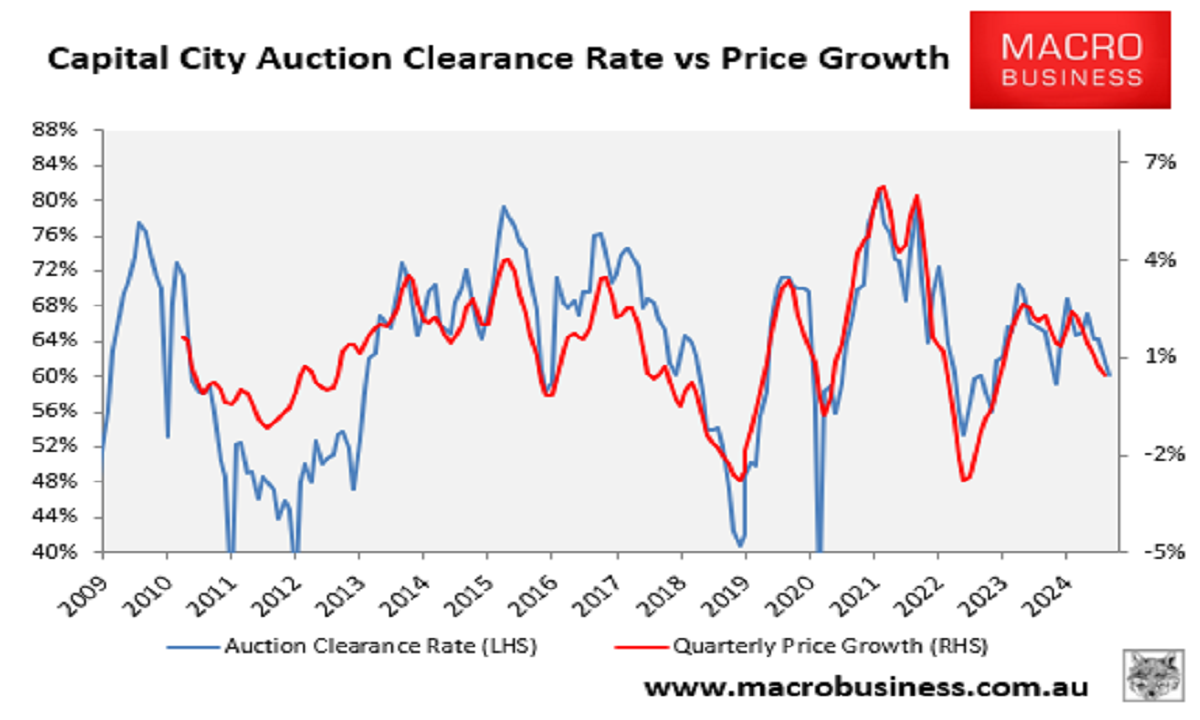

Australia’s auction market has been stuck in a firm bear market, with the monthly average national final clearance rate falling to its lowest level of the year last week, dragging down price growth:

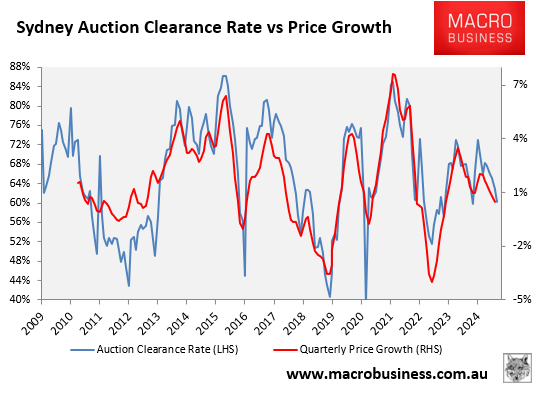

The following chart shows how Sydney has driven the national auction clearance rate decline:

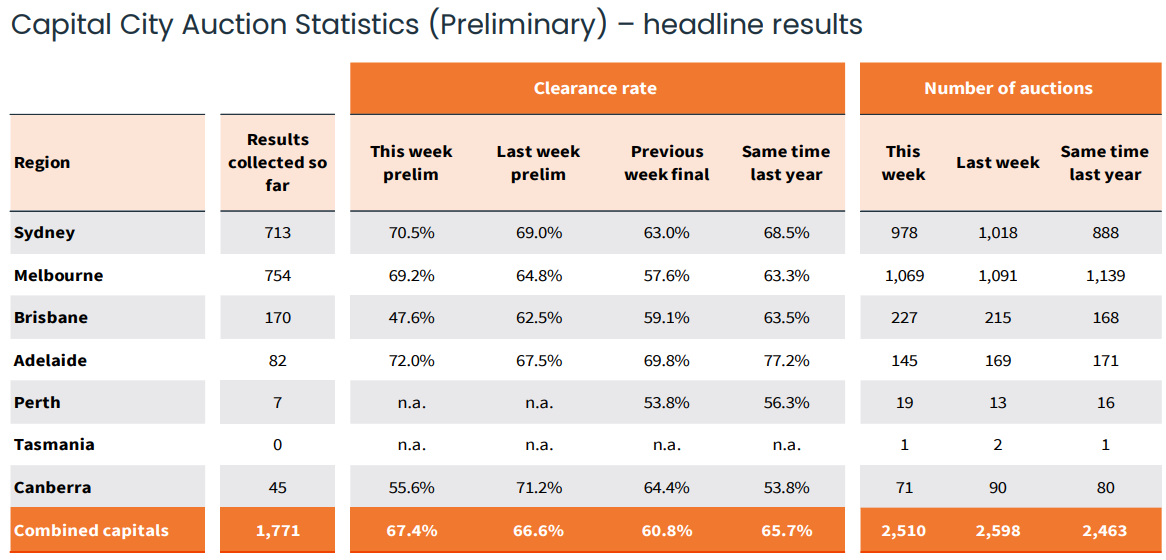

The auction market rebounded this weekend, with CoreLogic’s preliminary clearance rate rebounding to 67.4% from 66.6% last weekend and 65.7% in the same weekend last year:

1,069 auctions were held across Melbourne, the third week running where more than 1,000 properties have gone under the hammer. 69.2% of auctions recorded a successful outcome, the highest preliminary clearance rate in six weeks.

978 homes were auctioned in Sydney, returning a preliminary clearance rate of 70.5%, the highest in five weeks.

Despite the stronger result, leading Sydney auctioneer and agent Tom Panos believes the auction market has hardened as hopes for interest rate cuts have faded and listings have flooded the market.

“It is highly unlikely—close to impossible—that we will get a rate cut anytime soon”, Panos said in his weekend update. “There won’t be an interest rate cut this side of Christmas”.

“That news is what has actually spurred a lot of people to put their properties on the market because they thought there would be a rate cut and there would be a surge of buyers and they would get their price”.

“But that does not look like it will happen”.

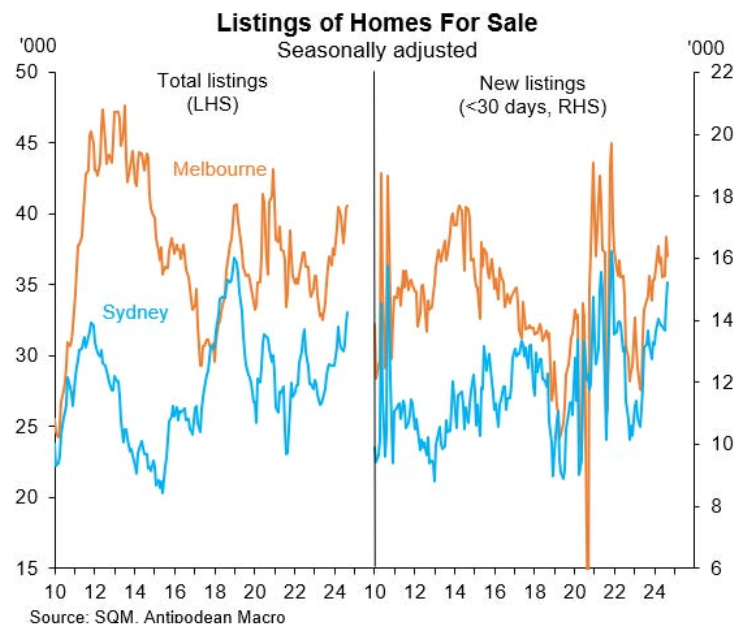

Panos said that it has become much harder to sell at auction because it is now a buyers’ market with lots of choice.

