With the federal election due by May 2025, all polling suggests that we are headed for a hung parliament.

Roy Morgan believes that the result would be “too close to call.” Preferences would determine which party forms government, with the support of minor parties and independents.

“If preferences are distributed by what voters tell us they prefer, the Coalition is marginally ahead, however, if preferences are distributed in the same way as the last Federal Election – the ALP is ahead”, said Michele Levine, CEO of Roy Morgan.

One thing is for certain: the Albanese government desperately needs the Reserve Bank of Australia (RBA) to cut interest rates before it heads to the polls.

Other Anglo nations, namely New Zealand, Canada, the United States, and the United Kingdom, have commenced interest rate easing cycles, and pressure is mounting on Australia to follow suit.

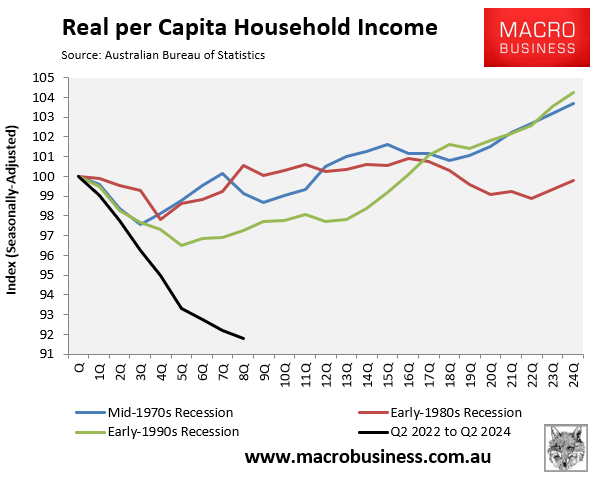

The cost of living is the major concern of voters, who are feeling the pinch from the sharp rise in mortgage rates, rents, and energy, alongside the record collapse in household disposable income.

The August rate cut from the Reserve Bank of New Zealand has worked wonders for the incumbent National-led Government (National, ACT & NZ First).

Support for the National-led Government jumped following the rate cut and it now leads by 10 percentage points.

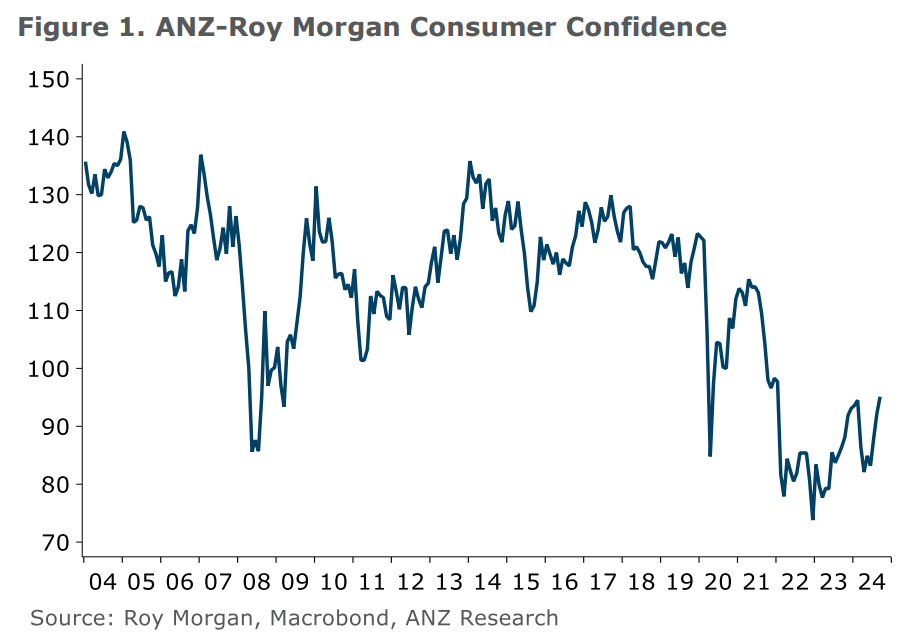

New Zealand Government Confidence also jumped, while New Zealand consumer confidence has risen to its highest level since January 2022, despite the ongoing recession and falling house prices:

“Consumers can see better times ahead now interest rates are falling”, noted ANZ economists. “Inflation expectations are lower, and house price expectations are lifting”.

The Albanese government will be desperately hoping that rate cuts from the RBA will have a similar impact in Australia and arrive ahead of the upcoming election.

The good news for Labor is that most economists expect the first rate cut to arrive at the first RBA board meeting in February 2025, whereas the CBA believes we could even get a cut by December 2024.

Either way, Prime Minister Anthony Albanese will wait for the RBA to cut before calling an election. He and Jim Chalmers will also continue to pressure the RBA to cut rates, citing the sharp fall in the headline inflation rate.

Labor may also state that the “objectives of monetary policy” in the Reserve Bank Act refers to headline inflation being within the target range of 2% to 3%, not trimmed mean inflation: