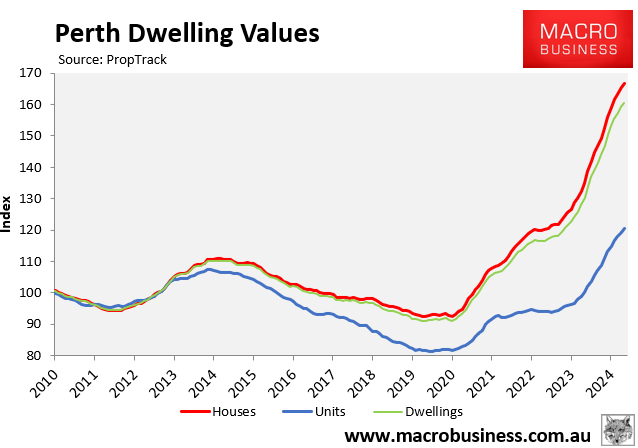

Perth’s housing market has experienced a monumental boom, rising by 76% since the beginning of the pandemic in March 2020, according to PropTrack:

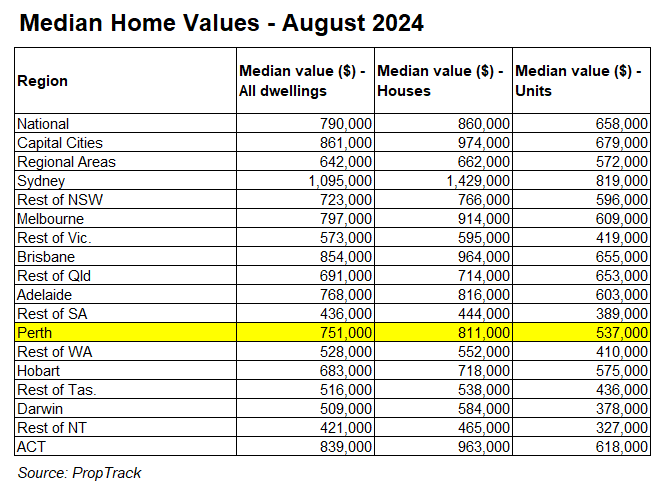

Despite the boom, Perth dwelling values are still relatively “affordable” with a median value of $751,000 in August, versus $861,000 across the combined capital cities:

This suggests that Perth dwelling values have further headroom to rise.

However, there are storm clouds building on the horizon.

