost of living pressures on the up, more expensive produce and the cost of energy are all having an impact”, Manickam said.

“People have less money in their pockets and a reduced ability to pay and go out, and there lies the problem the sector is facing”.

Restaurant and Catering Australia predicted that one in eleven hospitality businesses will fail over the coming year.

Australians are now being warned that the price of a cup of coffee could rise to $7 amid a 56% increase in the price of coffee beans over the past year.

Joe Taweel from the Australian Coffee Traders Association told the ABS that the industry is facing numerous headwinds.

Brazil, the world’s top producer of arabica beans, is experiencing its driest season since 1981, with wildfires damaging crops. Drought and typhoons have caused disruptions in Vietnam’s robusta bean production. Coffee is also being stockpiled across Europe before sustainability requirements take effect in December.

These factors are worsening supply shortages and transportation delays when importing coffee into Australia.

Brisbane-based industry expert Phillip Di Bella, founder of the Coffee Commune, warned the sector is on the verge of a crisis, with more than 2000 businesses expected to close over the next two years.

“The cost-of-living is crushing operators”, he said. “We know, everyone is doing it tough right now, so of course operators don’t want to be charging $7 for a flat white but that will become the norm”.

“After expenses, businesses are making roughly $1 profit per coffee and the average store sells 300 coffees a day”.

“Our members have families as well, so that is not a sustainable income”, Di Bella said.

Lincoln Testa, who has operated Madisons Cafe for more than 20 years, said that “coffees should probably be selling for $8 given it is handcrafted and it takes two people to do and they are time-consuming”.

“Coffee shops and cafes are falling over because they are not charging the right price”, he said.

In my opinion, the café scene in Australia needs to be downsized.

The number of cafés in Australia has grown unsustainably over the past two decades.

When I moved to Melbourne’s Ashburton in 2006, my local High Street shopping strip had about four cafés, which was the right amount.

Over the next 18 years, the number of cafés on or near High Street grew to more than a dozen, with the bulk of them empty most of the time.

The story is similar in Melbourne and throughout Australia.

While a small number of cafés thrive and stay busy, the vast majority struggle to break even.

The reality is that there were too many cafés to meet demand prior to the pandemic. And, as cost-of-living pressures rise, many cafés will be forced to close.

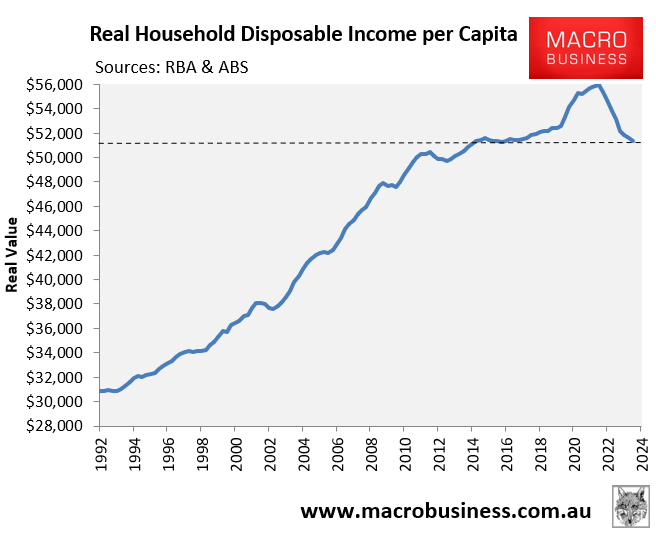

Given the high cost of mortgage and rent payments, as well as the significant decline in real household disposable income over the last two years, who can afford to pay $5 for a lukewarm coffee, let alone $7?

If you are really desperate for a coffee, make one at home or buy a machine-made coffee for $2 at a service station or 7-Eleven. That’s what I do.

Australia functioned fine with half as many cafés. It will do so again.