A civil war of sorts has broken out between the big four banks over lending standards pertaining to first home buyers.

NAB executive Andy Kerr told a parliamentary inquiry last week that prospective first homebuyers would have more buying power if rules restricting access to mortgages were more flexible.

Kerr argued that first homebuyers were no more risky than other borrowers.

The Australian Banking Association’s chief of policy, Chris Taylor, concurred with NAB, arguing that borrowing requirements should be assessed on a case-by-case basis.

However, the nation’s two largest banks—CBA and Westpac—argued that there was no reason to change the existing restrictions.

“We don’t think the right answer is to put customers into more debt”, Westpac manager Martin Green said.

CBA executive Angus Sullivan agreed, saying that based on the bank’s data, first homebuyers were a higher risk.

Nadia Harrison, chief executive of Mortgage Stress Victoria, also warned against relaxing lending standards.

“There are thousands of individuals and families behind each non-performing loan statistic, and any suggestion that we should target a higher arrears rate for homeowner borrowers would have a real human cost”, she said.

Meanwhile, non-mortgage lender Sucasa is aiming to make low-deposit home loans a larger part of the Australian mortgage market.

Mario Emmanuel noted that he and his co-founders saw a business opportunity when they discovered that low-deposit home loans were quite common overseas.

Emmanuel said that mortgages where borrowers had deposits of 3% or less of the purchase price account for some 10% of the US market.

He believes there is a big demand for low-deposit home loans in Australia, particularly among potential borrowers aged between 25 and 45.

“The LVR (loan-to-value ratio), in and of itself, is not an indicator that means that loan is not profitable, or a bad loan or somehow dangerous”, Emmanuel said.

“Sucasa is designed to increase affordability in as meritocratic way as possible, allowing people to make the most of their income and their savings”, financial backer Daniel Petre added.

“Sucasa is innovating on a financial product, taking a view on better pricing certain mortgage risk”.

There is little evidence that credit is unduly restrictive in Australia, given the huge rise in average loan sizes, which has helped drive housing values higher:

Furthermore, the Hayne Banking Royal Commission’s first recommendation was that responsible lending rules stay unchanged.

The Hayne Banking Royal Commission’s central recommendation was to keep responsible lending laws.

Twenty years of empirical experience show that demand-side “affordability” initiatives, such as looser credit access, have contributed to the rising cost of Australian housing.

As a result, boosting lending to marginal buyers will worsen the housing affordability crisis by raising prices, increasing consumer debt, and weakening financial stability.

Loosening lending standards would, therefore, be futile and self-defeating from an affordability standpoint.

If policymakers truly want to help first-time homebuyers into the housing market, they should do two things.

The number one solution is to reduce immigration to historical post-war levels.

Excessive immigration is particularly detrimental to first-time home buyers because:

- It pushed up rents, making it more difficult to save for a deposit.

- It raises prices, putting ownership further out of reach.

The federal government should also implement broad-based tax reform, lowering income taxes and reducing property investment incentives.

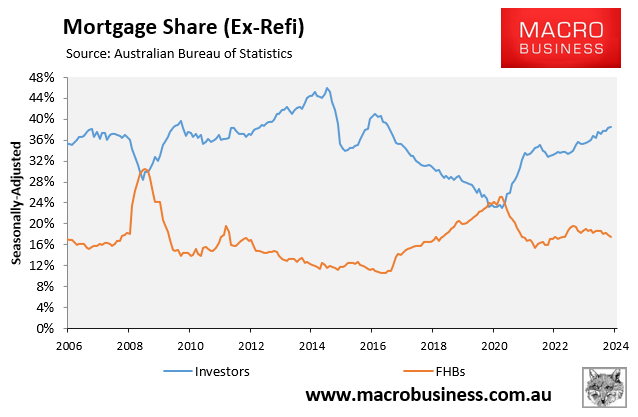

Reducing property tax breaks would diminish investor demand, raising the share of first-time homebuyers and house ownership rates.

The truth is that our political leaders and industry players do not genuinely want more affordable housing because it would require prices to fall.

They pretend to care about affordability by offering false solutions and hope to would-be first home buyers while continually driving up housing prices through stimulatory demand-side policies.

Policies surrounding “housing affordability” are one giant shell game.