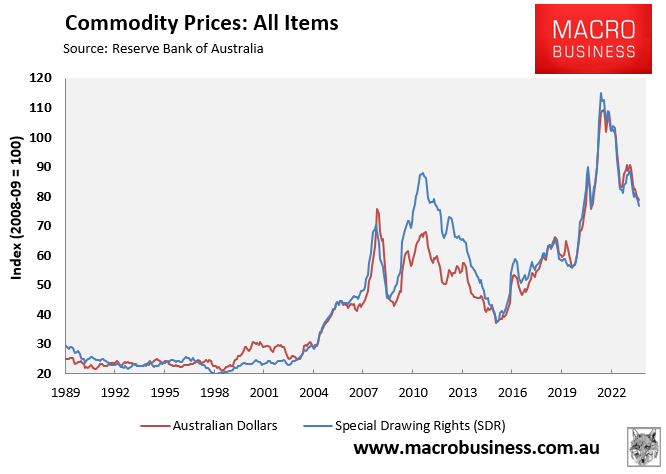

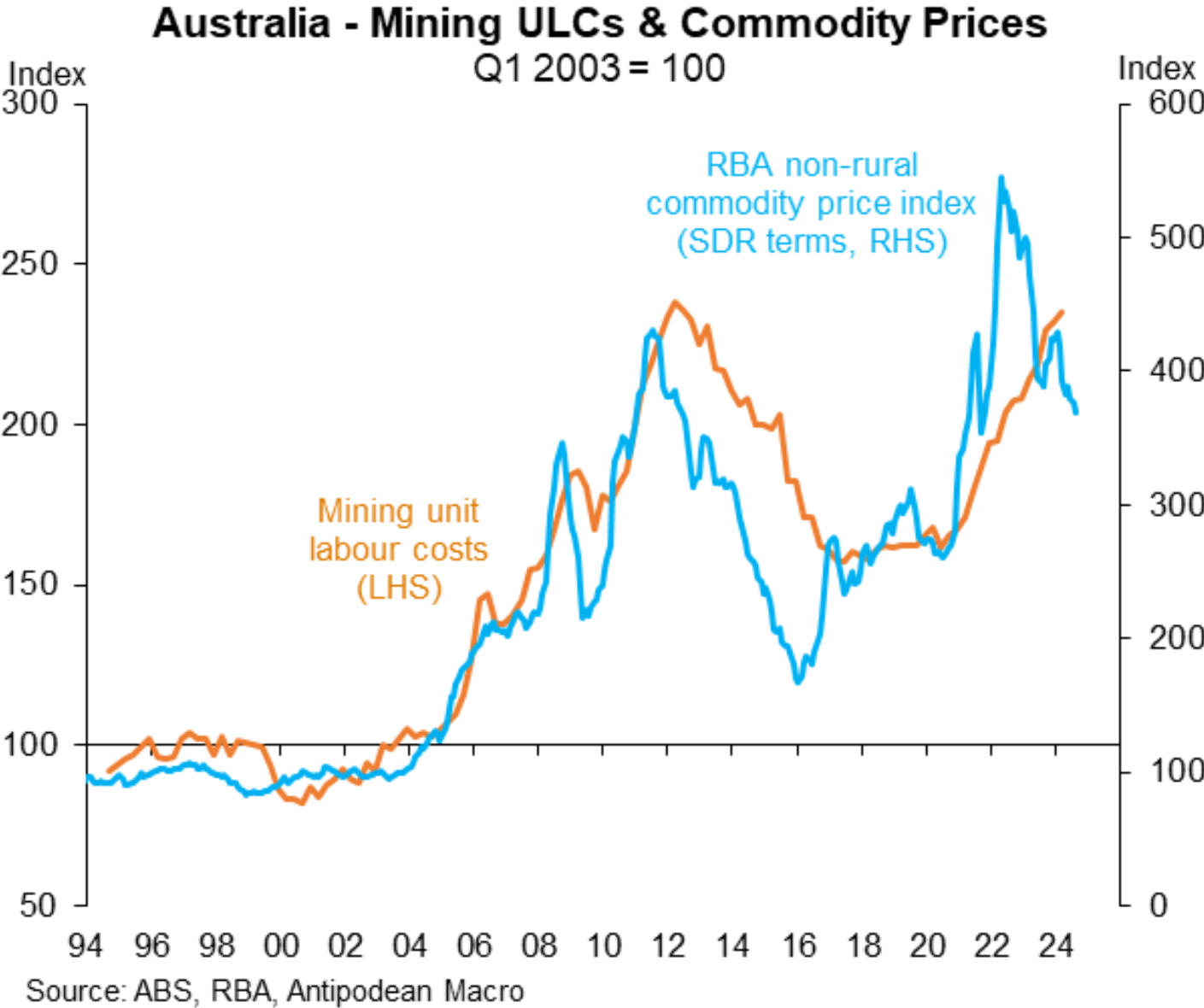

Perth’s economy and housing market are inextricably tied to the mining sector. And commodity prices are now falling, as illustrated in the following chart:

