The SMH’s deputy business editor, Clancy Yates, argues that consumers’ “frugal” response to the Stage 3 tax cuts is “music to the ears” of the Reserve Bank of Australia (RBA) and means that further rate hikes are off the agenda.

“So far, it’s been close to three months since the tax cuts kicked in and the response from punters looks muted”, noted Yates.

“The lack of a tax-cut–induced spending spree confirms there’s no need for any further Reserve Bank rises”.

“The picture emerging is that households remain pretty tight with their cash”, wrote Yates.

A key reason why consumers have remained frugal is because the massive war chest of savings accumulated over the pandemic has been exhausted.

Households are no longer spending more than they earn, which is offsetting the stimulus from the tax cuts.

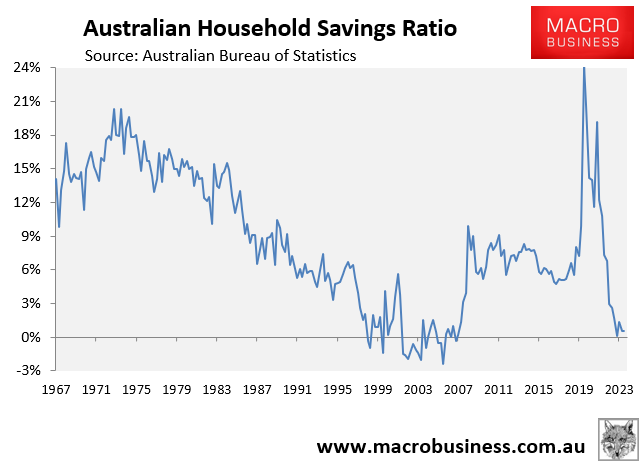

Indeed, the Q2 national accounts release from the Australian Bureau of Statistics (ABS) showed that the household savings rate remained at an incredibly low 0.6%:

Given that workers are mandated to save 11.5% of their incomes as superannuation, and these savings are locked away until retirement, this implies that households have been spending more than they earn.

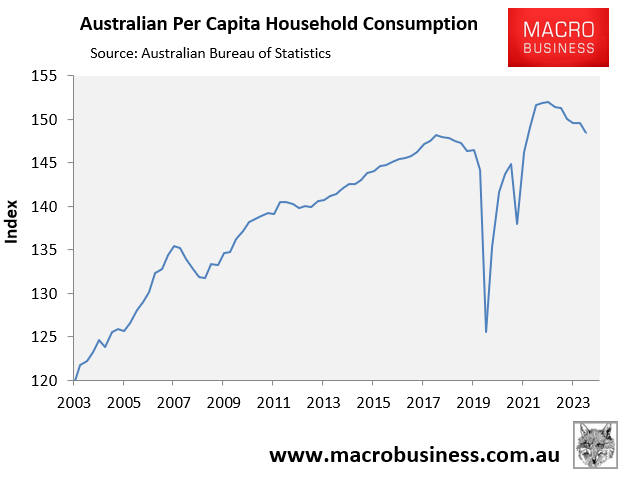

As a result, household consumption has fallen by less than the decline in disposable incomes.

The Q2 national accounts showed that real per capita household consumption declined by 2.4% from the December 2022 peak:

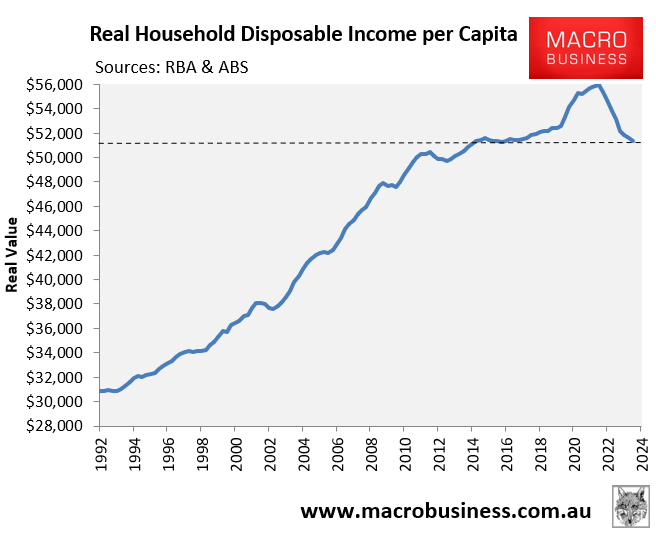

However, real per capita household disposable income had fallen a more severe 8.2% from its peak in June 2022:

Household spending and GDP growth would have declined further if not for the reduction in savings.

Looking ahead, the Stage 3 tax cuts will moderately boost both household income and consumption.

A further boost will arise when the RBA commences its next interest rate easing cycle, likely early next year.

However, the household sector faces a long road to recovery.