Last week, CoreLogic recorded a national final auction clearance rate of only 58.2%, which was the worst result of 2024.

It was only the second time in 2024 that the final national clearance rate had come in below the 60% mark. The other was the week ending 6 October (59.5%).

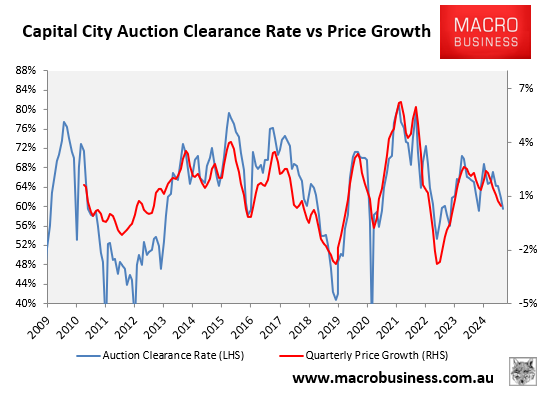

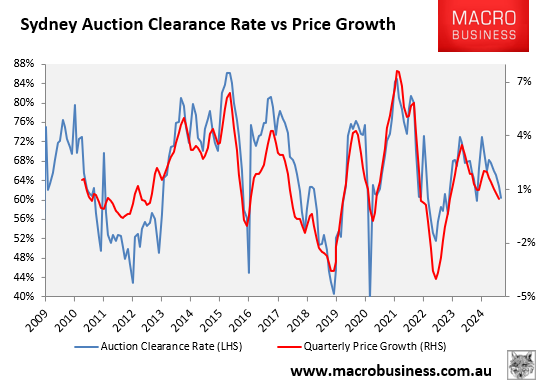

As shown in the following chart, Sydney has experienced the sharpest fall in auction clearances, driving the decline nationally:

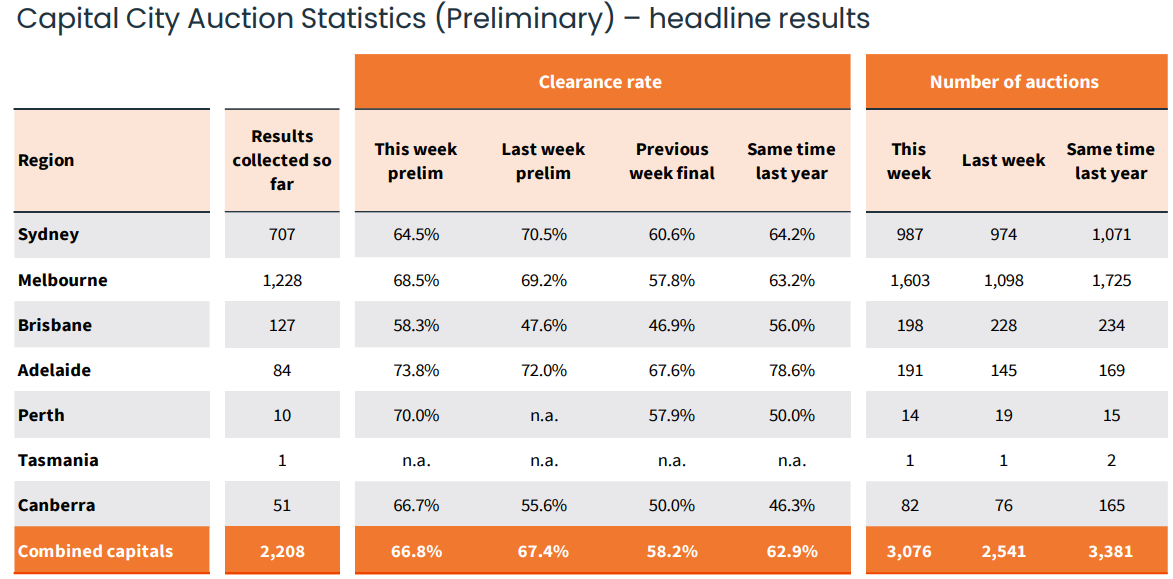

This weekend’s preliminary auction results from CoreLogic showed a further loss of momentum, with only 66.8% of homes selling, down from 67.4% last weekend (downgraded to 58.2% on final results):

Source: CoreLogic

The result came from 3,076 auctions held across the capital cities, which was the highest volume since the week prior to Easter (3,519) and only the second time this year where the weekly number of auctions has been above 3,000.

Melbourne’s preliminary clearance rate fell to 68.5%, down from 69.2% the prior week (revised to 57.8% on final numbers).

Only 64.5% of auctions were successful across Sydney based on preliminary results, well down from the 70.5% preliminary clearance rate recorded a week ago (revised down to 60.6% at final figures).

In his weekend auction market wrap, leading Sydney auctioneer Tom Panos warned that vendors had missed the top of the market.

“For the vendors out there that were chasing to sell at the top of the market, guess what? You’ve missed it. It’s gone, at least in Sydney”, Panos said.

“The market top has gone. You are not selling at the top of the market”.

“I’m so happy because it is a buyers market and I’m happy for the buyers because they have had it hard for a long time”.

“Buyers are coming in and if they are not getting their offers accepted, they are not negotiating. They are saying, ‘no problem, I’ll go to the next property’. That is what is happening right now”, he said.

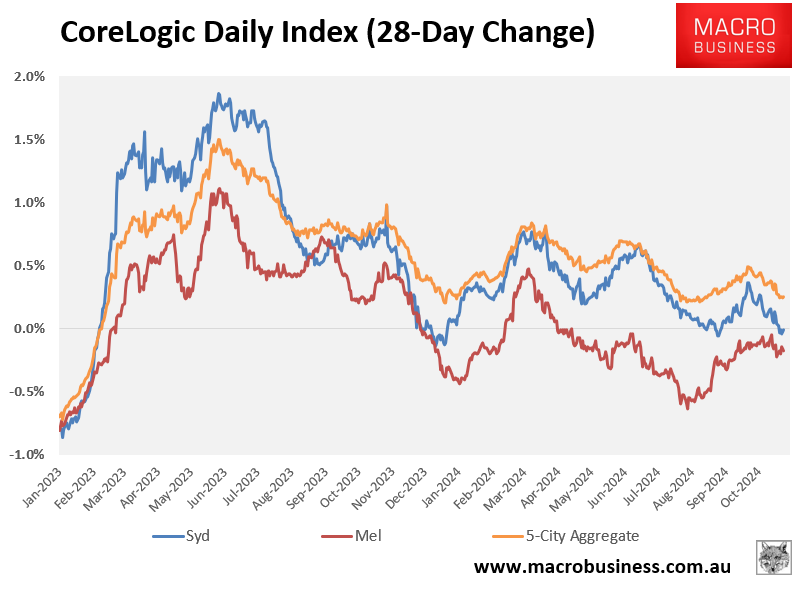

As illustrated in the following chart plotting CoreLogic’s daily dwelling values index, Sydney has now joined Melbourne by recording price falls over the past 28 days:

Based on the latest auction figures, Sydney’s housing market is now in mild correction mode as it waits for the Reserve Bank to commence its monetary easing cycle.