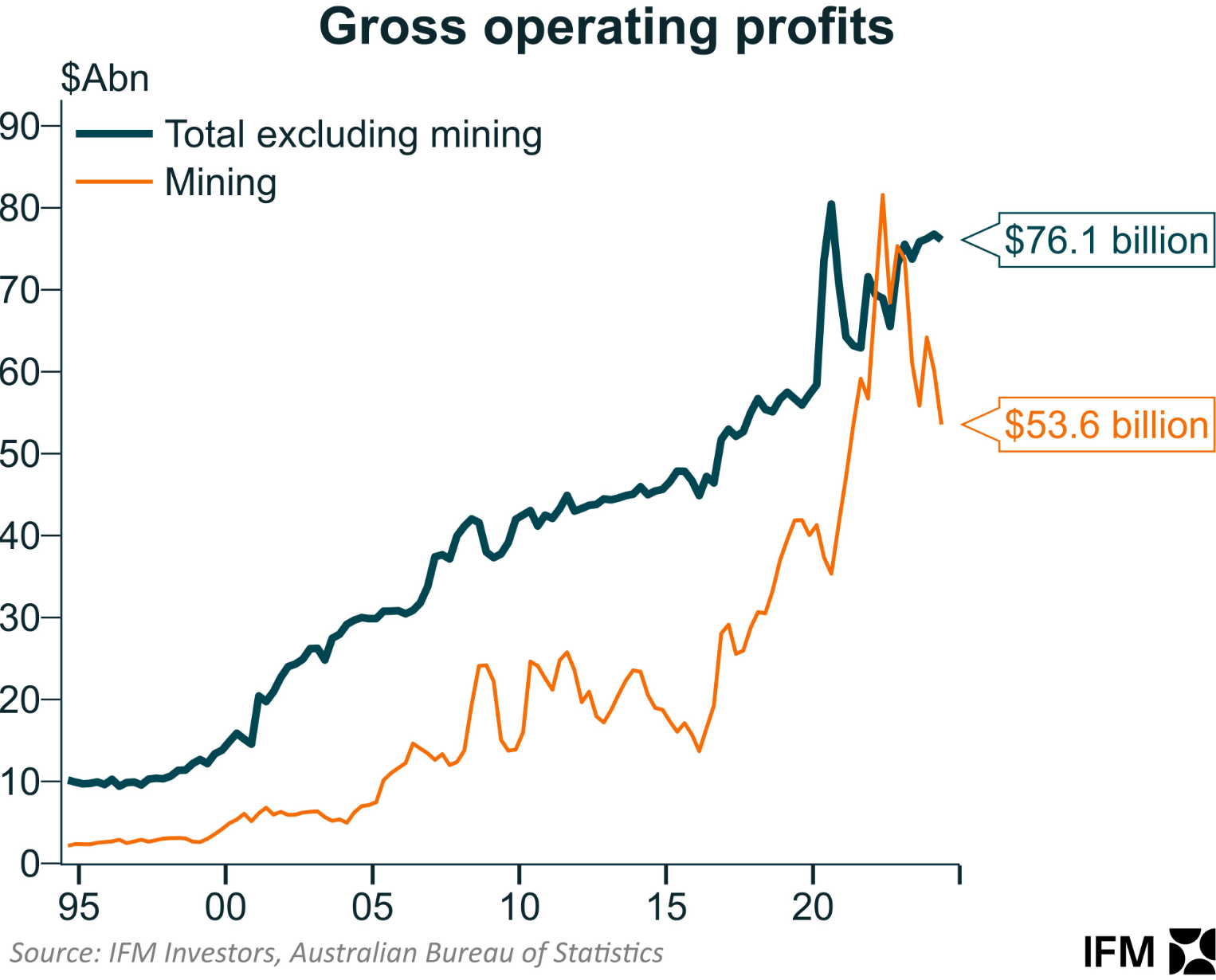

As a result, mining profits are now declining:

