Wednesday’s poor Q2 national accounts release from the Australian Bureau of Statistics (ABS) should raise eyebrows within the Reserve Bank of Australia (RBA).

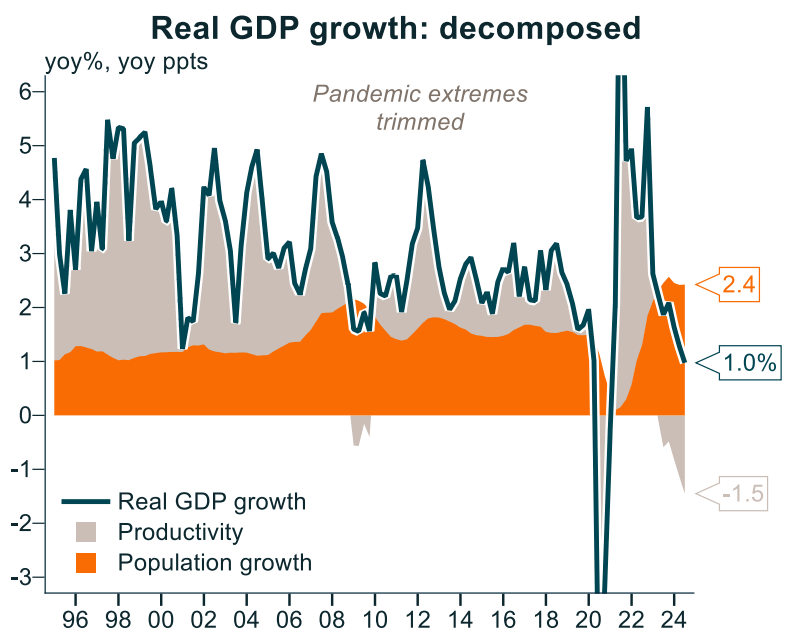

Source: Alex Joiner (IFM Investors)

While the 1.0% annual growth in real GDP was in line with the RBA’s latest forecasts, the Bank should be concerned about the private sector economy’s embedded weakness.