“It is getting hard because buyers are simply saying that if you don’t take my offer, I now have choices”.

“I had less choices before. And now I have choices. And they will continue to have choices with all the listings that are on the market”.

Certainly, there has been a sharp rise in for-sale home listings in Sydney and Melbourne, as illustrated below by Justin Fabo at Antipodean Macro:

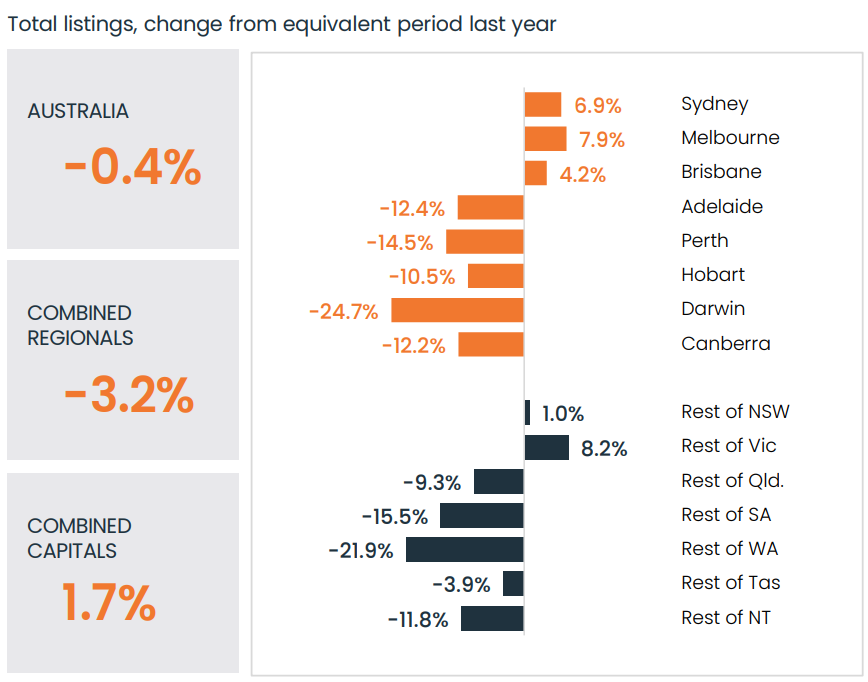

Separate data from CoreLogic also shows a solid rise in listings across Melbourne and Sydney:

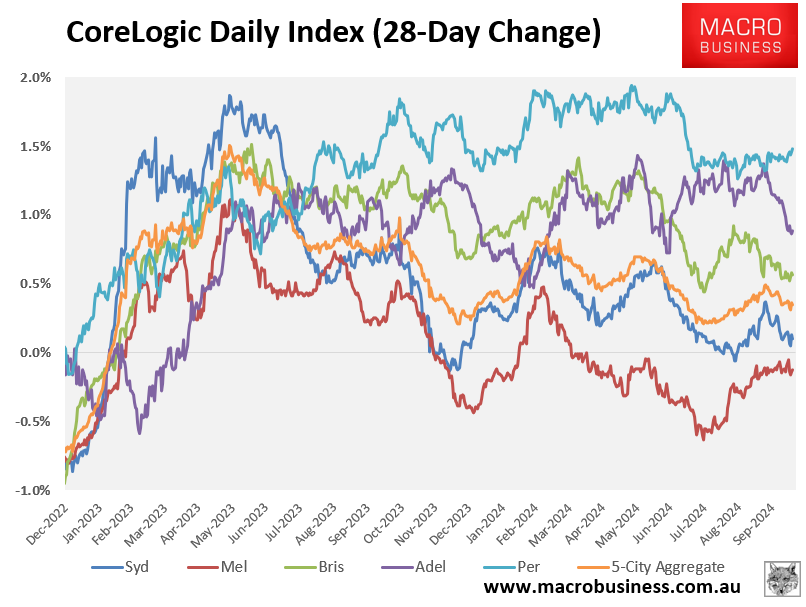

Meanwhile, CoreLogic’s daily dwelling values index shows that Melbourne and Sydney value growth has collapsed and is lagging the other major capitals:

This data lends weight to Panos’ claims, not withstanding this weekend’s bounce in the preliminary clearance rate.