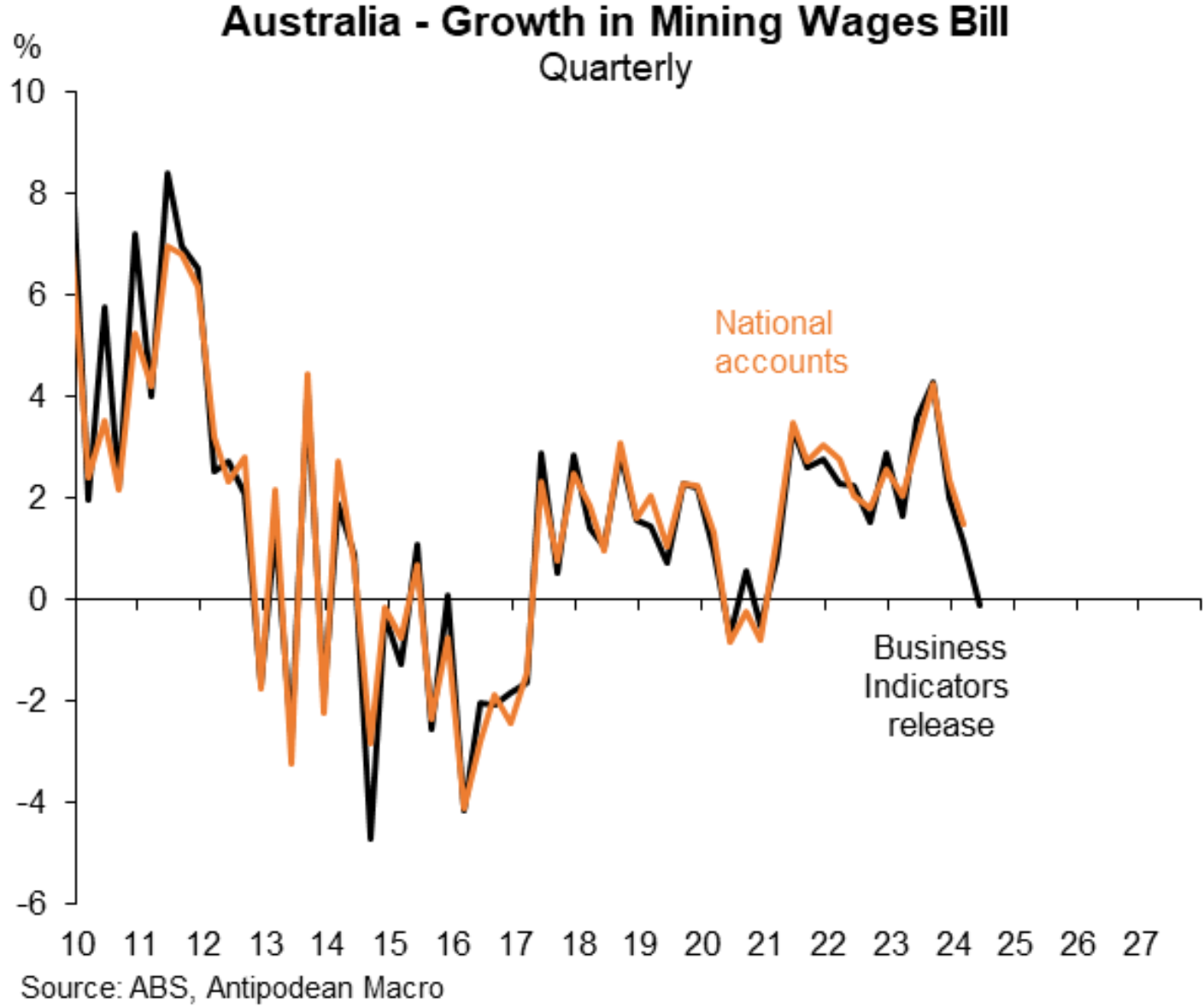

Total wages across the mining sector are also declining:

Moreover, more cost-cutting and rationalisation is likely across the mining sector, amid the decline in commodity prices and profits:

It should be recognised that Perth is Australia’s most volatile major capital city market that has traditionally experienced booms and busts alongside the mining sector.

For example, last decade’s commodity bear market, illustrated clearly in the charts above, was followed with an 18% nominal decline in Perth dwelling values between 2014 and 2019 (much larger in real terms).

So, while Perth’s housing market is currently running hot, it is likely to experience another prolonged downturn alongside the mining sector and commodity prices.

Perth’s housing market may appear to be relatively attractively priced. But purchasing today as an investment should be considered a very high-risk play.