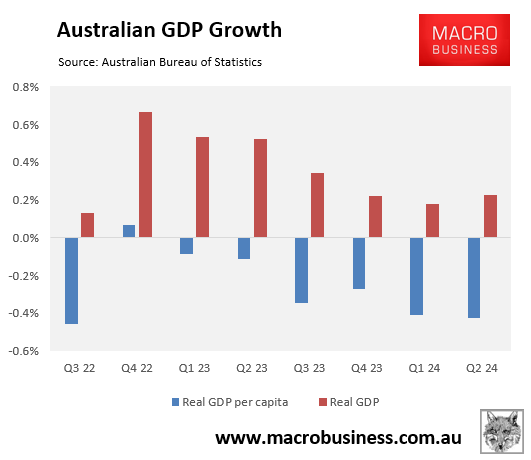

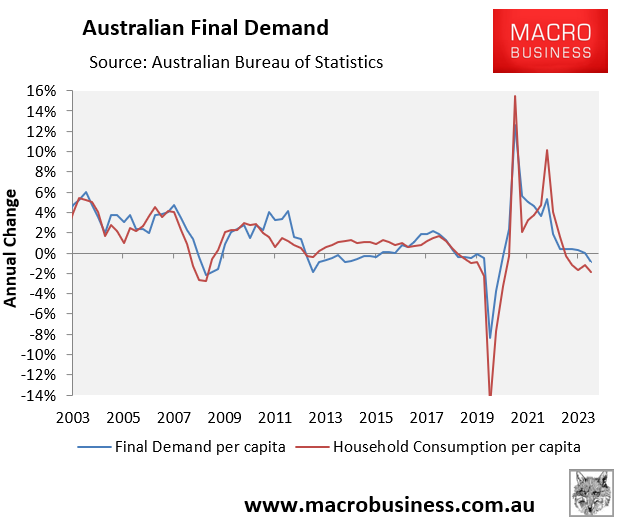

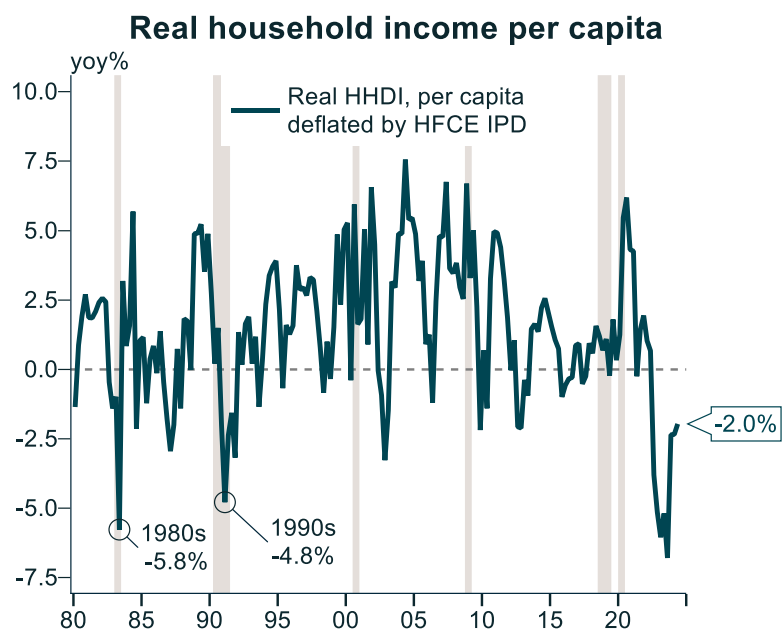

The 2.0% decline-from-peak in Australian real per capita GDP has been driven by the household sector.

Household consumption fell and has now contracted on a per capita basis over the past six quarters (down 2.4%):

Real per capita household disposable income also fell by 0.2% in Q2 and is now down about 8% from peak. This represents one of the largest declines in the world:

Source: Alex Joiner (IFM Investors)

The 2% annual decline was also well below the RBA’s expected 1.1% annual rise.

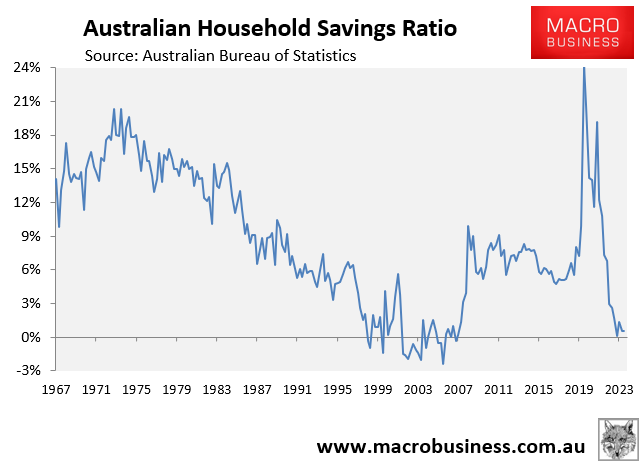

The only reason why household consumption didn’t fallen further is because the household savings rate has collapsed to just 0.6%, suggesting that households have drawn down their pandemic savings:

Note: the savings rate is almost always positive due to compulsory superannuation contributions, which are counted as savings but are not available for consumption.

While the overall growth rate in GDP was in line with the RBA’s expectations, the growth drivers were not.

As noted by Gareth Aird, head of Australian economics at CBA:

“The RBA will be surprised in particular by the weakness in household consumption. In the August Statement on Monetary Policy (SoMP) it was noted that household consumption proved stronger than expected at the time of the May forecasts”.

“The RBA’s view will need to be reversed in the November SoMP to note that household consumption has proved weaker than expected at the time of the August forecasts”.

