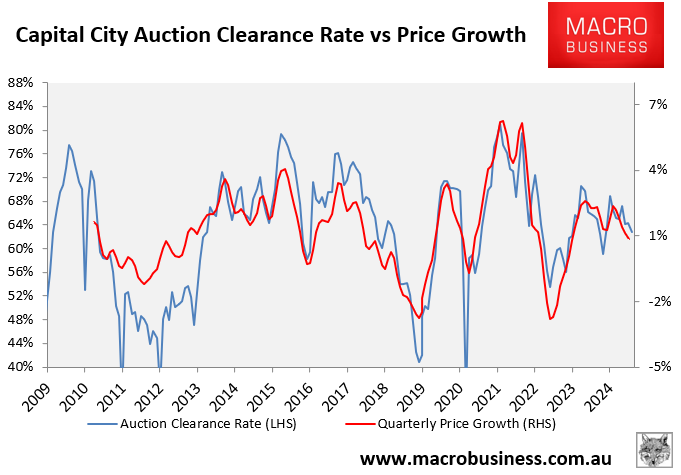

Australia’s auction market has eased over recent months, moderating house price growth.

The quarterly average auction clearance rate fell to 63% nationally, the lowest level reported this calendar year.

Similarly, quarterly capital city price growth fell to 0.9% in August, according to PropTrack, the lowest growth rate recorded this calendar year.

CoreLogic’s preliminary auction results for the weekend showed that only 68.2% of auctions were successful. This was the second lowest preliminary clearance rate this year after the week ending 9 June (the King’s birthday long weekend).

Rising stock levels have driven the recent downtrend in auction clearances. Last week, 2697 homes were auctioned, the highest number since the week before Easter.

Managing director of SQM Research, Louis Christopher, says the market slightly favours buyers rather than vendors at present. However, he expects the market to bounce when interest rates start to fall.

“Sydney and Melbourne have swung to a slight buyer’s market”, he said.

“Sellers are having to become more negotiable and buyers will look at this as a nice window, until we see a cut in interest rates”.

“We are quite confident the market will bounce once we see the first interest rate cut”.

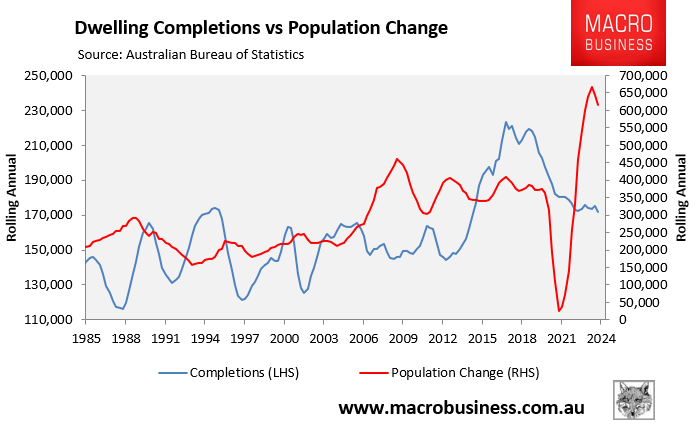

Christopher also noted that the fundamental imbalance between demand and supply has prevented price falls.

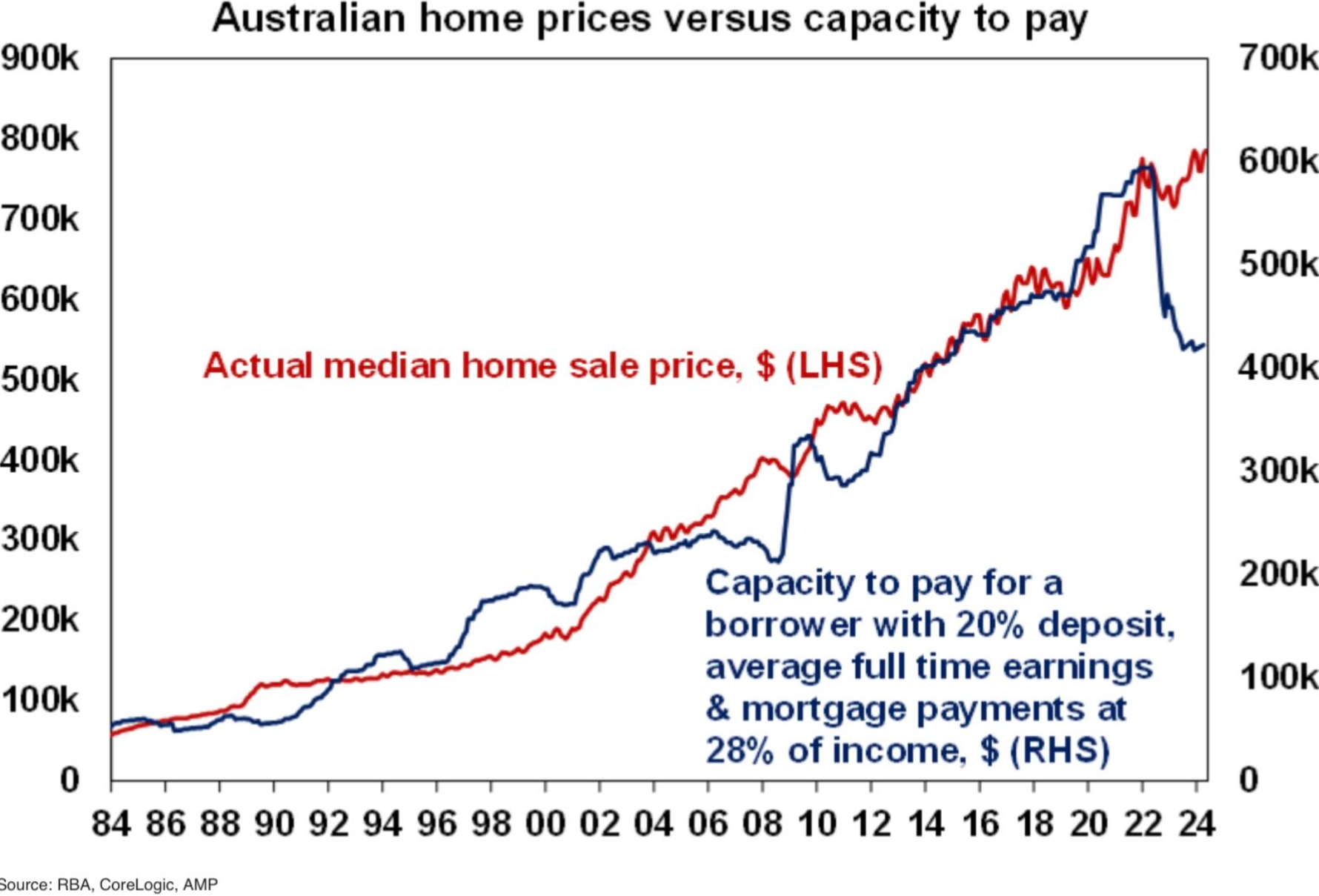

The following chart from AMP shows the record gap between home prices and borrowing capacity, which has put a ceiling on buyer demand:

A series of interest rate cuts from the Reserve Bank of Australia would lift borrowing capacity, adding renewed fuel to the housing bonfire.