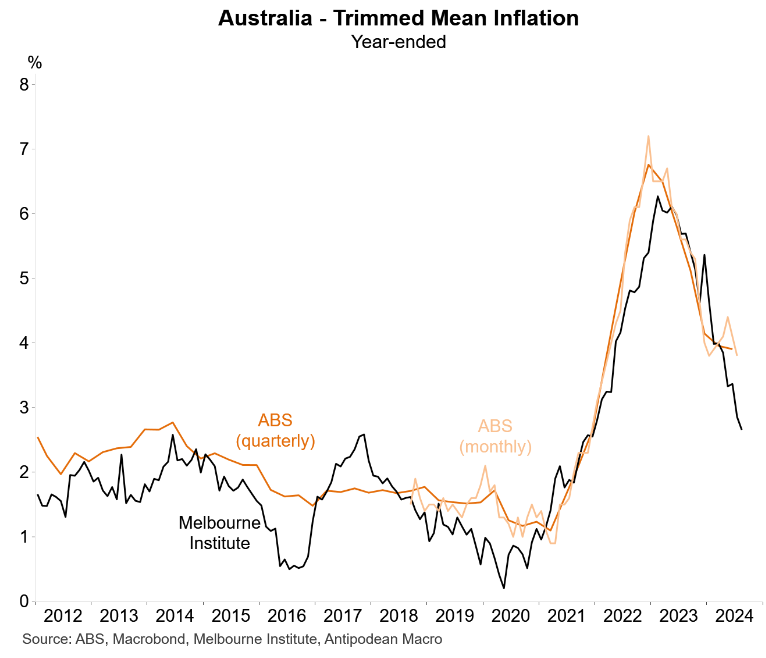

“The weakness in household expenditure leaves us with greater confidence that consumer inflation will continue to moderate”.

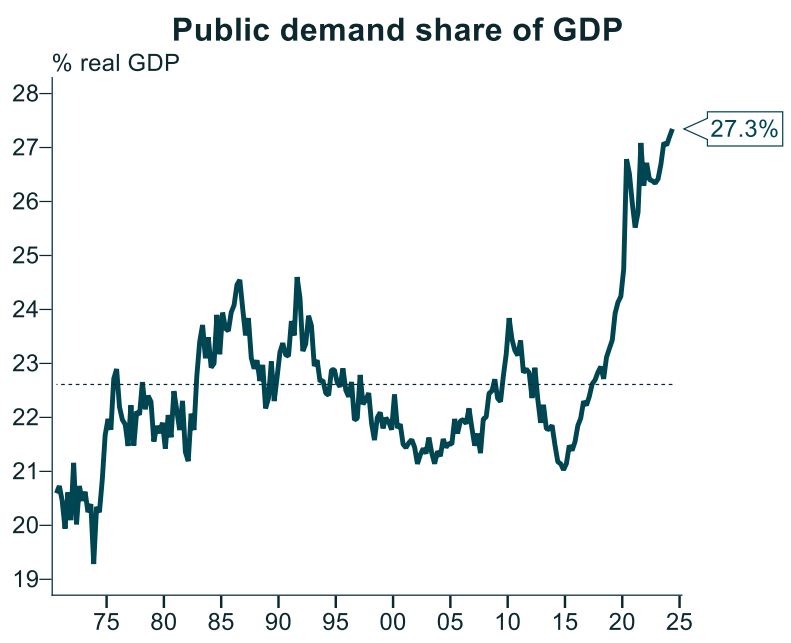

Indeed, public consumption contributed 0.4 percentage points of growth to GDP, and hit an all-time high share of the economy in Q2:

Source: Alex Joiner (IFM Investors)

As an aside. the latest Melbourne Institute trimmed mean monthly inflation gauge for Australia moderated further in August in both year-ended and quarterly terms, as illustrated below by Justin Fabo at Antipodean Macro:

Based on the above, will the RBA do an about face on interest rates?

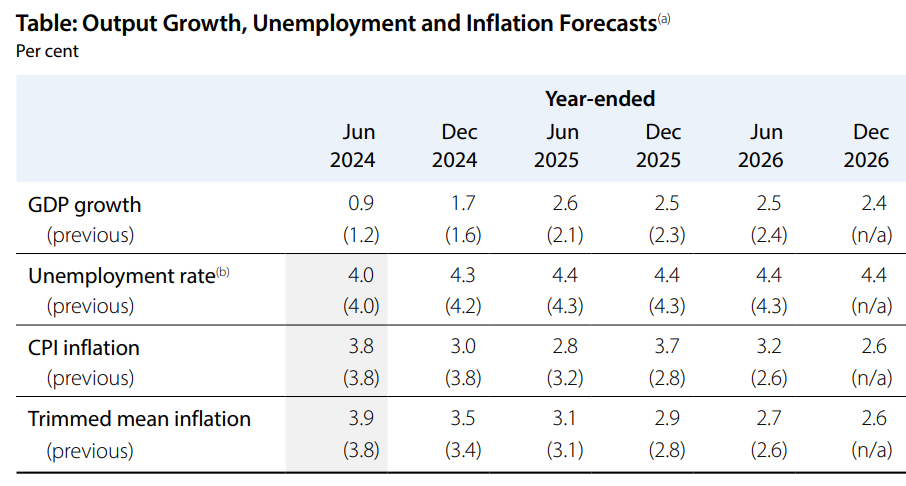

I believe that the RBA will need to see a material rise in unemployment above its end of year forecast of 4.3% (see below) before it cuts rates.